Noerr Public M&A Report 02/2021

Market Development and Trends

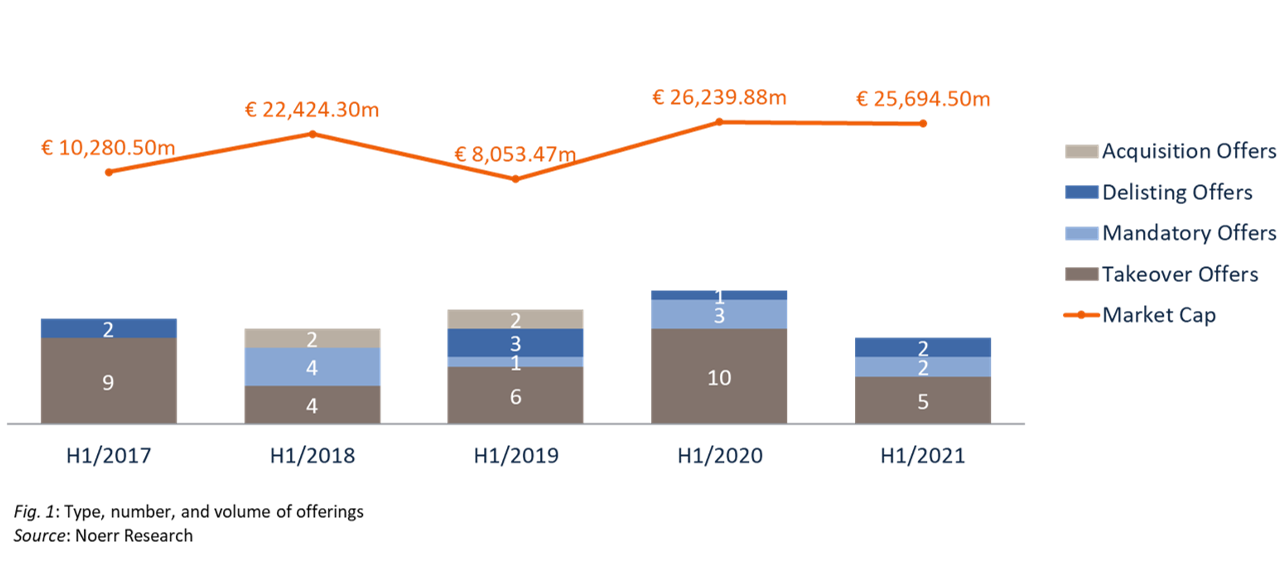

- In the first half of 2021, the offer volume in the market for public takeovers has decreased only marginally by approximately 2% compared to the first half year of 2020. However, the offer volume of HY1 2021 was spread across nine transactions compared to 14 in HY1 2020, so the average volume per transaction has risen significantly.

- The market for public M&A in HY1 2021 was characterized by the first takeover offer by Vonovia SE to the shareholders of Deutsche Wohnen SE. The transaction - which was terminated in July because the minimum acceptance threshold of more than 50% of the share capital set by the bidder had not been reached - represents 72.83% in the total offer volume of HY1 2021. This share significantly exceeds the share of 37.83% that the transaction with the largest volume of HY1 2020 had in the total volume of that period.

- There were only two transactions in the large-cap segment in HY1 2021. This stands in stark contrast to HY1 2020 in which seven large-cap offers - and thus more than in any other first half year of the previous seven years – were published. This development means a return to the level seen in the years 2014 to 2019 (between one and three transactions).

- In the mid-cap segment, the number of transactions in HY1 2021 stayed the same as in HY1 2020, whereas the average offer volume dropped by more than a third.

- The average premium rate dropped to 10.10%. Two transactions did not involve any premium at all. The average premium for the takeover offers in HY1 2021 was 16.45%, representing a decrease of approximately 14.3% compared to the HY1 2020 figure of 19.19%.

- Public M&A by industry sector: Our analysis of the 117 offers pursuant to the WpÜG published during the time period from 2016 to the present provided us with insights as to which sectors experienced most takeover activity and how the premium rates varied in the different sectors.

- Practice of granting restructuring exemptions: We analysed 25 BaFin decisions exempting bidders, on the basis of restructuring plans, from the obligation to make a mandatory offer to the target’s shareholders. Our analysis revealed that restructuring exemptions are only granted when strict requirements are fulfilled, although bidders are allowed considerable flexibility in deciding what kind of restructuring contribution to make.

Market Overview

Number and volume of offers

In HY1 2021, the German Federal Financial Supervisory Authority ("BaFin") reviewed ten public offers pursuant to the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – "WpÜG"). BaFin approved nine of them, which were then published by the respective bidder. The offers concerned targeted companies with an aggregate market capitalization at offer price ("MCO") of EUR 25,694.49 million. Five of the nine approved offers were takeover offers, two were mandatory offers and two were pure delisting offers, with one of the takeover offers and one of the mandatory offers being combined with a delisting offer. One offer was prohibited due to illiquidity of the shares offered for exchange.

