Public M&A Report 01/2018

Market Development

-

In 2017, the market volume reached another peak, driven by the exchange offer made to the shareholders of Linde AG. The number of transactions, however, remained constant compared with 2016, and increased only slightly compared over several years.

-

In 2017, the average premium offered on the three-month VWAP of the target company shares at announcement of the offer amounted to approx. 12.09%. Taking into account the inconsistent development of average premiums compared over several years, this value is relatively low.

-

The percentage of reasoned statements (begründete Stellungnahme) of the company bodies on offers (section 27 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz, "WpÜG") without fairness opinion amounts to 25%, and thus remains more or less unchanged compared over several years (2017: 22.73%).

-

Compared over several years, the practice of obtaining several fairness opinions to support reasoned statements has increased, especially in large cap transactions, particularly complex transactions, or controversial takeovers.

-

Compared to the previous year, a higher number of so-called "neutral statements" were issued in 2017.

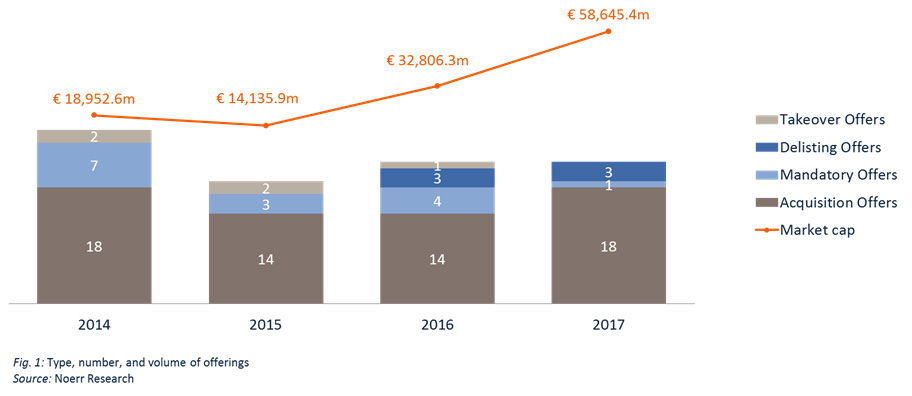

Number and volume of public takeovers

In 2017, 22 public offers pursuant to the WpÜG were approved by the German Federal Financial Services Supervision Authority (Bundesanstalt für Finanzdienstleistungsaufsicht; "BaFin") and published subsequently, as shown in the chart below. These offers concerned target companies representing an aggregate market capitalization at the offer price ("MCO") of EUR 58.6 billion (2016: EUR 32.8 billion). These offers comprised 18 takeover offers, one mandatory offer, and three delisting offers. In the entire year 2017 no acquisition offers were issued.

In 2017, the offer volume on the German market for public takeovers (mirrored in the MCO) peaked compared to preceding years. Compared to 2016, the offer volume increased by 78.76%. The aggregate volume of EUR 32.8 billion reached in 2016 already constituted a significant increase by 132.08% compared to 2015. This increase in offer volume, however, is a result of the major transactions of the years 2017 and 2016. In 2017, the exchange offer made to the shareholders of Linde AG regarding the merger with Praxair, Inc. alone amounted to an MCO of EUR 34.5 billion, which corresponds to a total market share of 58.78% in 2017. In 2016, the exchange offer (that ultimately was not consummated) made to the shareholders of Deutsche Börse AG regarding the merger with London Stock Exchange Group plc had a similarly prominent position. Deutsche Börse AG represented an MCO of EUR 22.1 billion (equalling a total market share of 65.19% in 2017).

The number of transactions show a different picture. In this regard, market activity for public takeovers remained constant compared to 2016 and is only marginally higher than in 2015 (19 offers).

