Noerr Public M&A Report 01/2019 - The German Market for Public Takeovers in the Year 2018

Market development in key points

- In 2018, after two years of growth the market volume shows a decline for the first time. The reasons for this development are only three offers in the large-cap-segment with offers to companies with more than EUR 1 billion market capitalization at the offer price. This segment was primarily characterized in 2018 by the takeover offer made by E.ON to the shareholders of the innogy SE.

- In 2018, the number of transactions also declined in comparison to the previous year as well as compared over several years. In particular, a disproportionately large decline in the number of transactions had to be noted in the large-cap-segment.

- Further, the average offer premium on the volume-weighted three-month average price before the announcement of the offer fell to around 8,08 % in 2018. In particular, the number of offers with premiums of more than 30 % is remarkably low. It fell even more sharply than the number of transactions in the large-cap segment, in which high premiums are typically granted.

- In the focus section: The practice of extraordinary general meetings in the context of public takeovers and takeover offers in times of tightening foreign trade regulation.

Number and volume of public offers

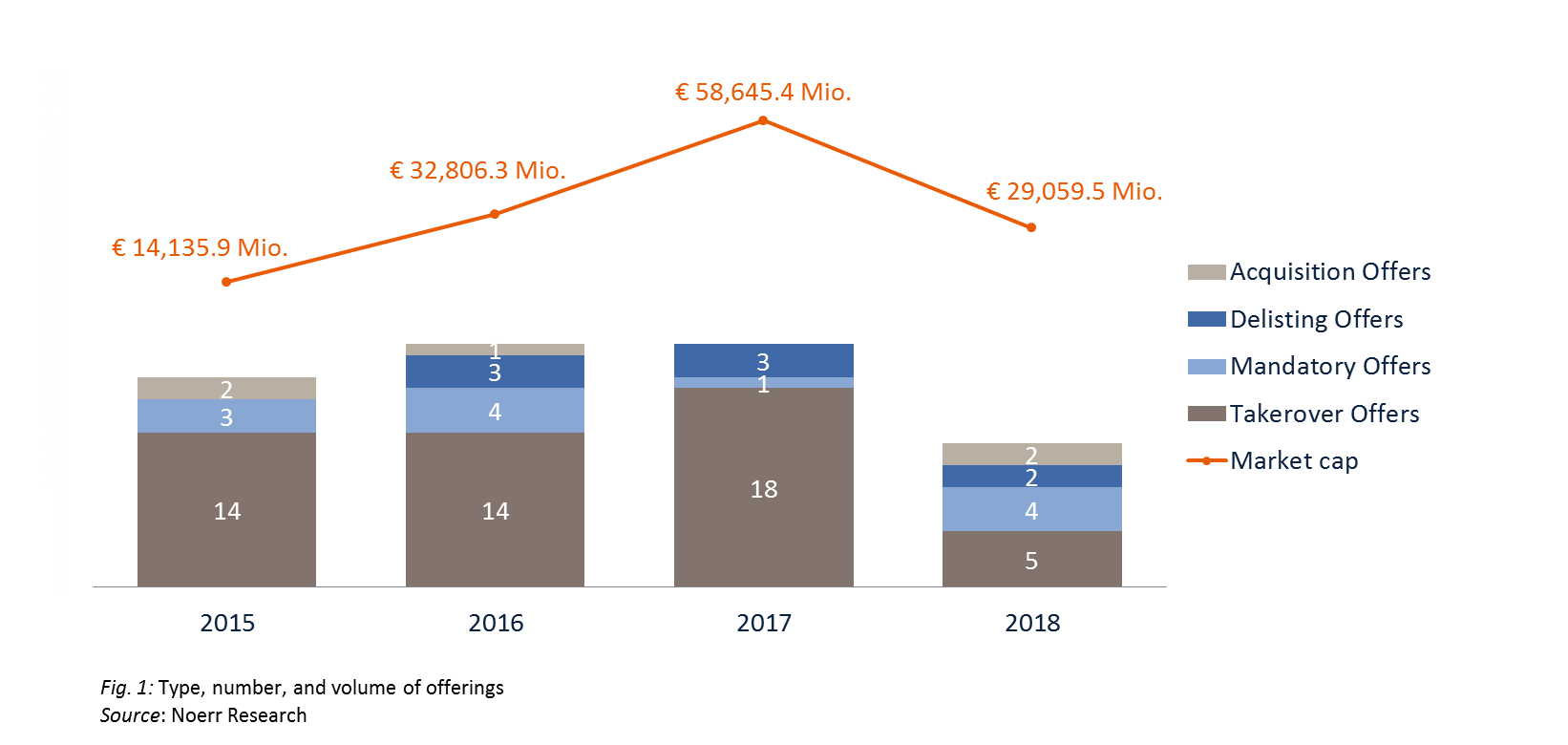

In 2018, 13 public offers pursuant to the WpÜG were approved by the German Federal Financial Services Supervision Authority (Bundesanstalt für Finanzdienstleistungsaufsicht; “BaFin“) and published subsequently (as shown in the chart below)[1]. The market capitalization at