The number of transactions in the German market for public takeovers decreased to nine in HY1 2021, compared to HY1 2020, when BaFin had approved as much as fourteen offers. The offering volume (in terms of MCO), however, dropped only slightly from EUR 26,239.88 million in HY1 2020 to EUR 25,694.49 million in HY1 2021, a decline of approximately 2%.

The only slight reduction in total offer volume in contrast to the considerable drop in the number of transactions from 14 to nine is mainly due to the large-volume takeover bid Vovonia SE made for Deutsche Wohnen SE. The offer was terminated in July because one condition, the minimum acceptance level of over 50% of the share capital, had not been met. In August, Vovonia started another takeover attempt on its target. With an MCO of EUR 18,714.56 million, the original transaction accounted for 72.83% of the total offer volume of HY1 2020. One further, not insignificant factor is the delisting offer by ams Offer GmbH to the shareholders of OSRAM Licht AG with an MCO of EUR 5,065.14 million, equal to another 19.71% of the total offer volume.

The high total offer volume of last year’s comparison period, however, was not due to the high volume of just a few transactions, but to the high number of seven large-cap transactions and to the large MCO of the mid-cap transactions in that period.

Developments within the market segments (large-cap, mid-cap, and small-cap)

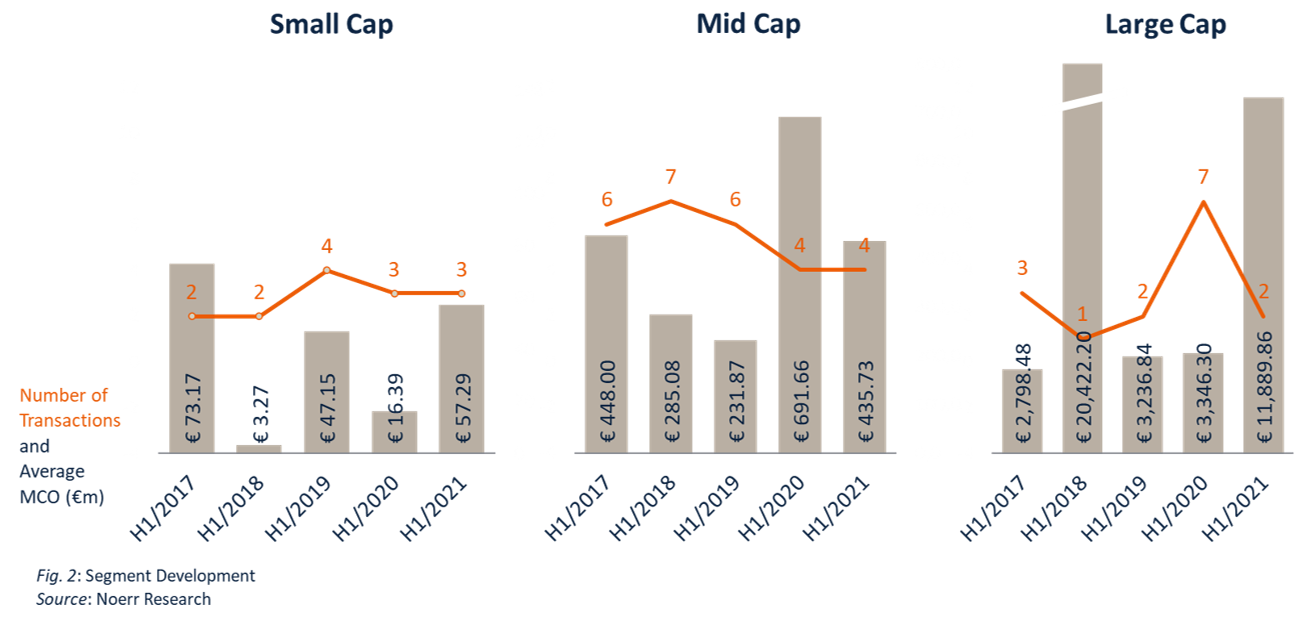

The market can be subdivided into three segments according to the target company’s MCO: small-cap (MCO of less than EUR 100 million), mid-cap (MCO equal to or greater than EUR 100 million, but less than EUR 1 billion), and large-cap (MCO equal to or greater than EUR 1 billion).

The following chart shows the development of the average MCO of all target companies divided by segment:

In the large-cap segment, the average offer volume was EUR 11,889.97 million in HY1 2021, more than 3.5 times higher than that of HY1 2020, which was EUR 3,346.30 million. It also significantly exceeded the volumes of the first halves of 2017, 2019 and 2020. However, the average offer volume of HY1 2021 did not reach the HY1 2018 level, which was EUR 20,422.20 million and consisted of a single large-cap transaction – the takeover offer to the shareholders of innogy SE. With a total of two transactions, the number of offers in the large-cap segment was significantly lower in the period under review than it was in HY1 2020, close to the level of the comparison periods of the years 2017 to 2019.

