Noerr Public M&A Report

Market development and trends

-

Compared to the first six months of 2018, the volume of offers declined significantly in the absence of major bids like the one RWE presented to the shareholders of innogy SE. RWE’s offer accounted for 94.25% of the total offer volume of the first half-year of 2018. In terms of the number of transactions, however, market activity remained stable in comparison with the first half-year of 2018.

- Towards the end of the period under review, the market began to show signs of an up-swing: In June 2019 alone, six decisions to submit an offer in accordance with WpÜG were published.

- In the large-cap segment, there were two transactions. The average offer volume of this segment went down (once again due to a lack of offers as big as RWE’s offer to innogy SE’s shareholders).

- In the small-cap segment, the average MCO has increased significantly.

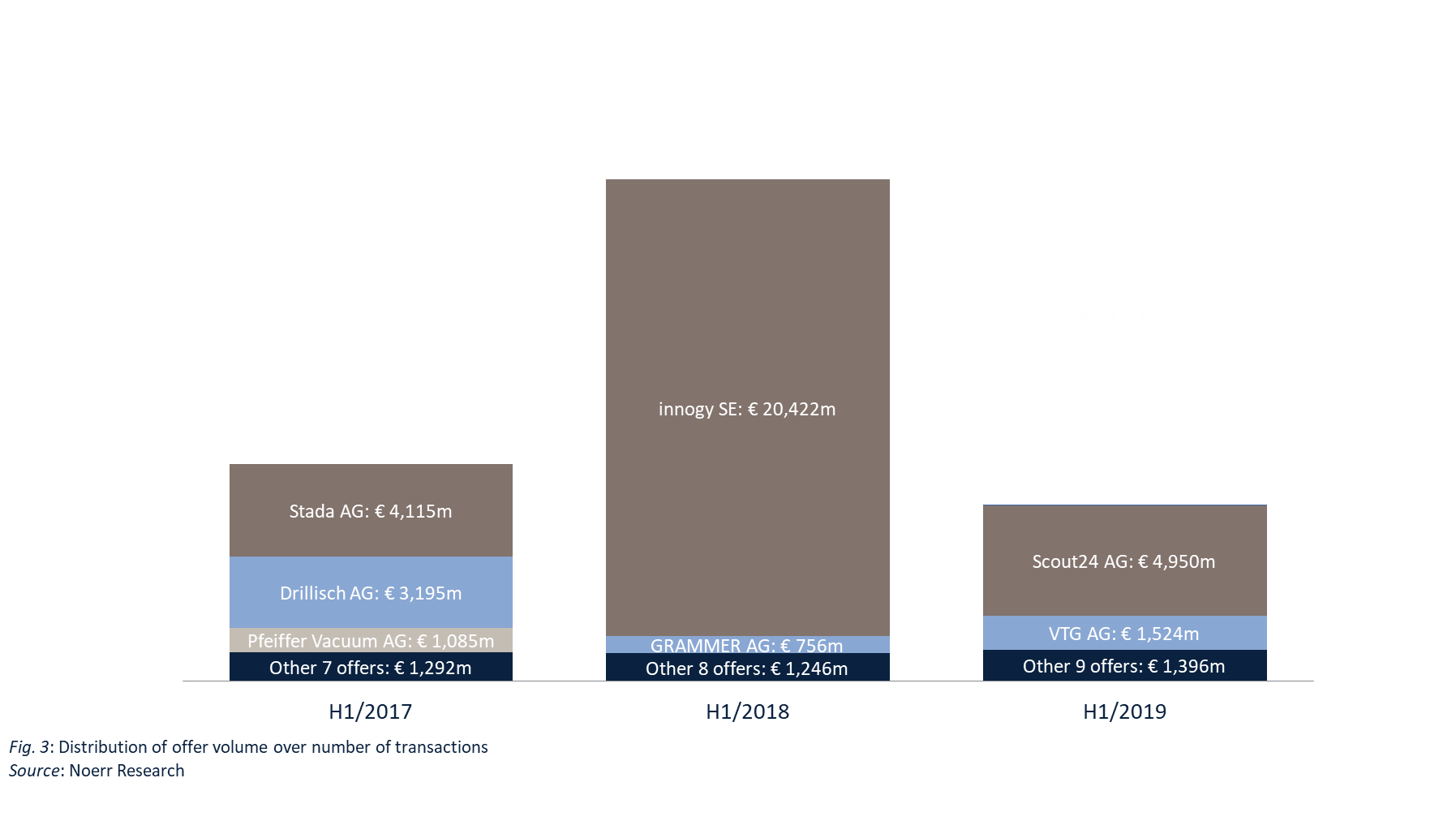

- As in the same periods of the previous years, the distribution of the offer volume over the number of transactions was uneven, but not as extremely unbalanced as in the first half-year of 2018.

