State support for start-ups during the coronavirus crisis – Update to the EUR 2 billion assistance package for start-ups

***** Updated on 30 June 2020: Mitigation of the requirement no “company in difficulty” for small and micro companies including start-ups *****

On 29 June 2020, the EU Commission extended the permissible framework for state aid.

This allows member states to grant state aid to small and micro companies, including start-ups (i.e. companies with fewer than 50 employees and an annual turnover and/or annual balance sheet total of less than EUR 10 million), even if these companies were already in financial difficulties on 31 December 2019.

***** News published on 08.06.2020 *****

In order to support Start-ups and young growth companies* during the corona crisis, the German federal government announced a EUR 2 billion assistance package for Start-ups.

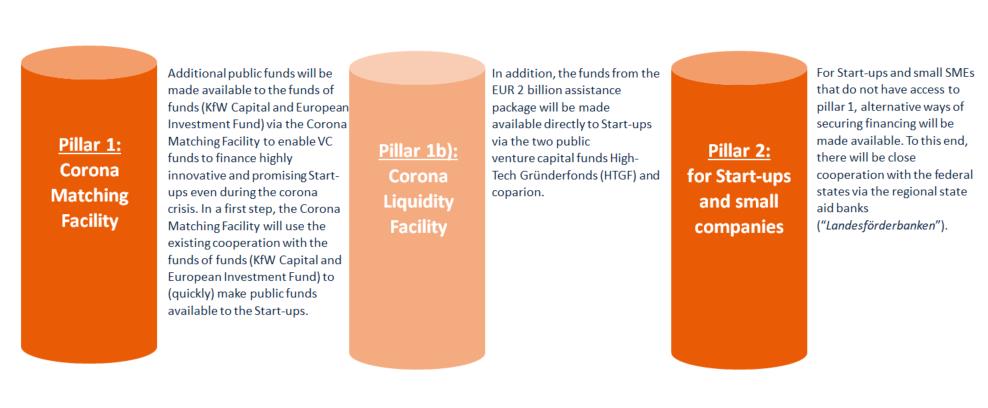

The EUR 2 billion assistance package is based on the following pillars:

According to more recent information, an amount of EUR 1.2 billion is to be allocated to pillar 1 and an amount of EUR 0.8 billion to pillar 2.

Pillar 1: Corona Matching Facility (‘CMF’)

The eligibility requirements for the use of the CMF (pillar 1) were finalized mid-May and the application process has since launched. The programme conditions are as follows:

Eligible applicants: VC Fund managers

To qualify for the CMF as a VC Fund manager (“GP”) with one or more VC funds (“VC Funds”), an accreditation process by KfW Capital or the European Investment Fund (EIF)** must be successfully completed. Only European GPs with corporate investments in Germany are eligible to apply. Furthermore, only those GPs whose managed fund volume is mainly held by private investors, none of whom holds a majority stake in the respective VC Fund, will be eligible to apply. Also, the GP must be independent, preventing corporate VCs and single family office VCs from being eligible to apply to pillar 1. The same applies to business angels and venture debt funds; however, it cannot be ruled out that they will play a role as intermediaries in connection with pillar 2.

GPs can decide whether they want to use CMF funds (i) only for current portfolio companies or (ii) additionally also for all new investments until 31 December 2020. New investments by a GP can be made through an already existing VC Fund or a special purpose vehicle, in which no other GPs or VC Funds have a stake.

Requirements for Start-ups

For GPs to be able to use CMF funds in financing rounds, Start-ups must meet the following conditions:

- Financing needs during the corona crisis

CMF funding supports Start-ups in need of financing during the corona crisis. It is not necessary, however, that the financing requirement was caused by the corona crisis in particular.

- Significant connection to Germany

The respective Start-up must have a significant connection to Germany. This can be assumed if the Start-up either has (i) its registered office, (ii) its head office, (iii) the main focus of its business activities, or (iv) the majority of its full-time employees work in Germany.