The mid-cap segment saw four transactions with an average offer volume of EUR 435.73 million. The number of transactions did not change in comparison to HY1 2020 and was thus still lower than the comparison figures of the years 2017 to 2019. Although the average offer volume of HY1 2021 represents a considerable drop compared to HY1 2020, it still exceeds the comparison figures of H1 2018 and H1 2019 and almost reaches the H1 2017 level.

In the small-cap segment, the HY1 2021 number of three transactions is also the same as that of the comparison period of 2020. The large average offer volume fluctuations seen in recent years continue. At EUR 57.29 million, the average offering volume of HY1 2021 by far exceeds that of HY1 2020, which was EUR 16.39 million, representing the second largest average volume of all comparison periods since 2014 – topped only by the HY1 2017 volume.

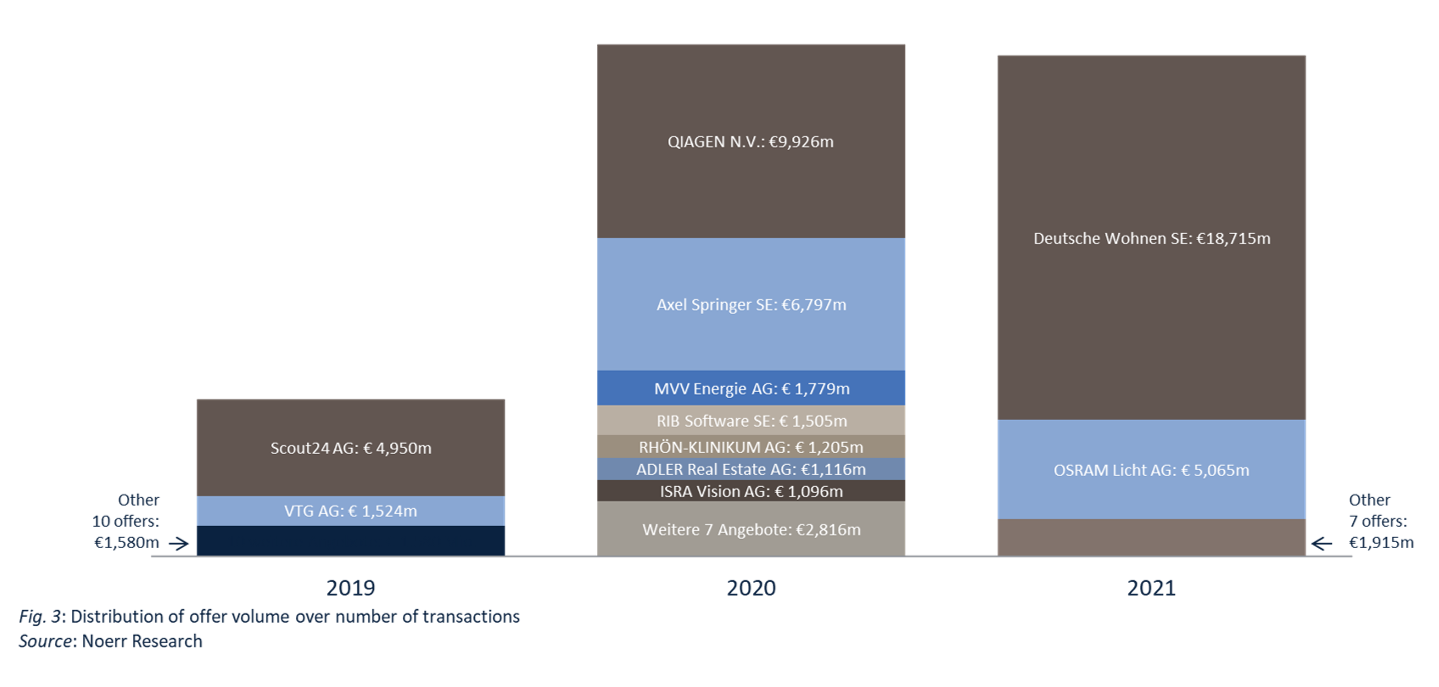

Distribution of offer volume vs. number of transactions

Two of the nine offers in the first six months of 2021 were made in the large-cap segment. These two alone accounted for the lion's share of 92.55% in the total offer volume of EUR 25,694.49m. This share even exceeds the 89.27% share of large-cap transactions in the 2020 comparison period, although that share consisted of far more offers.

The offer with the highest MCO was the takeover offer by Vonovia SE to the shareholders of its competitor Deutsche Wohnen SE, which accounted for 72.83% of the total offer volume. The second bid in the large-cap segment, the delisting offer by ams Offer GmbH to the shareholders of OSRAM Licht AG accounted for a further 19.71% of the total volume. Obviously, the trend of recent years of an uneven distribution of the total offer volume across all transactions is still unbroken.