the offer price (“MCO”) of the target companies affected by the offers amounted a total of EUR 29.1 billion (2017: EUR 58.6 billion). These offers comprised five takeover offers, four mandatory offers, two delisting offers (one of them combined with a mandatory offer) and two acquisition offers.

In 2018, the offer volume of the German market for public takeovers (expressed in the MCO) shows a decline of about 50.34 % for the first time after two years of growth. Nevertheless, it still significantly exceeds the minimum of the period under review which occurred in 2015.

The market is still characterized by singular major transactions. In 2017, the exchange offer of Linde AG for the purpose of a merger with Praxair, Inc. alone related to an MCO of EUR 34.5 billion (which corresponds to 58,78 % of the total market in 2017). In 2016, the exchange offer (that ultimately was not consummated) made to the shareholders of Deutsche Börse AG regarding to the merger with London Stock Exchange Group plc had a similar distorting effect on the volume offer of the total market. Deutsche Börse AG represented an MCO of EUR 22.1 billion (equaling a total market share of 65.19 % in 2017).

With the takeover offer of E.ON Verwaltungs SE made to the shareholders of the innogy SE, there was also such a formative transaction in 2018. It referred to an MCO of EUR 20.4 billion, which even corresponds to 70,28 % of the total market.

The number of transactions show a similar picture. In this regard, market activity for public takeovers declined significantly (i.e. by 40.91 %) in comparison to the two previous years in which 22 offers were submitted in each year.