- Not a company “in difficulty”

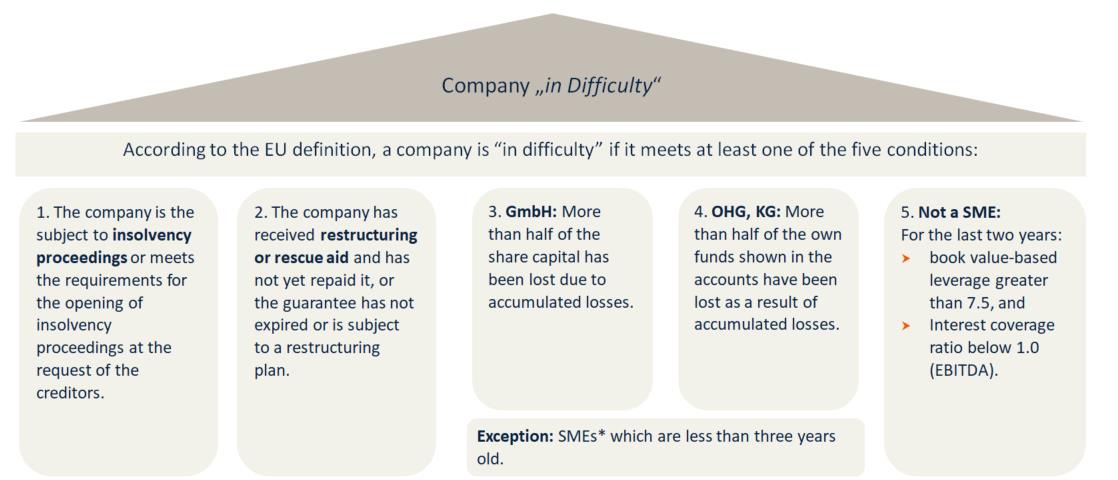

Another condition is that the assisted Start-up must not have been a company “in difficulty” as of the effective date (31 December 2019) within the meaning of European law.

With regard to Start-ups, “in difficulty” means the following:

1. Start-up is an SME and less than three years old: only criteria 1 and 2 are relevant.

2. Start-up is an SME and over three years old: in addition to criteria 1 and 2, criterion 3

(or 4, although Start-ups in the legal form of partnerships are unlikely to exist) is also relevant.

3. Start-up is not an SME: criteria 1 and 2, criteria 3 or 4 and criterion 5 are relevant.

Criterion 3 could be critical for Start-ups. In the case of limited liability companies (e.g. GmbHs), half of the share capital is due to accumulated losses lost if, after deducting the accumulated losses from reserves (and all other elements that are generally attributed to the Start-up’s own funds), there is a negative cumulative amount corresponding to more than half of the share capital. However, losses in the Start-up phase are common in a Start-up and, unlike as in a “normal” company, half the loss of the share capital is not necessarily an indication of a failure of the business model. Since criterion 3 applies only to Start-ups more than three years old, the number of Start-ups which are not eligible for CMF funding on the basis of (solely) this criterion should not be the majority.

- No majority shareholders

Furthermore, individual financial or strategic investors may not hold a majority stake in the Start-up.

VC matching process

Only the capital of private VC Funds can be matched by KfW Capital.

GPs may provide CMF funds to the Start-up concerned in the context of financing rounds until 31 December 2020 only, provided that the application process and signing of the financing documents can be completed by 31 December 2020.

A retroactive inclusion of CMF funds as of 2 April 2020 in relation to rounds already signed is possible, but only if provided for in the financing documents.

- Matching process for GP’s current portfolio companies

If a GP chooses to use CMF for its current portfolio companies, it has to determine a fixed matching ratio, which then applies equally to all investments in the portfolio of the GP in question, i.e. it is not possible to determine the matching ratio selectively for individual financing rounds.

This is accompanied by an obligation of the GP to offer all future investments in current portfolio companies to KfW Capital for matching until 31 December 2020. This is intended to avoid “cherry-picking” by GPs, whereby only the riskier or less promising investments are matched, while investments with a higher return profile or lower default risk are carried by only the GP. KfW Capital will also reserve the right to participate in follow-up rounds - even after 31 December 2020.