Premium amount

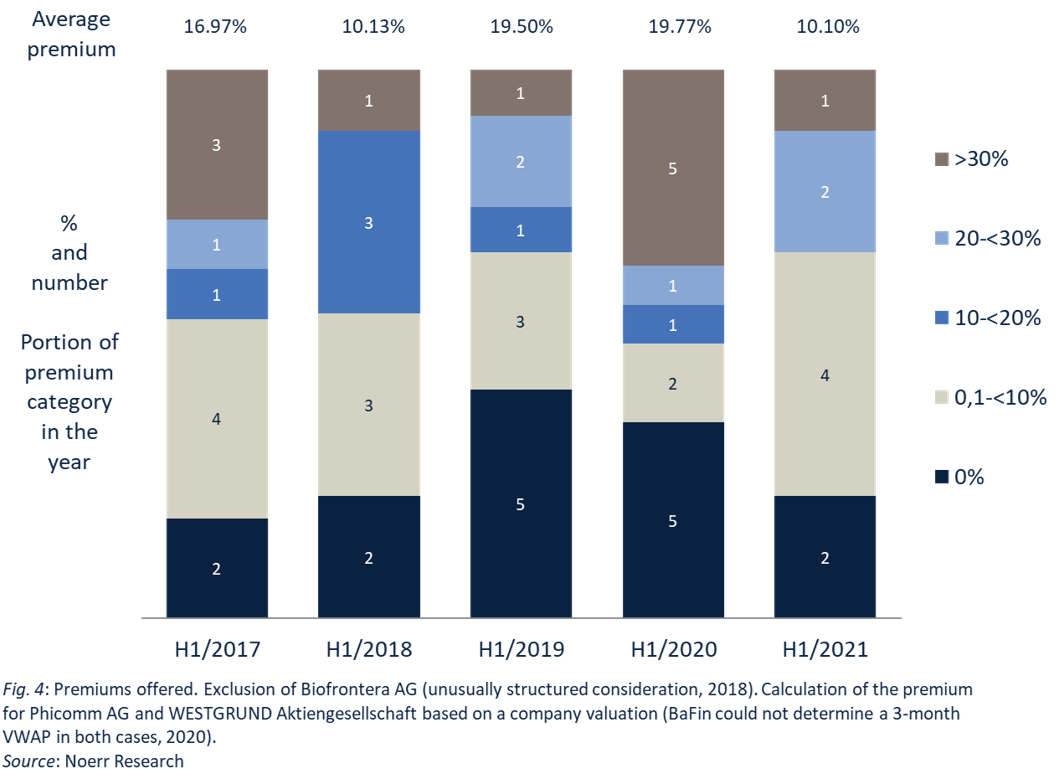

In HY1 2021, bidders paid an average premium of 10.10% on the volume-weighted average price of the respective target company‘s shares measured in the three-month period preceding the announcement of the bid (“3-month VWAP”). The highest premium of 37.71% was paid to the shareholders of Tele Columbus AG in connection with the takeover offer by Kublai GmbH.

In two cases, the shareholders of the target company did not receive any premium, namely in connection with the offers to the shareholders of DEAG Deutsche Entertainment AG and SURTECO GROUP SE.

The following chart illustrates the premiums offered in connection with the transactions of HY1 2021 divided by category and shows the average premium for each period. It contrasts those premiums and average premiums with those of the first halves of 2017 to 2020:

The average premium in the first half of 2021 in the amount of 10.10% represents a decline of almost 50% compared to the 19.77% reached in HY1 2020 and is thus on a similarly low level as the average premium of HY1 2018.

The premium a bidder offers is quite meaningful, as the bidder is trying to gain control over the target by means of the intended takeover and thus attaches great importance to offering an attractive price. For the five takeover offers of HY1 2021, an average premium of 16.45% was offered. This figure is 2.74 percentage points (equivalent to approximately 14.3%) below the average premium of HY1 2020.

Reasoned statements pursuant to section 27 WpÜG

by Philipp Schmoll, Noerr Partnerschaftsgesellschaft mbB, Frankfurt am Main.

In the first half of 2021, the corporate bodies of the target companies published a total of ten reasoned statements pursuant to section 27 WpÜG in reaction to nine public offers. Nine of these ten statements were published jointly by the management and supervisory boards of the respective target company. Separate reasoned statements were published by the management board and the supervisory board of AKASOL AG respectively as a response to the takeover offer by ABBA BidCo AG. The reason for this approach was the role of the CEO of AKASOL AG, who not only was indirectly the largest shareholder of the company but also had committed himself irrevocably vis-à-vis the bidder to accept the takeover offer.