Development in the small-cap, mid-cap and large-cap segments

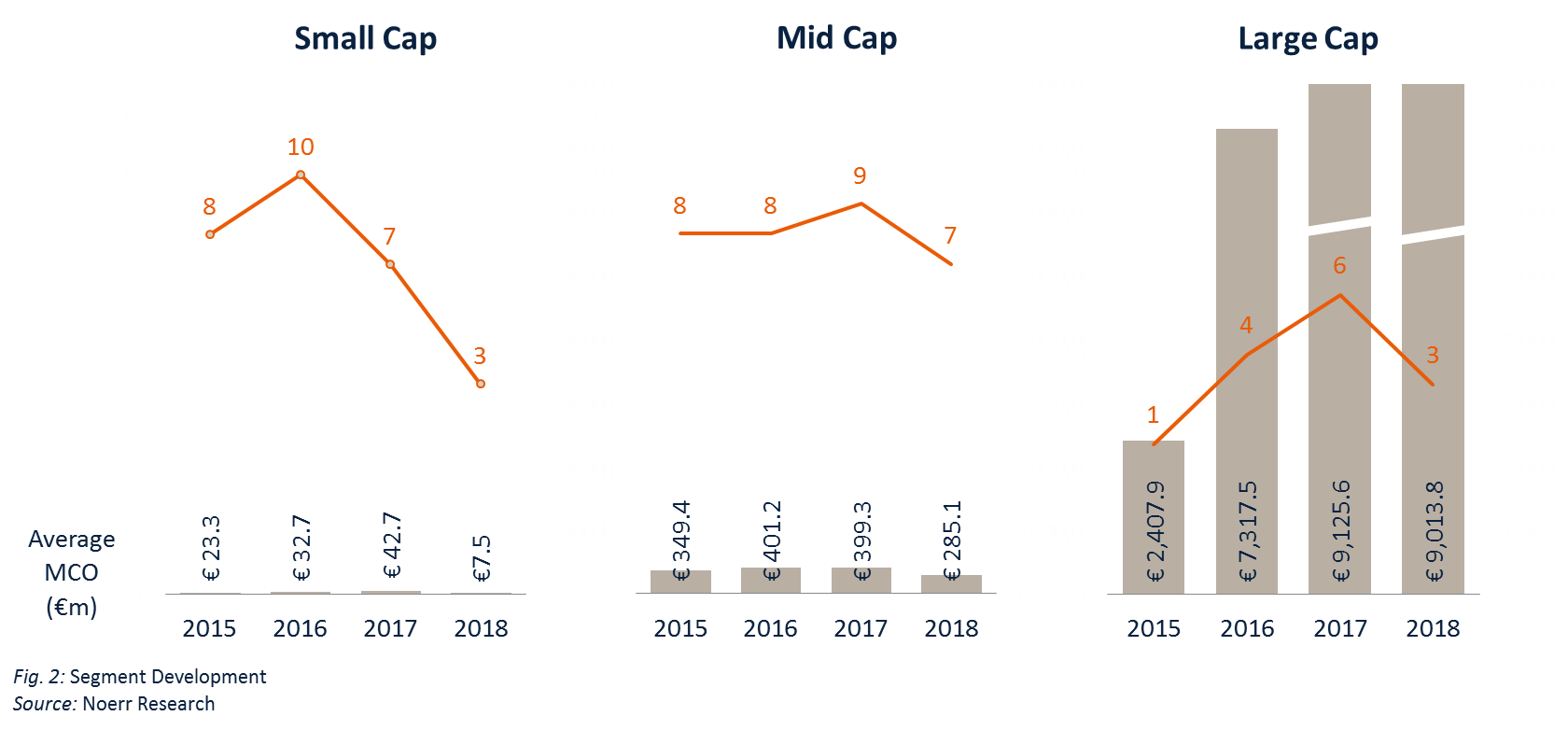

Dividing the market into the segments small-cap, mid-cap and large-cap by market capitalization of the target companies[2] results in the following picture:

An analysis of the market segments reveals that the area of large-cap transactions showed a significant decline in comparison with the two previous years. The average volume of offers in these (few) transactions remained roughly the same.

In the mid-cap segment the number decreased only slightly while the average offer volume has decreased noticeably after a conspicuously small range of fluctuation in the previous years.

Furthermore, the development in the small-cap segment shows a clear downward trend. The number of transactions as well as the offer volume fall to their lowest level in years.