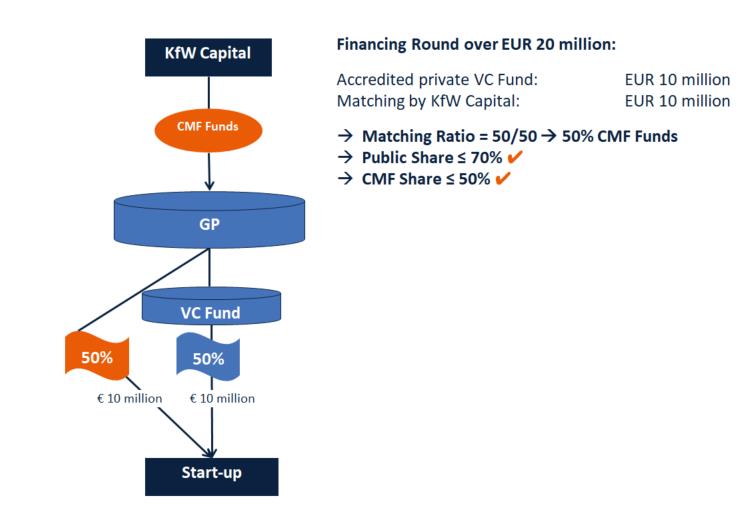

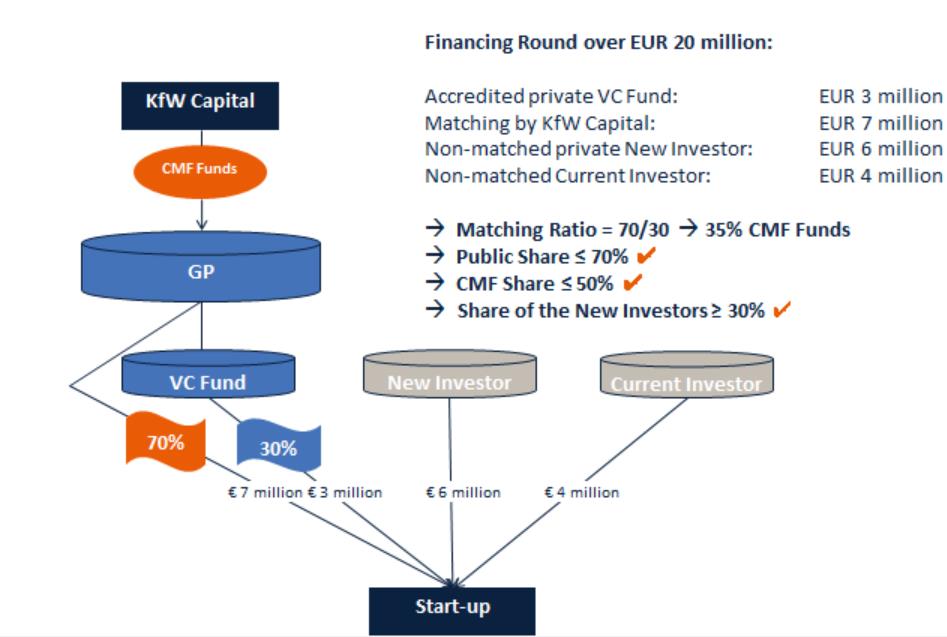

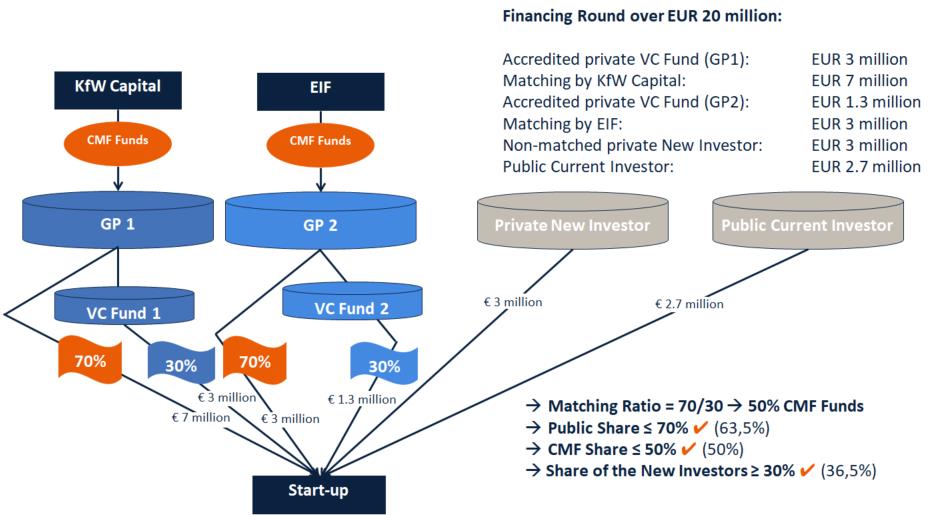

The private capital invested by the VC Fund concerned is in principle mirrored by the CMF at 50%. Deviating from this, the GP concerned may also opt to have a lower or higher matching ratio (maximum 70% public funding) with regard to all its investments. It should be noted that the total CMF share for each financing round should not exceed 50% (“50% ceiling”), i.e. further private or public investors would have to participate in order for the desired matching ratio of 70/30 to be applied in the respective financing round, while still only a maximum of 50% flows out of the CMF. If this is not the case, the matching ratio will be automatically reduced by the amount necessary to reach the 50% ceiling.

Furthermore, matching is only possible in the case of an internal financing round (exclusively current investors) or if the share of new investors amounts to at least 30%. Lastly, the share of public funding, which in addition to CMF funding also includes public funding under other support programmes, may not exceed 70% per financing round.

The systematics of the matching process can be illustrated by two examples of financing rounds with a total investment of EUR 20 million in each case:

Example 1:

Example 2:

- Matching process for GP’s new investments

Furthermore, the GP can decide to match all new investments (outside the portfolio) with the CMF, also at a specific matching ratio until 31 December 2020; it remains to be seen whether this option will be used to any significant extent. The GP can determine the matching ratio for new investments in a different way from the matching ratio for the current portfolio investments, whereby the matching ratio for new investments may not exceed that for current investments. Accordingly, there can be two different matching ratios. In addition, at least 30% of the financing round must be provided by new investors (including the matched new investments of the respective VC Fund).