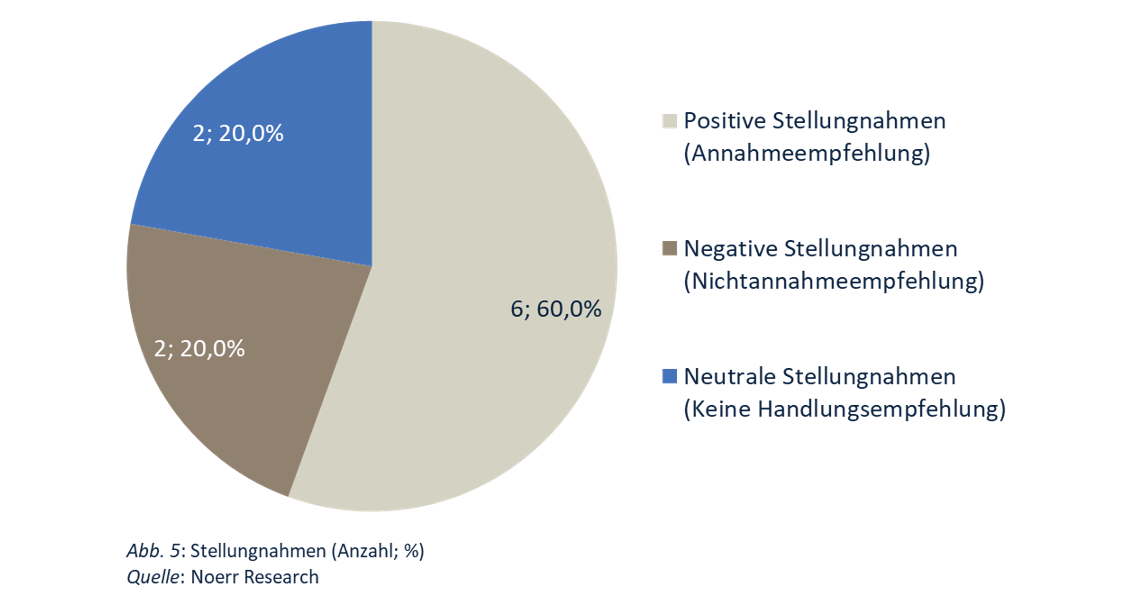

Assessment of offers

The following final assessments of offers were made by the corporate bodies of the target companies:

One noteworthy case is the negative statement by the management and supervisory boards of SMT Scharf AG with respect to the combined mandatory/delisting offer by Shareholder Value Beteiligungen AG and Share Value Stiftung. In this case, bidder and target concluded a delisting agreement before the offer was made, as the corporate bodies of the target company were in favor of both a delisting of SMT Scharf AG and of the other intentions of the bidder. Nevertheless, after their having obtained a fairness opinion, both the management board and the supervisory board of SMT Scharf AG reached the conclusion that the consideration offered by the bidder was not adequate, so they advised their shareholders to not accept the offer.

Fairness Opinions

Seven of the ten reasoned statements (70%) were based on so-called fairness opinions obtained from external advisors with respect to the adequacy of the consideration offered. Only in the cases of Tele Columbus AG, AKASOL AG and Deutsche Wohnen SE (30%) obtained the management board and the supervisory board more than one fairness opinion:

- The management boards and the supervisory boards of Tele Columbus AG and AKASOL AG each obtained their own fairness opinion. In both cases, the fairness opinions were commissioned in reaction to a takeover offer in the mid-cap segment, with the target’s MCO between EUR 100 million and EUR 1 billion. Furthermore, the management board and the supervisory board of AKASOL AG prepared separate reasoned statements of their own.

- The management board and the supervisory board of Deutsche Wohnen SE obtained a total of five fairness opinions in the context of their joint statement with respect to the takeover offer by Vovonia SE, the highest number ever in the history of the WpÜG. The management board of Deutsche Wohnen SE commissioned three, the supervisory board two fairness opinions.

The timing of the reasoned statements

The reasoned statements of the first half of 2021 were made on average 7.9 days after the publication of the offer document. In eight of the ten cases (80%) of reasoned statements, the corporate bodies of the target companies were aware of the intention of the bidder to make a public offer, because the target had entered into a transaction agreement with the bidder or received from the bidder a binding instruction under a domination agreement.