- The average premium level has increased significantly and returned to the level of the first half-years of 2016 and 2017.

- In the spotlight: Competing offers and the battle for Biofrontera AG

- Public M&A in brief: Distribution of offers over the course of the year

Number and volume of offers

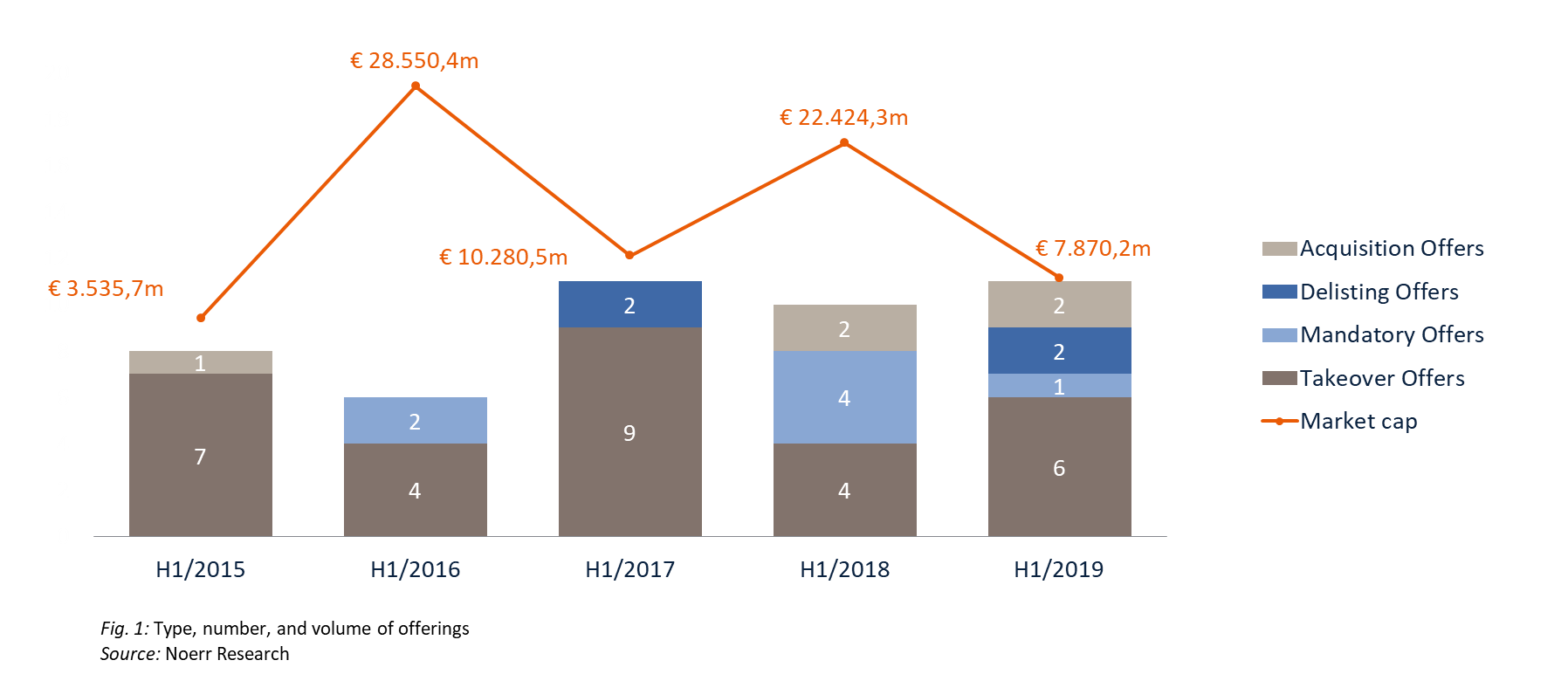

In the first six months of 2019, eleven public offers pursuant to the German Securities Acquisition and Takeover Act (Wertpapierübernahmegesetz, „WpÜG”) were approved and published by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, „BaFin“). BaFin did not prohibit any offers. The bids targeted companies that represented an aggregate market capitalization of offer price (“MCO”) of EUR 7.87 billion. Six of the eleven offers were takeover offers, the remainder comprised two delisting offers, two partial acquisition offers and one mandatory offer.

