Noerr Public M&A Report

Market development and trends

-

Slight decline in market activity in relation to the number of transactions compared to H1 2017, but significant increase of the total offering volume to E.ON Verwaltungs SE's takeover bid to the shareholders of innogy SE.

-

Only one transaction in the large-cap segment; extremely low offer volume in the small-cap segment.

-

Since 2002, around 3.28% of all announced offers were prohibited; on average, this concerns approximately one public takeover per year. In recent years, difficulties in relation to the availability of the consideration, be it shares of the bidder or cash, have been the most frequent background for a prohibition of public offers.

Number and volume of offers

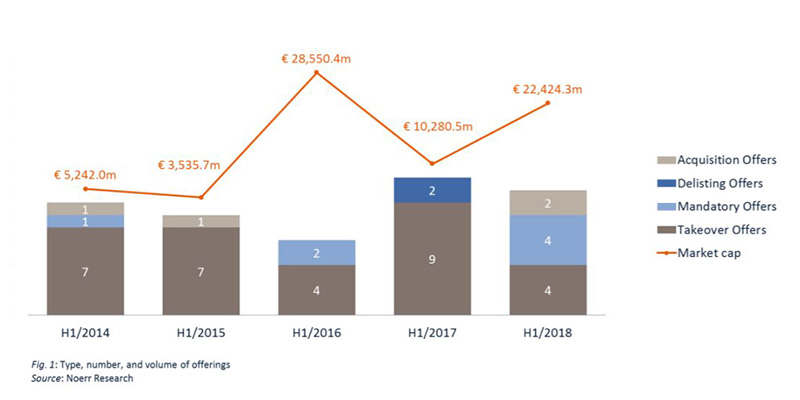

In the first six months of 2018, ten public offers in accordance with the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz “WpÜG”) were approved and published by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, “BaFin”). These offers concerned target companies representing an aggregate market capitalization at the offer price (“MCO”) of EUR 22.4 billion (H1 2017: EUR 10.3 billion). They included four mandatory, four acquisition and two takeover offers. There were no delisting offers in the first six months of 2018.

While the number of transactions in the German market for public takeovers in the first half of 2018 fell slightly below the volume of the first half of 2017, the total offer volume (expressed in the MCO) increased significantly compared to the first half of the previous year, namely by 110.68%. A comparable offer volume was last achieved in the first half of 2016 (EUR 28.6 billion). In both the first half of 2016 and 2018, the high offer volumes were the result of a limited number of major transactions. In the first half of 2018, the E.ON Verwaltungs SE’s takeover offer to the shareholders of innogy SE stood out with an MCO of EUR 20.4 billion (corresponding to 94.25% of the total market in H1 2018). In 2016, the exchange offer (that ultimately was not consummated) to the shareholders of Deutsche Börse AG regarding the merger with London Stock Exchange Group plc had a similarly prominent position. Deutsche Börse AG represented an MCO of EUR 22.1 billion. This confirms the long-term experience that large individual transactions have a decisive influence on the overall market volume.

Development in the small-cap, mid-cap, and large-cap segments

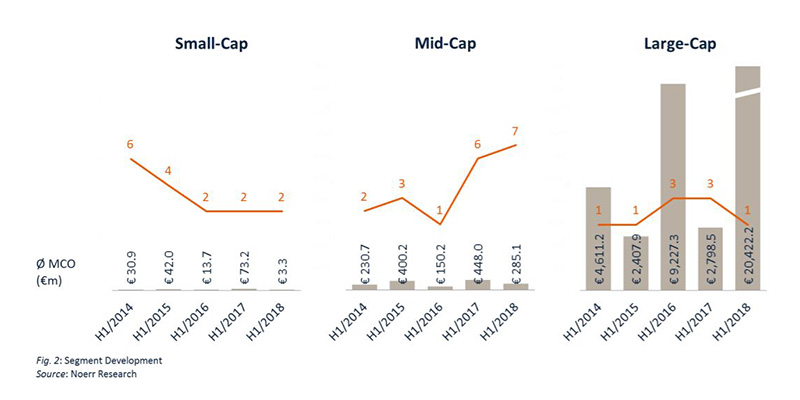

Dividing the market into the segments small-cap, mid-cap, and large-cap by market capitalization of the target companies[1] results in the following picture:

In the large-cap segment a remarkably high offer volume of EUR 20.4 billion is evident compared to the previous year’s periods, which results exclusively from E.ON Verwaltungs SE’s takeover offer to the shareholders of innogy SE. With one offer, however, the number of transactions is lower than in the same period of the previous year with three transactions. In this area – even more than in the market as a whole – a high volatility of the offer volume can thus be observed, which depends on the appearance of major transactions with an extremely high MCO.