Public M&A by industry sector

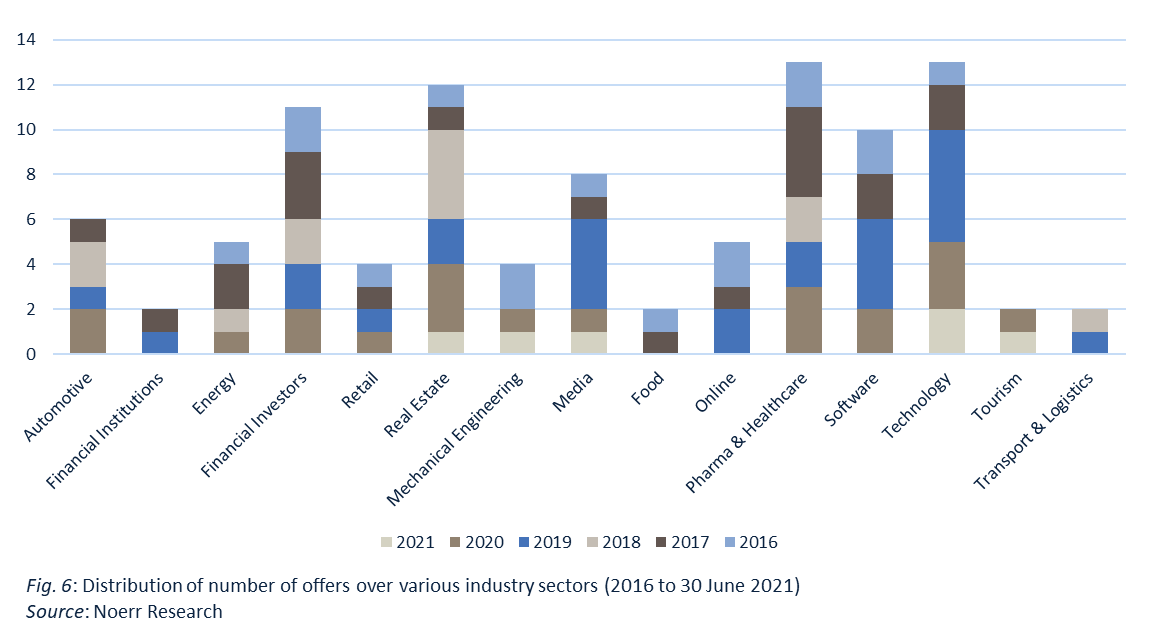

Experience has shown that markets hardly ever develop in a homogeneous way across industries. Therefore, we analyzed the public takeover offers pursuant to the WpÜG published by bidders and approved by BaFin in the time period from 2016 to 2021 on a sector-by-sector basis. The objects of our investigation were 117 offers from 16 industry sectors. In cases where only a single offer from a particular sector was published during the period under review (which was the case for 18 of 117 offers, equal to 15.38%), we categorized that offer as “miscellaneous”, a category not included in the charts below.

Quantity and volume of offers by industry sector

The following chart illustrates how the number of offers was distributed across the different industry sectors during each year.

During the 5-year period we reviewed, most M&A activity happened in pharma & healthcare as well as in technology (13 offers respectively, equal to 11.02% ), real estate (12 offers, 10.17%), financial investors (11 offers, 9.32%) and software (10 offers, 8.47%). The value of these figures, however, is somewhat reduced by the fact that some companies, such as Osram Licht AG (technology) as well as Biofrontera AG and Stada Arzneimittel AG (both pharma & healthcare), were targeted several times, so that in trying to assess takeover activity in the respective industry sectors, they have to be interpreted with caution.

Four of the most active industries in terms of offer quantity also belong to the top five industries where offers had the largest volume measured by target company MCO. This group of five comprises energy (EUR 30,564.58 million), real estate (EUR 25,679.83 million), pharma & healthcare (EUR 25,447.63 million), financial investors (EUR 24,431.52 million) and technology (EUR 22,288.36 million). Thus, with the exception of the software sector, the most active industries measured by offer quantity also register the highest volumes.

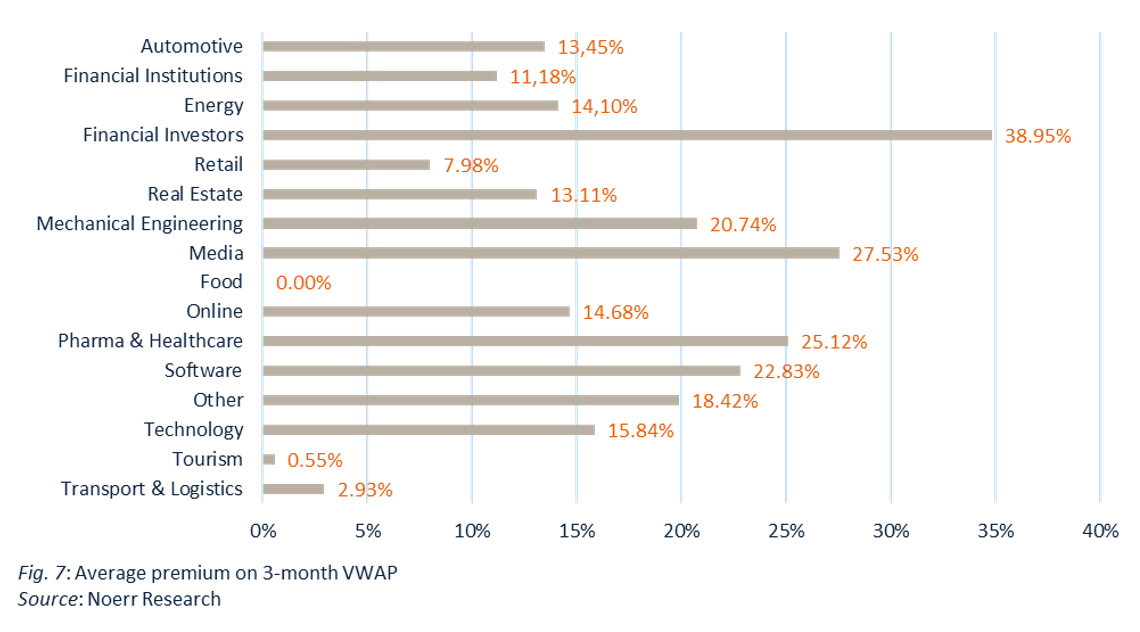

Premium rates

The average premiums offered in the different sectors during the period under review were as follows:

