Government Draft of the Future Financing Act (Zukunftsfinanzierungsgesetz – ZuFinG) – Opportunities for Real Estate Funds

From the first draft bill to the government bill

On 16 August 2023, the German Federal Cabinet approved the government's draft bill for a law on the financing of future-proof investments [Future Financing Act (Zukunftsfinanzierungsgesetz – ZuFinG)]. The cabinet decision was preceded by a lobby hearing on the first draft of the bill published by the Federal Ministry of Finance on 12 April 2023 (see our previous article here).

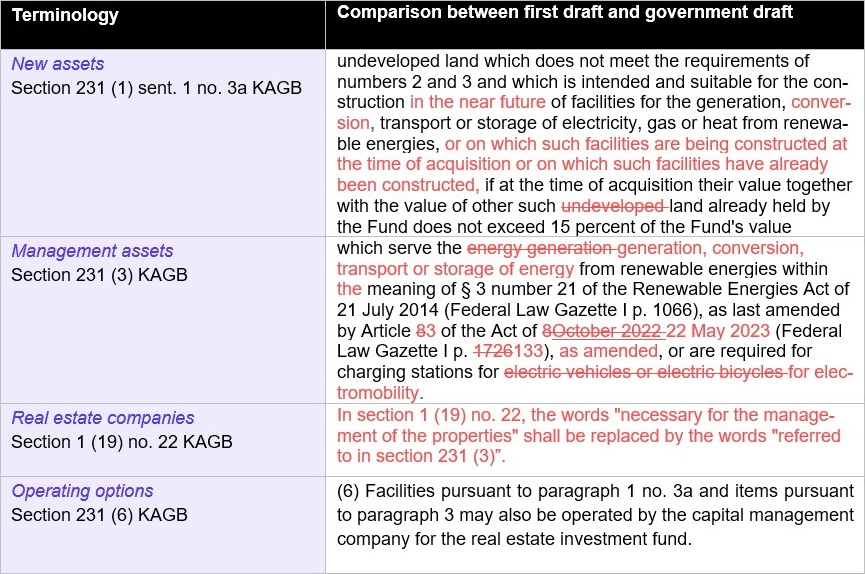

For the area of retail real estate funds pursuant to Sections 230 et seq. of the German Capital Investment Code (Kapitalanlagegesetzbuch – KAGB), there have been changes in the government draft bill compared to the first draft bill. The wording of these amendments is shown in the following table:

Click image to enlarge

Impact on retail real estate investment funds

New assets

Notwithstanding the amendments of the government's draft bill compared to the first draft bill, the ZuFinG shall for the first time enable retail real estate investment funds to acquire land with facilities for the generation, conversion, transport or storage of electricity, gas or heat from renewable energies ("RE facilities").

Acquisition of land: Contrary to the petitions of some lobby groups, the requirement that ownership of real property must be (co-)acquired has not been abandoned.

In our view, lease structures that are common in Germany, where the operator builds the RE facilities on the basis of a lease agreement on a third-party property but continues to be the owner of the facilities (due to easements), are therefore not covered by section 231 (1) sentence 1 no. 3a KAGB (on the eligibility pursuant to section 231 (3) KAGB, see below).

However, such structures can be acquired through retail infrastructure funds within the meaning of sections 260a et seq. KAGB, special AIFs with an infrastructure focus and foreign funds.

Stages of development: On the other hand, it was clarified that real property with RE facilities in all stages of development is covered:

- Undeveloped real property intended and suitable for the construction of RE facilities in the near future,

- Real property on which RE facilities are currently being erected at the time of acquisition, and

- Real property on which RE facilities have already been erected at the time of acquisition.

For the terminology and the delimitation of the stages of development, we believe that the interpretation of section 231 (1) sentence 1 nos. 1 to 3 KAGB can be referred to.

Undeveloped real property: In our view, this also applies in particular to the first stage of development, the constituent elements of which are now essentially identical in wording to Section 231 (1) sentence 1 no. 3 KAGB due to the addition of "in the near future". Preconditions for the acquisition of undeveloped real property pursuant to Section 231 (1) sentence 1 no. 3a KAGB are:

- On the one hand, the real property must be intended for the construction of a RE facilities in the near future. In our view, this is the case if the intention is to start construction soon and to complete it within a reasonable period of time. However, the criterion of "in the near future" cannot be given a rigid time limit, but it can be further defined on the basis of the stages of development mentioned below.

- On the other hand, the real property must be suitable for the construction of a RE facilities in the near future, which can be specified according to the stages of development of wasteland, land awaiting construction, raw building land and land ready for construction. It is commonly accepted that land ready for construction is suitable for building/erection in the near future. Raw building land is said to be acquirable if there is a development plan, a division into parcels has taken place and the development is secured. In contrast, wasteland and land awaiting construction are generally not suitable for construction in the near future.

- Leasehold rights: In our view, leasehold rights over RE facilities should also be eligible due to the spirit of the law.

In our view, it should be clarified in Section 231 (1) sentence 1 no. 4 KAGB that the requirements of the new Section 231 (1) sentence 1 no. 3a KAGB are to be observed.

Management assets

Compared to the first draft bill, section 231 (3) KAGB has been expanded by the government's draft bill:

- RE facilities: Whereas previously only RE facilities for energy production were covered, the provision now covers facilities (i) for the generation, (ii) conversion, (iii) transport and (iv) storage of renewable energy. If the explanatory memorandum to the draft bill continues to refer in particular to rooftop photovoltaic facilities (see Draft, p. 188), this is too narrow according to the new wording.

- Charging stations: In our view, the amendment regarding charging stations, which were previously intended for "electric vehicles or electric bicycles" and are now intended for "electromobility", is less substantive than semantic, but in any case keeps the wording of the law open to development.

Based on the mere wording of the new Section 231 (3) KAGB, it now appears possible to acquire RE facilities and charging stations even without buildings or real property. However, this is in contradiction to the original spirit of the provision, which only wanted to allow the acquisition of assets serving buildings or real property and were of minor importance (so called annex assets).

Real estate companies

By referring to Section 231 (3) KAGB in Section 1 (19) no. 22 KAGB, the government's draft bill now clarifies that real estate companies may acquire RE facilities and charging stations in addition to management assets in the narrower sense.

Operating options

Finally, it is further provided that a retail real estate investment fund may also operate the RE facilities within the meaning of Section 231 (1) sentence 1 no. 3a KAGB and also the assets pursuant to Section 231 (3) KAGB (i.e., management assets in the narrower sense, RE facilities and charging stations) – in our view, this clarifies at the same time that realizing income from operating these assets is permissible under investment law.

With regard to special AIFs with a real estate focus, it is interesting to note that in the explanatory memorandum to the draft bill, the reference to the fact that the 15 % limit of Section 231 (1) sentence 1 no. 3a KAGB is intended to result in "funds retaining their asset administrating character overall and not becoming purely operationally active companies" was deleted. In our view, this suggests that in the case of special AIFs with a real estate focus, the operation of RE facilities to a significant extent or even exclusively may be permitted.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now