In the mid-cap segment, both the number of transactions and the transaction volume remained relatively stable, as in the prior year periods.

In the small-cap segment, only two transactions were concluded. These were transactions with a particularly low MCO (combined only EUR 3.3 million). The low number of transactions compared with previous years could indicate a market shakeout in the small-cap segment as a result of completed delistings. Delisting offers had led to an increase in the respective offer volumes in the small-cap segment in the years 2016 and 2017.

Distribution of offer volume over number of transactions

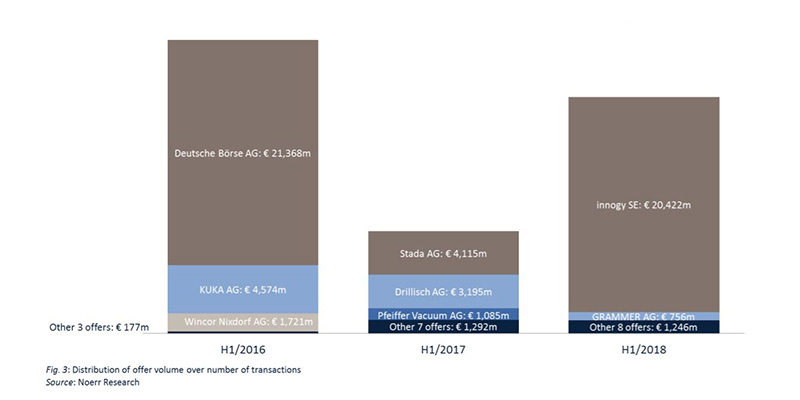

The volume of offers in the market for public takeovers was again unevenly distributed across the number of transactions. While one single target company had a very high market capitalization, the remaining target companies were rather low-valued.

In the first half of 2018, the only large-cap transaction accounted for 94.25% of the total market’s MCO. Although this continues the trend of uneven distribution from the first half of 2016 and 2017, it is worth noting that it concerns one target company only. In previous years, individual offers also stood out, such as Deutsche Börse AG (EUR 22.1 billion) in the first half of 2016. Nonetheless, there were always further offers in the large-cap segment, which was not the case in the first half of 2018.

Premium amount

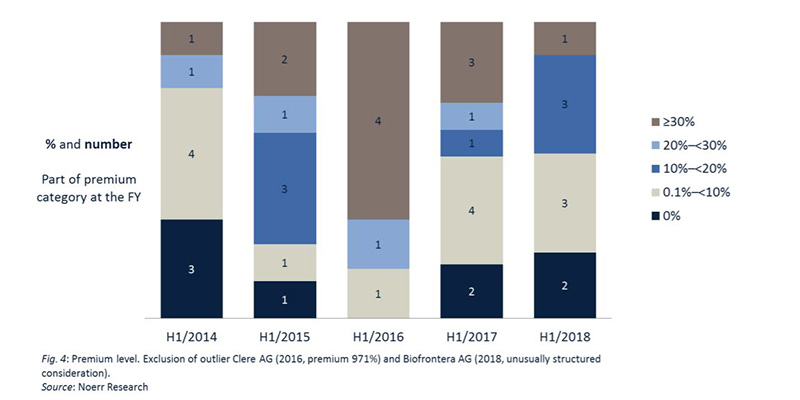

The average premium on the volume-weighted average price of the shares of the target companies in the three months prior to the announcement of the offer was 10.13% for the offers in the first half of 2018.[2] No premium was granted in two cases (offers to the shareholders of the target companies Accentro Real Estate AG and Fair Value REIT-AG). The highest premium offered was 47.48% (offer to the shareholders of Westag & Getalit Aktiengesellschaft). The average value of the first half of 2017, with average offer premiums of 21.08%, thus fell by 9.45%. A decline of 23.96% was also recorded in this respect compared with the first half of 2016. The premium level in the first half of 2018 can therefore be described as rather low.

The chart below shows the premiums offered for the first half of 2018, divided into several categories.

Focus: Prohibition of public offers

Section 15 para. 1 WpÜG authorizes BaFin to prohibit offers under the WpÜG under certain conditions. In the first half of 2018, BaFin made use of this right against Deutsche Balaton AG as bidder for an acquisition offer to the shareholders of Biofrontera AG. This case provides an opportunity to take a closer look at the practice of prohibiting public offers.