Distribution of offer volume over number of transactions

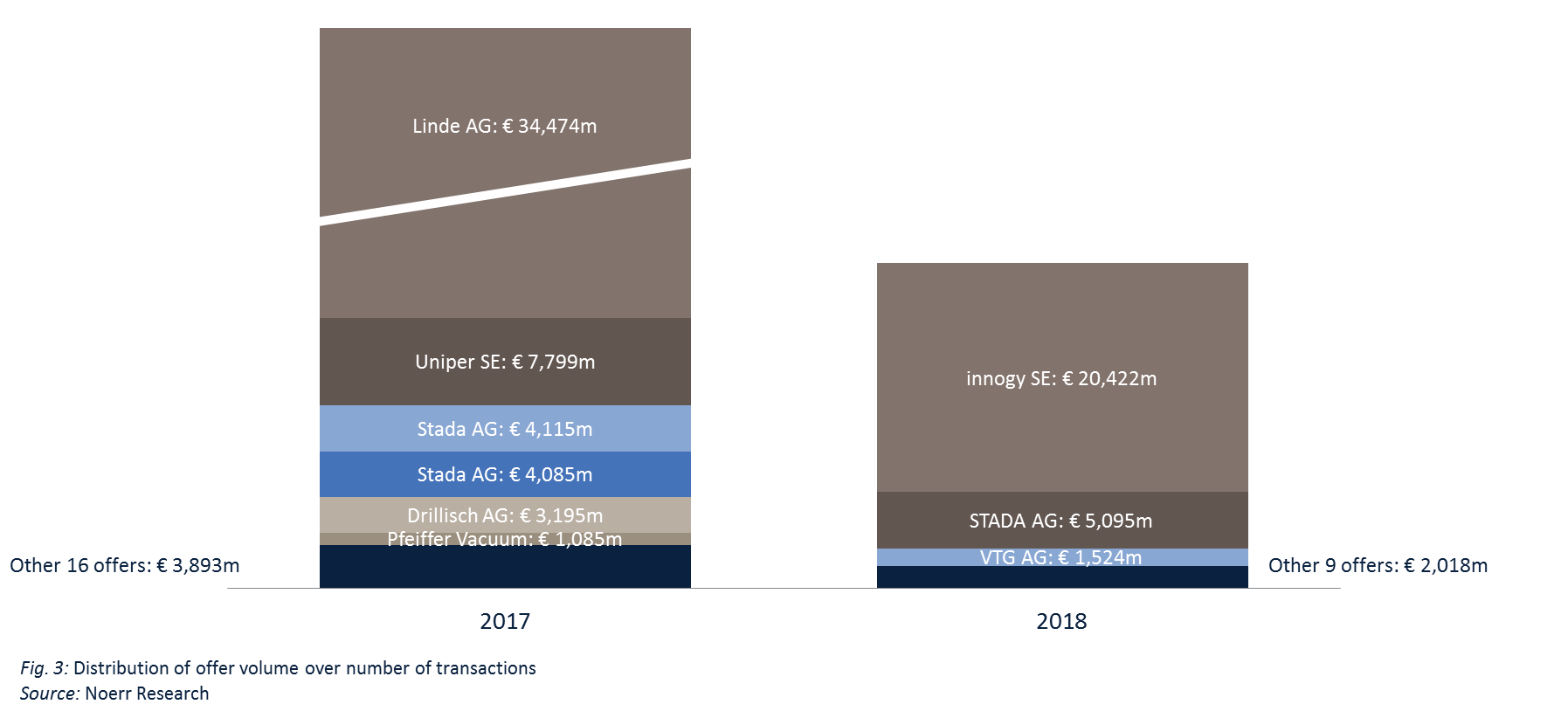

Also in 2018 the offer volume was distributed unevenly among the number of transactions. While a small number of target companies represented very high market capitalizations, most target companies had a low market value.

Of the 13 offers in the year 2018, the three large-cap transactions accounted for 93.06 % of the total MCO. 2017 shows an almost identical picture. Among the 22 offers of that year, the six large-cap transactions accounted for 93.36 % of the total MCO.

The following graphic shows the share of large-cap transactions in the aggregate MCO of the market in the years 2017 and 2018.