According to our analysis, the sector financial investors had the highest average premium of 34.83%. The remaining top five were the media sector (27.53%), pharma & healthcare (25.12%), software (22.83%) and mechanical construction (20.74%). It is striking how much the average premiums diverge in the different industries. This phenomenon can also be observed when comparing industry sectors in which many offers were made and whose average premiums are thus not dominated by a few offers with an outstandingly high price. A comparison of premiums in the financial investors (34.83%) and pharma & healthcare sectors (25.12%) with those in real estate (13.11%) and technology (15.84%) is a case in point.

The practice of granting restructuring exemptions

Background

Financial crises bring about many challenges for everyone involved, in particular when the target company is listed on a stock exchange. Takeover law aspects can play an important role in such situations. Let us assume that a target company has succeeded in finding an investor who, in spite of the company’s precarious financial standing, is prepared to contribute significantly to the company’s capital resources. Should the threshold of 30% of the voting rights be exceeded as a result of the acquisition, this would constitute an acquisition of control within the meaning of the WpÜG, and the investor would normally be obligated to extend a mandatory offer in accordance with section 35 para. 1 WpÜG to all shareholders. In other words, the investor would have to offer the remaining shareholders to purchase their shares at a price consistent with the minimum pricing rules, i.e. at least the investor’s own prior acquisition price or the 3-month VWAP at the time of the acquisition of control, whichever is higher. From the investor’s perspective, this would mean that funds go to third parties instead of benefitting the company’s recovery.

The legislature has recognized that this legal situation is unsatisfactory and could prevent economically reasonable restructuring processes from happening. According to section 37 para. 1 WpÜG, one scenario in which BaFin has the power to exempt a bidder from the aforementioned obligations is when such exemption seems justified in light of the reason of the bidder to acquire control over the target, taking into account the interests of both the bidder and the other shareholders. According to section 9 sentence 1 no. 3 WpÜG-AngebotsVO, such an exemption may be especially justified if control over the target company is acquired in the context of its restructuring (so-called restructuring exemption; „Sanierungsbefreiung“).

The current economic situation, and especially the ongoing discussions about a „spate of insolvencies“ waiting to happen after the Covid-19 support measures have fully expired, have prompted us to analyze the practice of granting restructuring exemptions based on the information published on the website of BaFin (Not all, but only – according to BaFin parlance – „significant“ exemption decisions are published on the BaFin website. There is no general publication requirement for the applicant, but rather, BaFin can decide in its own discretion whether to publish or not (compare section 44 WpÜG).).

Practical significance

Our first finding was that restructuring exemptions are of a considerable practical relevance. 105 exemption decisions pursuant to secstions 36, 37 WpÜG for the time period from 2011 until today were published on the BaFin website. 25 of those cases (approx. 23.8%) were restructuring exemptions (status: August 29, 2021). According to our analysis, the annual number of restructuring exemptions did not increase as a consequence of the Covid-19 pandemic: Only one restructuring exemption was published so far in 2021 (TUI AG), and only one in the full year 2020 (co.don AG).

Prerequisites for a restructuring exemption

Both the administrative practice of BaFin and the legal literature on takeover law accept that a restructuring exemption may be granted if (i) the target company must be in need of restructuring and has restructuring potential and (ii) the bidder brings a contribution to the restructuring process. If these requirements are met, the authority decides in its own discretion if an exemption from the obligation to extend a mandatory offer will be made.

The target company’s restructuring need and restructuring potential

To begin with, a target company must be in need of restructuring in order to qualify for a restructuring exemption. A company is deemed to be in need of restructuring, if there are existing or impending risks threatening the existence of the company’s business within the meaning of sec. 322 para. 2 sentence 3 German Commercial Code (Handelsgesetzbuch - “HGB”). In the application process, the bidder must present BaFin with evidence that such risks exist or are likely to arise. This usually requires the written confirmation of an auditor or another external assessor. A reference to the auditor’s comments in the audit certificate in accordance with section 322 para. 2 sentence 3 HGB (as was done in 8 of 25 cases, equivalent to 32.0 %) may suffice for this purpose. Some bidders submit separate expert opinions (as happened in 8 of 25 cases, equivalent to 32.0%), sometimes citing statements from the opinion on the target’s restructuring potential (see below for details). We were not able to finally conclude whether the need for restructuring can in practice only be established by means of third party statements. For some of the decisions published on the BaFin website, the published material does not clearly state if an external expert opinion had been submitted. Most of these decisions concerned cases in which the target company had already filed for insolvency (5 of 25 cases, equivalent to 20%).