The systematics of the matching process for new investments can be illustrated by the following example of a financing round with a total investment of EUR 20 million:

Contractual relationships

A direct contractual relationship exists between KfW Capital and the GP in the form of a co-investment and trust framework agreement (“CTFA”) to be concluded between them, according to which the GP acts on its own behalf in the external relationship, but internally for KfW Capital.

On the basis of the CTFA, capital can then be called up for Start-ups by way of individual investment agreements. Subsequently, an individual trust agreement is concluded between the VC Fund and KfW Capital (with the participation of the GP) with regard to this specific Start-up. The investment by KfW Capital will be subject to the same terms and conditions as the VC Fund’s investment, in particular in the event of an exit, KfW Capital will participate like the private VC Fund (pari passu). The GP does not receive management fees from KfW Capital for the management of the respective VC Fund or the CMF funds and is not entitled to a so-called carried interest (disproportionate share of profits). The transaction fees and fiduciary costs are distributed between KfW Capital and the GP according to the matching ratio.

KfW Capital does not appear in the cap table of the respective Start-up, since contractual relations exist exclusively between the VC Fund and the Start-up. Only the VC Fund is a party to the respective financing documents. However, it will nevertheless have to ensure that the scope of the reporting obligations imposed on the Start-up also meets the requirements of KfW Capital.