Average premiums offered

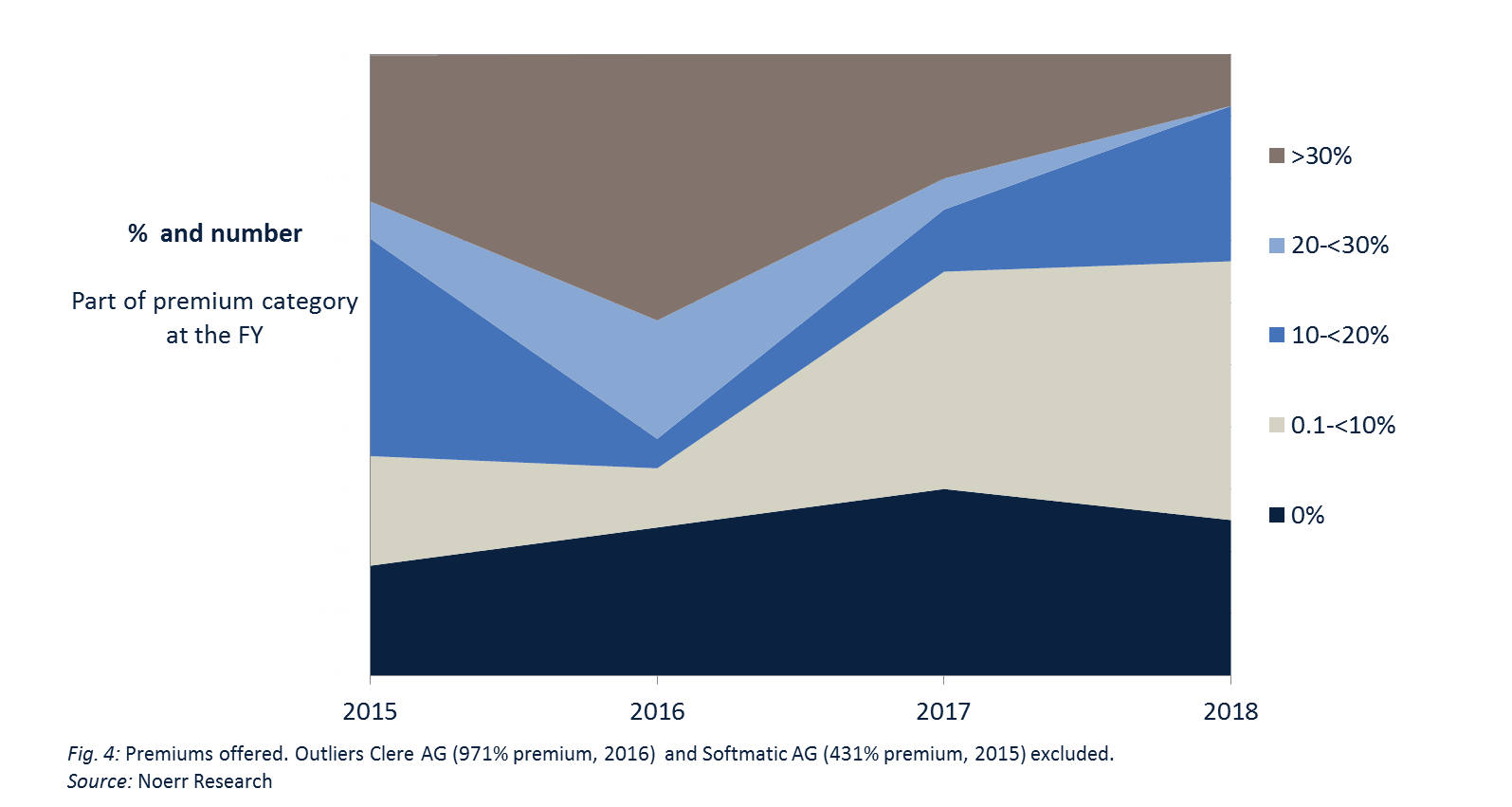

The premium, that was granted by offers in the year 2018[2] on the volume-weighted average price of the shares from the target company within three months before the publication of the offer, amounted to 8.08 % on average.

The corresponding average amounted to about 12.09 % in 2017, so that 2018 showed a slight decline in comparison.

In 2016, however, the (unadjusted[4]) average indeed amounted to 73.21 %. But adjusted for the mandatory offer by Elector GmbH to the shareholders of Clere AG, where due to the effects of a capital reduction a calculated premium of 971.43 % was paid, the average amounted only 33.81 %.

The corresponding average values amounted to (adjusted ) 19.87 % in 2015 and 7.58 % in 2014.

As the average offer premiums evolved very unevenly over the years, it is virtually impossible to make general statements regarding their development.

The picture is similarly uneven when the offers of the years 2015 to 2018 are divided into classes according to premium amount and compared over this period:

The distribution of offers over the premium categories still varies greatly. The number of offers with premiums of more than 30 % is strikingly low. The number of offers in the highest premium category is declining a lot more than the number of large-cap transactions, in which these high premiums are typically paid. In addition, it is noticeable that a significant amount of offers still constitute so called Low Balling-offers, i.e. offers based on the legal minimum offer price, with only a minimum or no offer premium.

Focus: Takeover general meetings

Paragraph 3 of section 3.7 of the German Corporate Governance Code[5] recommends that in the event of a takeover offer, the management board of the target company should convene an extraordinary general meeting “at which shareholders discuss the takeover offer and, if appropriate, decide on corporate actions.” This is merely a recommendation made by the Code, meaning that the governing bodies of the company do not have to comment on this in the “Declaration of Conformity with the Code” required by sec. 161 of the German Stock Corporation Act (Aktiengesetz – AktG) if they do not follow this recommendation. However, the fact that the “takeover general meeting” has been included in the Code at all makes it clear that convening such a meeting is in line with good corporate governance in the Code Commission's assessment.