In the first half-year of 2019, the number of transactions in the German market for public takeovers remained unchanged compared to the corresponding time period in 2018. The first half-year of 2018 also saw eleven offers, although one of those was prohibited. The total offer volume (expressed in MCO) fell considerably from EUR 22.4 billion in the first half-year of 2018 to EUR 7.87 billion in the first-half year of 2019, a decrease by 64.85%.

This significant drop can be attributed to the absence of any offer comparable in volume to the one RWE made to the shareholders of innogy SE. With a volume of EUR 20.4 billion, that offer corresponded to as much as 94.25% of the total market volume of the first six months of 2018. For the first half of 2017, the largest share of the offer volume is attributable to the takeover offer of Pulver BidCo GmbH’s to the shareholders of Scout24 AG.

This, again, confirms the long term observation that outstandingly large transactions decisively influence the total market volume. However, for the period under review, it must be emphasized that the volume of the offer to the shareholders of Scout24 AG does not even represent a fifth of the volume of the offer to the shareholders of innogy SE.

Towards the end of the period under review, however, the market began to show signs of an upswing. 16 decisions to submit an offer in accordance with WpÜG were published in the first six months of 2019, the highest number for a first half-year since 2014. Six decisions were published in June 2019 alone, among them offers to the shareholders of Axel Springer SE, of Metro AG and of OSRAM Licht AG. Therefore, it promises to be an interesting second half of the year.

Development of the market segments (Large Cap, Mid Cap and Small Cap)

The market can be subdivided into three segments according to MCO: small-cap (MCO of target company less than EUR 100 million), mid-cap (MCO of target company equal to or greater than EUR 100 million but less than EUR 1,000 million) and large-cap (MCO of target company equal to or greater than EUR 1,000 million).

The development of the average MCO in the individual segments can be depicted as follows:

At EUR 3,236.84 million, the average offer volume in the large-cap segment in H1 2019 was extremely low compared to the first half-years of 2018 and 2016 respectively. This is again due to the fact that in each of those two half-year periods, one individual offer with an extremely high volume was submitted. In H1 2018 it was the takeover offer to the shareholders of innogy SE, whereas in H1 2016 it was the exchange offer to the shareholders of Deutsche Börse AG. No offer of such dimensions was made in the first six months of 2019 (similar to the first six months of 2015 and 2017). The total number of two transactions in the large-cap segment can be considered as moderate.

The number of transactions and the average offer volume in the mid-cap segment remained largely stable (EUR 241.6 million) compared to H1 2018.

In the small-cap segment, the number of transactions doubled to four in the first half-year of 2019, compared to two in the corresponding periods of the previous years. At EUR 47.15 million, the average MCO of the first half-year of 2019 was significantly above that of the corresponding 2018 period, which was extraordinarily low at a mere EUR 3.3 million.

Distribution of offer volume over number of transactions

The large-cap segment registered two offers during the first six months of 2019. These two offers corresponded to 82.26% of the aggregate offer volume of EUR 7,870.04 million. All other target companies had a low MCO in comparison. Like in previous years, the result is an uneven distribution of the aggregate offer volume across the number of transactions, but not to the same degree as in the first half-year of 2018, when a major share of the volume came from one single target company.

In the first half-year of 2019, the takeover offer by Pulver BidCo GmbH to the shareholders of Scout24 AG particularly stood out with a share of 62.89% of the aggregate offer volume. In contrast to the first half-year of 2018 though, one additional offer registered in the large-cap category (Warwick Holding GmbH to the shareholders of VTG AG).