Financing instruments

Possible financing instruments include classic equity financing (financing round), the conclusion of convertible loans or the granting of subordinated shareholder loans, whereby only the GP, possibly together with other investors, negotiates the terms (e.g. conversion and repayment modalities) or the form and timing of the exit with the Start-up.

Although KfW Capital invests not only in VC Funds but also in venture debt funds, the inclusion of venture debt as a matchable financing instrument has been explicitly excluded.

Application process

For the purpose of sending the application documents, interested GPs can contact KfW Capital (VC-matching@kfw.de) or EIF (German-CMF@eif.org), provided that one of these CMF institu-tions already belongs to the group of investors of the VC Fund. If this is not the case, inquiries can be addressed to KfW Capital or any other CMF institution. Only after the complete documentation has been submitted the respective GP will be checked for its suitability and, ideally, a CTFA will be concluded, a single investment agreement will be signed, the financing documents will be signed, and finally, capital will be distributed.

Pillar 1b: Corona Liquidity Facility (“CLF”)

Pillar 1 funds are also to be distributed directly to Start-ups via the two public VC Funds High-Tech Gruenderfonds and coparion. A separate financing framework is still to be developed for this purpose.

Pillar 2: Start-ups without access to pillar 1 and small companies

As of today, KfW Banking Group is making global loans with exemptions from liability available to the regional state aid banks to finance Start-ups without access to pillar 1 and small SMEs. These funds enable the regional state aid banks to refinance promotional programmes tailored to the needs of the individual federal states. Depending on the respective programme, this can be mezzanine or equity financing, e.g. financing via open or silent partnerships. Funding is provided for expenditure on purchases (investments) and running costs (operating resources, i.e. rent, salaries and warehouses, etc.).

According to today’s KfW press release, the specific funding structure varies from federal state to federal state. The demand of individual associations to avoid a “federal patchwork quilt” was therefore not heard.

The Start-ups can apply for funding from the respective regional state aid bank or an integrated intermediary agency until the end of this year. You can find an overview of the responsible regional aid banks here.

The requirements for Start-ups to qualify for funding are partly identical to those for Start-ups covered by pillar 1.

In detail:

- Financing requirements

According to today’s KfW press release, Start-ups must have a proven need for financing.

- Significant connection to Germany

The respective Start-up must have a significant connection to Germany. This can be assumed if the Start-up either (i) has its registered office, (ii) the head office, (iii) the main focus of its business activities in Germany, or (iv) the majority of its full-time employees work in Germany.

- Not a company “ in difficulty”

A further condition is that the Start-up seeking funding must not already have been a company “in difficulty” on 31 December 2019 within the meaning of European law. For details, please refer to the above comments on pillar 1.

- Group turnover

In contrast to pillar 1, there is an additional requirement that the Start-up’s group turnover must not exceed EUR 75 million.

Further requirements

According to KfW, it is possible, but not mandatory, to involve private investors, such as business angels, to provide the overall financing.

The respective funding programmes of the federal states may give rise to further funding requirements.

Scope of the funding

With the temporary adjustment of the legal framework for state aid until 31 December 2020, the EU Commission has granted a scope of action of up to a maximum of EUR 800,000.00 per Start-up for pillar 2.

Retroactive effect

According to today’s KfW press release, funding commitments already made by the state development institutions to Start-ups or small SMEs can be taken into account retroactively until 2 April 2020. It remains to be seen how this inclusion will be structured in concrete terms. It would be conceivable to increase or extend the funding commitments already made.

The EUR 2 billion assistance package is the “first tranche” of the so-called Future Fund. The coalition committee of the governing coalition had already approved the Future Fund in November 2019, thus clearing the way for the distribution of EUR 10 billion over ten years. This first tranche of emergency aid during the crisis represents an above-average share of the planned volume. KfW has been commissioned to prepare it. It remains to be seen when further details will be announced and through which channels these additional funds of the Future Fund will be distributed.

* Hereinafter referred to as “Start-up”

** The following statements also apply to the EIF, even if only KfW Credit is mentioned herein.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now