A look at the practice of public takeovers in Germany, however, sheds some doubt on this finding. In the period from 2012 to 2018, 148 takeover bids were submitted, but only three extraordinary takeover general meetings were convened by management boards[6]. Two of these general meetings were cancelled before the day of the meeting[7]. The third was not based on an independent resolution of the management board, but on a minority request[8]. Since the management board members of a stock corporation normally pay particular attention to compliance with the principles of good corporate governance, especially in the “stress situation of a takeover”, this extremely small number of general meetings is surprising.

If the legal situation that a management board is exposed to when a takeover general meeting is convened is taken into account, this hardly common practice becomes more understandable: In itself, the announcement of the takeover bid is not a reason for the governing bodies of the target company to convene such a meeting. Rather, the general rule applies according to which the management board must convene a general meeting if it is “necessary in the best interests of the company” (section 121(1) 2nd alternative AktG). In this context, the management board must make an entrepreneurial decision in which it has to balance the interests of all stakeholders in an appropriate manner; however, prevailing opinion gives the management board broad decision-making scope in this respect.

A distinction has to be made between two cases here: firstly, the case in which the management board rejects the takeover offer. This leads to the question of whether it is in the interest of the company to defend itself against the offer. If the defence strategy pursued by the management board includes measures which can only be implemented with an appropriate resolution of the general meeting (e.g.an ordinary capital increase, restructurings to which the “Gelatine” doctrine of the Federal Court of Justice[9] applies), their implementation is in the interest of the company to the extent that the defence strategy is also in its interest. In this special case, the management board will therefore convene the general meeting.

On the other hand, there are cases in which the management board welcomes the offer or is neutral towards it. There is then no need for resolutions that would have to be adopted at the general meeting. The only purpose that then remains to justify convening a general meeting in the interest of the company is to use the general meeting to consult with the shareholders on the offer. Although such a general meeting at which no resolutions are adopted is considered permissible by prevailing opinion, the interest of shareholders in obtaining information alone will not justify such a meeting of the shareholders which would involve a lot of preparatory work and incur costs. Information can normally be communicated to shareholders in a less complicated manner. There are also other ways to get a picture of the mood among shareholders which can be considered (e.g. discussions with investors), since shareholders known to the management with larger shareholdings are likely to be given more weight in this context. In this case, it is not generally necessary to hold a general meeting in the interest of the company.

This conclusion is in line with empirical findings, according to which takeover general meetings at which no resolutions were adopted were only convened in cases in which there was a public conflict between the management and bidders (or related members of the supervisory board). After clarification of the underlying personnel issues, both of these takeover general meetings were cancelled again accordingly.

This shows that the recommendation of the Code that a general meeting should be held in the event of takeover offers is doubtful in terms of legal policy. This criticism, which has already been repeatedly voiced, has led to the fact that the deletion of this regulation has been proposed during the ongoing consultations for a revision of the Code. It is to be hoped that this sensible proposal is implemented.

Takeover offers in times of tightening foreign trade law regulations

It is difficult to assess whether the low number of public offers last year is also due to the political climate becoming increasingly hostile to investment. At any rate, there is a continuing trend that investors considering an offer for a company listed on the stock market in Germany are still showing increased interest in the regulations of German foreign trade law and their practical application. According to these regulations, the Federal Ministry for Economic Affairs and Energy can prohibit or restrict a transaction if an investor from a country outside the European Union and EFTA is seeking to acquire a stake in a company above a certain threshold and the restriction is necessary to ensure the public order or security of the Federal Republic of Germany.

The regulations have been repeatedly tightened within a short period of time and the market perception is that their implementation has also been tightened. The original threshold of 25 % of the voting rights in a German company was recently lowered to 10 % if the target company produces certain military or IT security products or operates in a more specific way in the so-called critical infrastructure sector. This can include companies from the following sectors: energy, water, food, information technology and telecommunications, cloud computing, healthcare, finance and insurance, transport and data traffic, telematics and media. The threshold for all other target companies remains at 25 %. The lowering of the threshold to 10 % means that the establishment of strategic positions, even prior to takeovers, can be subject to these regulations.

