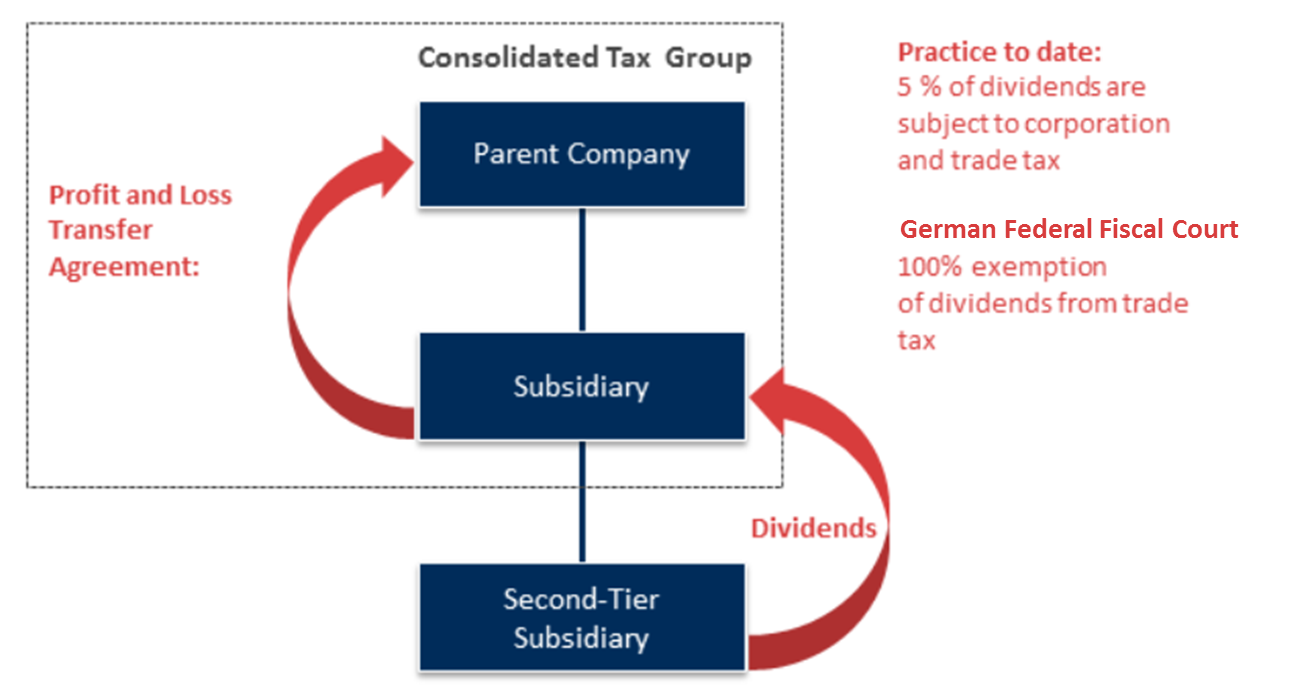

German Federal Fiscal Court judgement: Intercompany dividends exempted from trade tax if the companies are a single taxable entity

In a judgement handed down on 17 December 2014 (I R 39/14), the German Federal Fiscal Court ruled that contrary to the practice of the tax authorities, profit distributions from affiliated enterprises do not enjoy only a 95% exemption from trade tax, but are fully exempt from trade tax. The judgement concerned a dividend which a controlled entity received from a foreign subsidiary corporation. The principles of this judgement, however, also apply to dividends that a controlled entity receives from a domestic subsidiary.

Affiliated companies can expect high trade tax refunds on the basis of this judgement. A non-application decree from the Federal Ministry of Finance or a legislative amendment cannot be ruled out. The German Federal Fiscal Court agrees with the judgement handed down by the lower-instance Münster Fiscal Court (see report of 10.07.2014) and rejects the contrary view of the tax authorities (decision of the Münster Fiscal Court of 04.09.2006).

Tax law background

This paradoxical outcome is due to the relationship between corporation tax and trade tax regulations which apply to a single taxable entity: although for trade tax purposes, the controlled entity is deemed to be the permanent business establishment of the controlling entity, the trade earnings of the controlled entity are nevertheless established separately and then added to the trade earnings of the controlling entity, which are likewise established separately. In addition, the basis for the establishment of trade earnings is the income subject to corporation tax in each case. An additional special feature of the corporation tax regulations that apply to single taxable entities is relevant here, whereby the corporation tax exemption and the 5% taxation on intercompany dividends is only applicable at the level of the controlling entity (this is referred to as the “gross method” pursuant to the first and second sentences of No. 2 in sentence 1 of Section 15 of the German Corporation Tax Act). For this reason, dividends are fully included in the income of the controlling entity and reduced to the fullest extent by applying what is referred to as the “trade tax intercompany dividend privilege” (sentence 1 of Section 9 No. 7 of the German Trade Tax Act). They are therefore not included in the trade earnings of the controlled entity which are attributable to the controlling entity. Nor does trade tax at the level of the controlling enterprise take account of the 5% taxation on dividends received from the controlled entity because although this is deemed corporation tax income, it is not included in the trade earnings of the controlling entity.

In the opinion of the German Federal Fiscal Court, any “add-back gap” (Hinzurechnungslücke) that results from this cannot be closed either by interpretation or analogy, or by a specific correction with respect to single taxable entities via sentence 2 of Section 2(2) of the German Trade Tax Act.

Practical impact

As already mentioned (cf. report of 10.07.2014), the case ruled on here concerned a foreign dividend. The same would, however, also apply to a domestic dividend received by a corporation that has entered into a profit and loss transfer agreement with its parent company. Groups that have had corresponding dividend earnings in the past should keep these cases open and request a trade-tax reduction or complete trade-tax exemption for assessment periods that have not yet become statute-barred.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now