In addition, the company must have restructuring potential. In order to make sure that this is the case, a restructuring plan that is objectively suitable to secure the continued existence of the target company must be submitted. According to the prevailing view in the expert literature and the administrative practice of BaFin, it is also required to present an independent expert opinion confirming that the measures stipulated in the restructuring concept are suitable for reaching the restructuring goals. BaFin’s publications on its own practice, however, do not specify which circumstances would constitute an exception justifying a deviation from this rule. With respect to a target company’s restructuring potential, almost all published decisions (24 of 25 cases (In one case, the publication does not contain any information as to whether an expert opinion was or was not prepared.), equivalent to 96%) refer to an expert opinion according to or in line with the German auditing standard IDW S6.

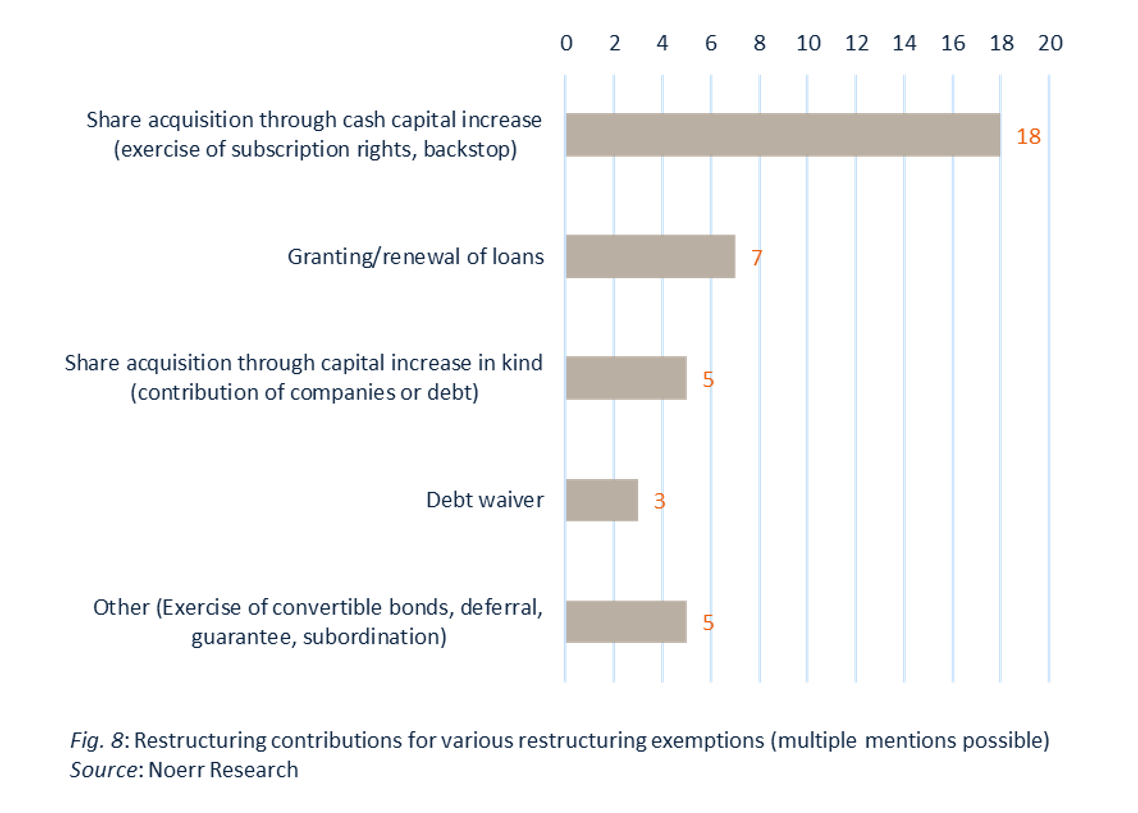

Restructuring contribution by the bidder

Finally, the bidder must make a contribution to the financial restructuring of the target. A number of different measures are possible in this context. According to the administrative practice of BaFin, the bidder is required to provide for a significant, financially measurable advantage for the target company. The restructuring exemptions published on the BaFin website show that in many cases (15 of 25, equivalent to 60%), these contributions consist of a combination of different measures. The following summary shows how often the various kinds of restructuring contributions were made in the 25 cases of restructuring exemptions we reviewed.

Conclusion

Our research shows that a restructuring exemption is only granted if strict formal requirements are met. Investors aiming for such an exemption should be prepared to provide an expert opinion proving at least the restructuring potential of the target. If such an opinion does not yet exist (it could have been prepared for other reasons, e.g. in connection with the refinancing of loans), it must be prepared specifically for the purpose of obtaining the exemption. More flexibility is allowed in relation to the contributions to the restructuring process required from the investor, with the published administrative practice presenting a colorful combination of measures that were basically considered to be sufficient. However, it is certainly not possible to decide whether one particular restructuring contribution is sufficient without knowing the restructuring plan behind it.

Download report: Public M&A Report 02/2021

The parts of the report for which the authorship has not been indicated were authored by the editors. The editors wish to thank Juri Stremel, Noerr Partnerschaftsgesellschaft mbB, Hamburg, for his support in the preparation of the Noerr Public M&A Report.