It was not until 2017 that the German government introduced the additional restrictions for companies operating in the critical infrastructure sector and notification requirements for such investments. For all other transactions, the bidder can apply to the ministry for a clearance certificate before completing the transaction.

Such a voluntary application can above all be advisable in light of a further tightening of regulations in the course of the changes introduced in 2017. In this case, the German government had extended the appeal period to five years from the purchase agreement being signed. This period can only be shortened if the acquisition is reported to the ministry beforehand. In this case, the ministry has three months to initiate a formal review procedure. There have also been major changes to the review deadlines: The ministry normally has two months to initiate a formal review procedure following receipt of an application for a clearance certificate. The review procedure has to be completed within four months of complete documentation being submitted. This deadline is, however, suspended when negotiations on a public-law contract are commenced.

The already high level of attention paid to the risks of M&A transactions being prohibited or restricted under foreign trade law was further increased by the 50Hertz and Leifeld cases. In both cases, the German government rejected the acquisition plans of Chinese investors. In the Leifeld case, the investor ultimately withdrew from the transaction after the German government had already given its required consent to a prohibition. In the 50Hertz case, the German government anticipated the acquisition plans of a Chinese investor by the development bank KfW acquiring the 20 % stake that was up for sale on its behalf.

The most recent offer documents show that some bidders controlled by shareholders from countries outside the EU had obtained a clearance certificate before the offer was published, although this was not always the case. It can be concluded that investors are clearly aware of the increasingly hostile investment climate.

[1] The partial offer by Deutsche Balaton Aktiengesellschaft to the shareholders of Biofrontera AG as well as the mandatory offer byTriton Liegenschaften GmbH and Mr. Jochen Schwarz to the shareholders of Pinguin Haustechnik AG were prohibited by BaFin. However, the offer regarding Biofrontera AG was repeated and approved in the following month.

[2] Definition of the segments: large-cap transactions: MCO of the target company equal to or greater than EUR 1,000 million; mid-cap transactions: MCO of the target company equal to or greater that EUR 100 million; small-cap transactions: MCO of the target company less than EUR 100 million.

[3] For calculation of the average premiums, offers prohibited by BaFin were disregarded. Furthermore, the voluntary partial acquisition offer of Deutsche Balaton Biotech AG to the shareholder of Biofrontera AG, which, because of its nature as a “simple” acquisition offer, was not subject to the requirements of the WpÜG as regards the determination of the amount of the consideration offered, is disregarded.

[4] For the calculation of the average premium in 2015, the mandatory offer by LIVIA Corporate Development SE to the shareholders of Softmatic AG was disregarded, where based on an MCO of the target company of roughly EUR 4.2 million, a calculated premium of 431.1 % was paid.

[5] In the version of 7 February 2017, which entered into force upon publication in the Federal Gazette on 24 April 2017.

[6] Source: Own research. It was not examined to what extent topics relevant to the offer were discussed at an ordinary general meeting held after the publication of the decision to submit a takeover offer.

[7] Invitation to the Hawesko Holding AG general meeting published on 19 December 2014; invitation to the Pfeiffer Vacuum Technology AG general meeting published on 3 July 2017.

[8] Invitation to the Rücker AG general meeting published on 26 September 2012.

[9] Cp. Federal Court of Jusitice, judgement of26 April 2004, NZG 2004, 571 et seq. – Gelatine I; Federal Court of Jusitice, judgement of26 April 2004, NZG 2004, 575 et seq.– Gelatine II.

Download Public M&A Report

The Noerr Public M&A Report analyses the evolution of public takeovers over a four-year period by number and volume, as well as the evolution of premium amounts and market trends.

The Noerr Public M&A Report analyses the evolution of public takeovers over a four-year period by number and volume, as well as the evolution of premium amounts and market trends.

The authors Volker Land and Stephan Schulz closely examine some of the currently relevant issues for public takeovers from a legal perspective. This issue focuses on general meetings dealing with takeovers and on takeovers in times of increasing foreign trade regulation.

as PDF> Noerr Public M&A Report