Premium amount

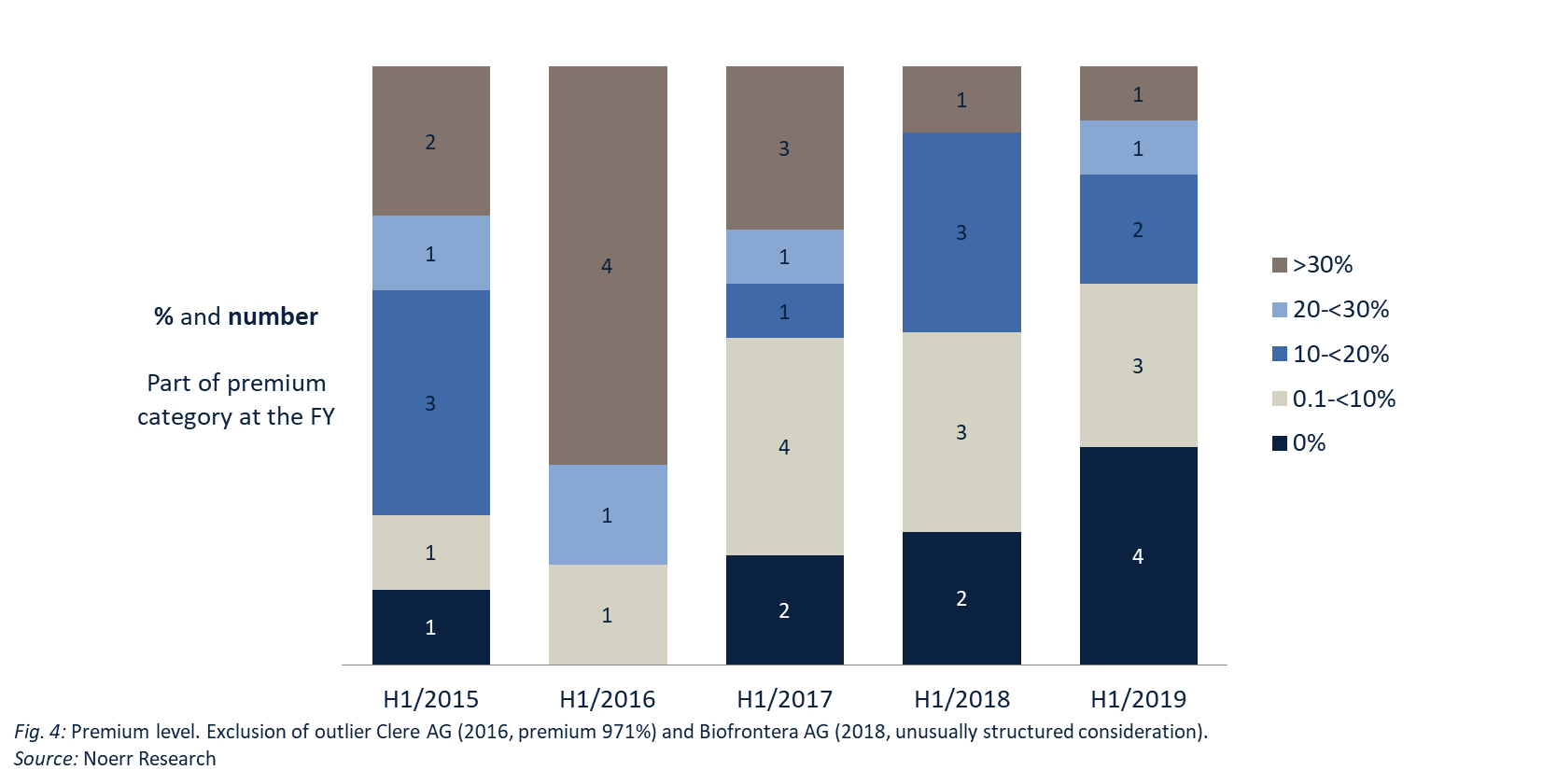

In the first half-year of 2019, bidders paid an average premium of 20.12% above the volume-weighted average price of the target companies‘ shares as calculated over the three-month period preceding the publication of each respective bid („3-month WVAP“). The highest premium - 158.33% - was paid to the shareholders of Fyber N.V. in the context of the mandatory offer by Advert Finance B.V. In three cases, namely the bids for Wild Bunch AG, TOM TAILOR Holding SE and SHW AG, the target’s shareholders did not receive any premium at all.

While only two transactions involved premiums above 20% during the first six months of 2019, the average premium rose by 98.6% compared to 10.13% in the first half-year of 2018. This significant increase is mainly due to the remarkable premium rate of 158.33% offered to the shareholders of Fyber N.V. The average premium has thus returned to the level of the first half-year periods of 2016 and 2017.

The following chart illustrates the premiums generated in the bid transactions of the first half-years 2015 through to 2019 respectively, with each half-year subdivided into several categories:

In the spotlight: Competing offers

In the first half-year of 2019, a case of competing offers for biotech company Biofrontera AG held the attention of those interested in public M&A in Germany. A competing offer pursuant to WpÜG is an offer that is submitted by a third party during the acceptance period of an offer (Sec. 22 (1) WpÜG). Both Maruho Deutschland GmbH („Maruho Germany“), a subsidiary of Maruho, the Japanese producer of dermatological medications, and a bidder consortium around investment company Deutsche Balaton Biotech AG („DB Bidder Consortium“) offered to acquire shares in Biofrontera. In Germany, this is a fairly rare phenomenon: Since 2014, the bidder contest for Biofrontera has been the only case of competing offers.