Empirical evidence

Since 2002, a total of 17 public offers were prohibited by BaFin (corresponding to around 3.28% of all announced offers). Except in 2003 and 2008, with three prohibitions each, these were spread fairly evenly over the last 16 years. In the last four years, about one offer per year was prohibited on average. The six prohibited offers since the beginning of 2012 comprised three mandatory offers, two takeover offers and one acquisition offer. [3]

The prohibition notices published by BaFin since 2012 show that the authority has based its prohibition in five of six cases on sec. 15 para. 1 no. 1 WpÜG (absence of required information in the offer document) and only in one case on sec. 15 para. 1 no. 2 WpÜG (obvious violation of legal requirements for offer documents). The question of how it could have come to the prohibition can only be answered on a case-by-case basis.

- The prohibition of the exchange offer of Deutsche Wohnen AG to the shareholders of LEG Immobilien AG (2015) concerns a special case. The extraordinary general meeting, at which a capital increase was to be resolved by the shareholders to create the shares to be granted as consideration, was cancelled by the management board of Deutsche Wohnen AG. The reason behind was the parallel takeover offer made by Vonovia SE to the shareholders of Deutsche Wohnen AG, in the context of which shareholders who held shares in both Vonovia SE and Deutsche Wohnen AG signalled that they would not approve the capital increase.

- In three cases of cash offers, the incompleteness of the offer document was based on a missing financing confirmation pursuant to sec. 13 para. 1 WpÜG. The facts contained in the prohibition notices suggest that the bidders had difficulties in financing the offer in these cases.

- In one case, the incompleteness was due to the lack of prospectus-equivalent disclosure in the offer document for an offer in which securities should be offered as consideration. Another case concerned various shortcomings in the offer document, including a condition for the offer which was formulated too vaguely in the opinion of BaFin.

Legal background and administrative practice

Even though prohibitions of offers are rare, they still occur from time to time. The recent prohibition notices show that BaFin only prohibits offers if an offer document does not contain information specifically required under the WpÜG or the corresponding offer regulation or if its content does not comply with requirements set forth in these bodies of rules. If, in the opinion of the authority, such a case exists, it will regularly address the issue and notify the bidder in the approval process and, if necessary, may extend the time limit for the approval and draw its attention to the addition or correction of the offer document. A shortcoming of the offer document which may justify a prohibition should therefore regularly and readily be avoidable for the bidder without particular effort.

In case of prohibition, the bidder faces further consequences in addition to the prohibition of the publication of the offer document and the invalidity of the already submitted declarations of acceptance.

Firstly, in the case of prohibited acquisition or takeover offers, there is a blocking period of one year pursuant to sec. 26 para. 1 sentence 1 WpÜG. If the bidder allows the offer to be prohibited, it is therefore not possible for him to “rectify” it quickly by means of a new offer. However, this blocking period only applies to the bidder itself. For subsidiaries of the bidder and other persons acting jointly with the bidder (e.g. an affiliated company), offers are not blocked.

In case of mandatory offers, the legal consequences are more serious. The bidder is obliged to pay the target company’s shareholders’ interest in the annual amount of 5 percentage points above the base interest rate according to sec. 247 BGB (German Civil Code) for the duration of his breach of the duty to make an offer. Even more serious is the fact that the bidder and certain other parties pursuant to sec. 59 sentence 1 WpÜG are affected by a loss of rights. This primarily affects the voting rights at the annual general meeting of the target company. However, the dividend entitlement does not lapse if the offer was not intentionally omitted and the bidder makes up for it (sec. 59 sentence 2 WpÜG).

Conclusion

In recent years, difficulties regarding the availability of the compensation, be it shares of the bidder or cash, have formed the most frequent background for a prohibition of public offers. This conclusion is relevant to the discussions in the literature as to whether the legal consequences of a prohibition of acquisition or takeover bids for the bidder (and its group parent company) are insufficient and open up opportunities for circumvention. The practically relevant constellations in which the bidder is ultimately prevented from submitting a complete offer document by financial reasons are no cases of circumvention.

[1] Definition of market segments: large-cap transactions: MCO of the target company equal to or greater than EUR 1,000 million; mid-cap transactions: MCO of the target company equal to or greater than EUR 100 million; small-cap transactions: MCO of the target company less than EUR 100 million.

[2] In the case of innogy SE, an offer price of EUR 36.76 per share was applied. This may increase by EUR 1.64 if the takeover offer is completed before the day on which the general meeting of innogy SE decides on the appropriation of the balance sheet profit for the business year 2018.

[3] Prohibited offices before 2012 are not available.

Download Public M&A Report

The Noerr Public M&A Report analyses the evolution of public takeovers over a five-year period by number and volume, as well as the evolution of premium amounts and market trends.

The Noerr Public M&A Report analyses the evolution of public takeovers over a five-year period by number and volume, as well as the evolution of premium amounts and market trends.

The authors Volker Land and Stephan Schulz closely examine some of the currently relevant issues for public takeovers from a legal perspective. This publication focusses on the prohibition of public offices.

as PDF> Noerr Public M&A Report