At first glance, this is an astonishing finding. After all, the search for a „white knight“ in the shape of an investor whom the organs of the target company regard as preferable is one of the classic defences against an unwanted bid. If one considers, however, the effort and expenses connected with a competing offer as well as the resulting uncertainties (amplified by potential reactions of the first bidder), the empirical finding is not all that surprising. The competitor must have considerable interest in the target and must regard its value potential as enormous to accept such risks and disadvantages.

Judging by the bidder contest, Biofrontera AG was regarded as such an attractive target. On 1 April 2019, Maruho Germany published its decision to submit a partial offer for the Biofrontera shares at a price of EUR 6.60. The offer itself was published on 15 April 2019, with an acceptance period initially ending on 27 Mai 2019. Later, the consideration was raised to EUR 7.20. Due to a request by Deutsche Balaton AG, an extraordinary shareholders‘ meeting was called causing the acceptance period for the offer to be extended until 24 June 2019 pursuant to sec. 16 (3) sentence 1 WpÜG. On 29 Mai 2019, the DB Bidder Consortium published its decision to also submit a partial offer to the shareholders of Biofrontera AG. The offer document was published on 21 June 2019, with an acceptance period until 19 July 2019. DB Bidder Consortium initially offered a price of EUR 7.20, which it later raised to EUR 8.00.

The WpÜG includes a series of provisions designed to protect the shareholders of the target company in a case of competing offers and to ensure that shareholders always have a choice between both offers. First, the acceptance periods for the offers are being synchronized: The acceptance period for the first offer is extended by law until the end of the acceptance period of the competing offer, if the latter ends later than the acceptance period of the first offer (sec. 22 (2) WpÜG). Second, the shareholders who have accepted the first offer are entitled by law to revoke their acceptance of the offer if the respective agreement was signed before the publication of the competing offer document (sec. 22 (3) WpÜG).

In the bidder contest for Biofrontera AG this meant that the acceptance periods for both offers ended 19 July 2019. It would have been possible for the bidders to further prolong the acceptance periods by changing the conditions of their offers, in particular by raising the consideration (see below). This, however, did not come to pass in the case of Biofrontera. As both bidders had made partial offers – Maruho Germany for a maximum of 4,322,530 and DB Bidder Consortium for a maximum of 500,000 Biofrontera shares – and as none of them had provided for any closing conditions, both offers were consummated.

A change in the conditions of competing offers, notably an increase in consideration, can complicate the situation a lot. If the competing bidder raises the offer price in the last two weeks of its acceptance period, the acceptance period of the competing offer is extended by two weeks pursuant to sec. 21 (5) sentence 1 WpÜG. The same applies to the acceptance period of the original offer, so that subsequently the acceptance period is the same for both offers. Although pursuant to sec. 21 (6) WpÜG the competitor is basically prevented from further raising its price, this does not apply to the original bidder. There is a general consensus that, if the original bidder raises its consideration during the extended acceptance period, the acceptance periods for both offers are further extended. The competitor is then allowed to change its offer again. In extreme cases, a „never ending“ takeover battle could ensue.

So far in the German practice, no takeover battle has actually escalated to such an extent. Therefore the legal situation is still controversial in many respects. Still, the Biofrontera case illustrates that bidder contests have the potential to burden a target. The process can draw on for months and overly engage the attention of the target’s corporate bodies who are required under sec. 27 WpÜG to present a reasoned statement after each change to an offer. This effect can be further compounded if the participants take legal action against each other or confront each other at extraordinary shareholders‘ meetings. When takeover battles spiral out of control and impose extraordinary stress on the target company and its shareholders, sec. 14 (1) WpÜG essentially empowers BaFin to intervene in such a dispute.

Public M&A in brief: Distribution of offers over the course of the year

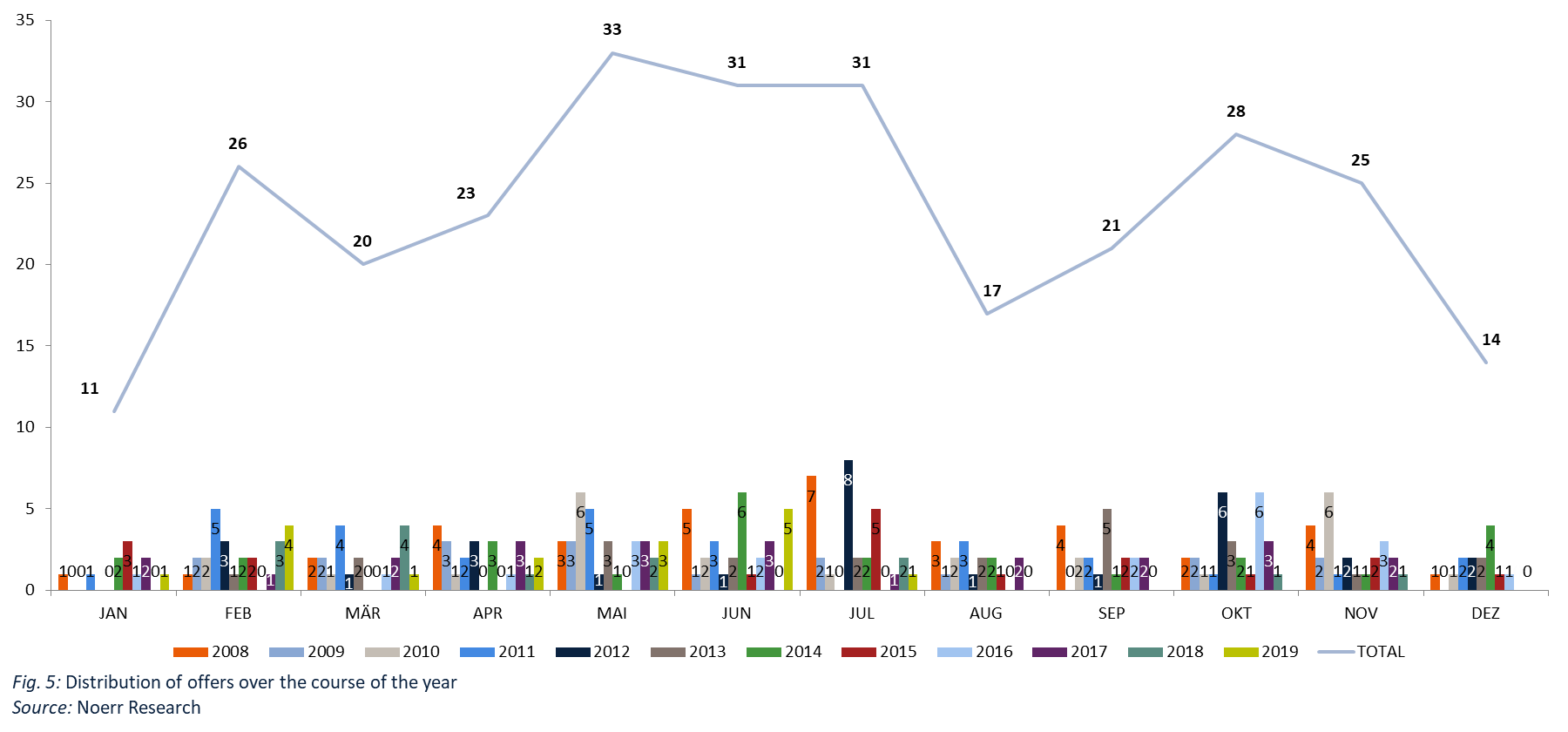

For this issue of the Public M&A Report we also examined how the public offers of the past years were distributed over the course of the year. The following table shows the number of offers announced in accordance with WpÜG for each month of the years 2014 through to the first half-year of 2019, as well as in the aggregate for the entire period:

The chart shows that the decisions to submit an offer are spread relatively evenly across the respective years, with peaks in February, May through July and October/November. The curve is difficult to interpret due to a lack of regulatory aspects that determine when to submit an offer. The slumps in December and January are probably due to bidders for target companies whose business year corresponds to the calendar year preferring to delay their bid until the results of the completed business year have been published.

Download Noerr Public M&A Report

Download Noerr Public M&A Report

The Noerr Public M&A Report for the first half of 2019 analyses the development of public takeovers over a five-year period in terms of number and volume as well as the development of premium levels and market trends.

In addition, the authors Volker Land and Stephan Schulz take a close look at some of the issues currently relevant to public takeovers from a legal perspective. This issue deals with competing offers and the distribution of offers over the course of the year.

Share

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now