Development in the small-cap, mid-cap, and large-cap Segments

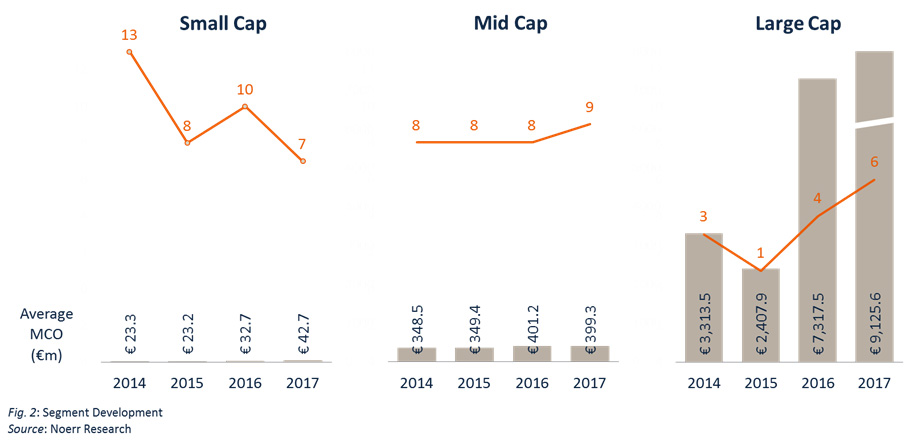

Dividing the market into the segments small-cap, mid-cap, and large-cap by market capitalization of the target companies results in the following picture:

An analysis of the market segments reveals that the area of large-cap transactions showed a particularly dynamic development in the years 2016 and 2017. The (low) number of transactions increased significantly as compared to the years 2014 and 2015. The offer volume increased even more significantly.

In the mid-cap segment, however, number and volume of transactions remained stable. This segment shows only minor fluctuations in both variables.

In the small-cap segment, the trend over several years seems to indicate a decline of market activity. The increase in the average offer volume in this segment after 2015 (by 40.67% from 2015 to 2016, and by 30.71% from 2016 to 2017) may be interpreted as a result of the numerous delistings between October 2013 and November 2015. This timeframe comprises the aftermath of the Frosta decision of the German Federal Supreme Court (Bundesgerichtshof, BGH), until the new version of section 39 of the German Stock Exchange Act (Börsengesetz,

BörsG) became effective. During that time, at many German stock exchanges a delisting from the regulated market was possible without a consenting resolution of the general shareholders’ meeting and without an offer to the shareholders buy their shares against of compensation. As a result, many companies withdrew from the regulated market, many of them which had a low market capitalization.

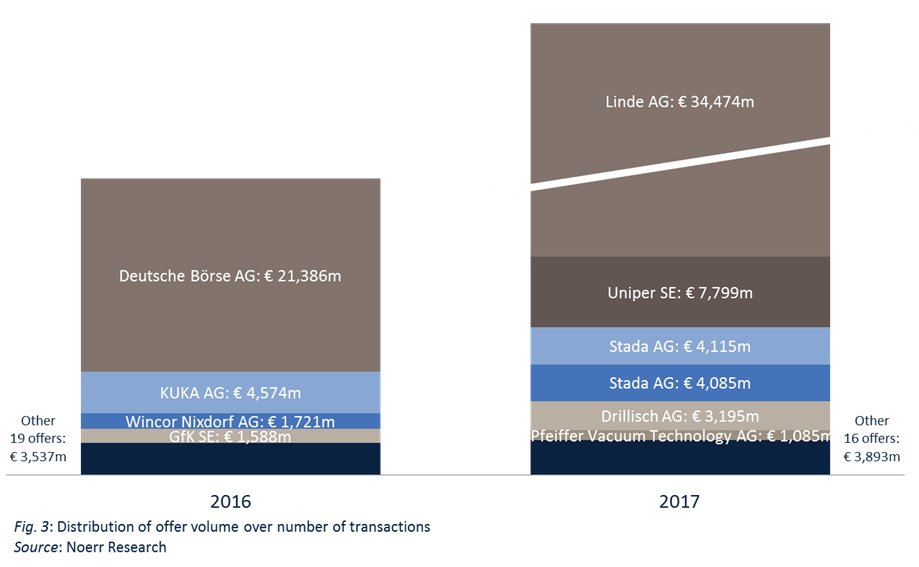

Distribution of offer volume over number of Transactions

In 2017, the offer volume was distributed unevenly among the number of transactions. While a small number of target companies represented very high market capitalizations, most target companies had a low market value.Of the 22 offers in the year 2017, the six large-cap transactions accounted for 93.36% of the total MCO. 2016 shows a similar, albeit not quite so drastic, picture. Among the 22 offers of that year, the four large-cap transactions accounted for 75.28% of the total MCO.

The following graphic shows the share of large-cap transactions in the aggregate MCO of the market in the years 2016 and 2017.

Average premiums offered

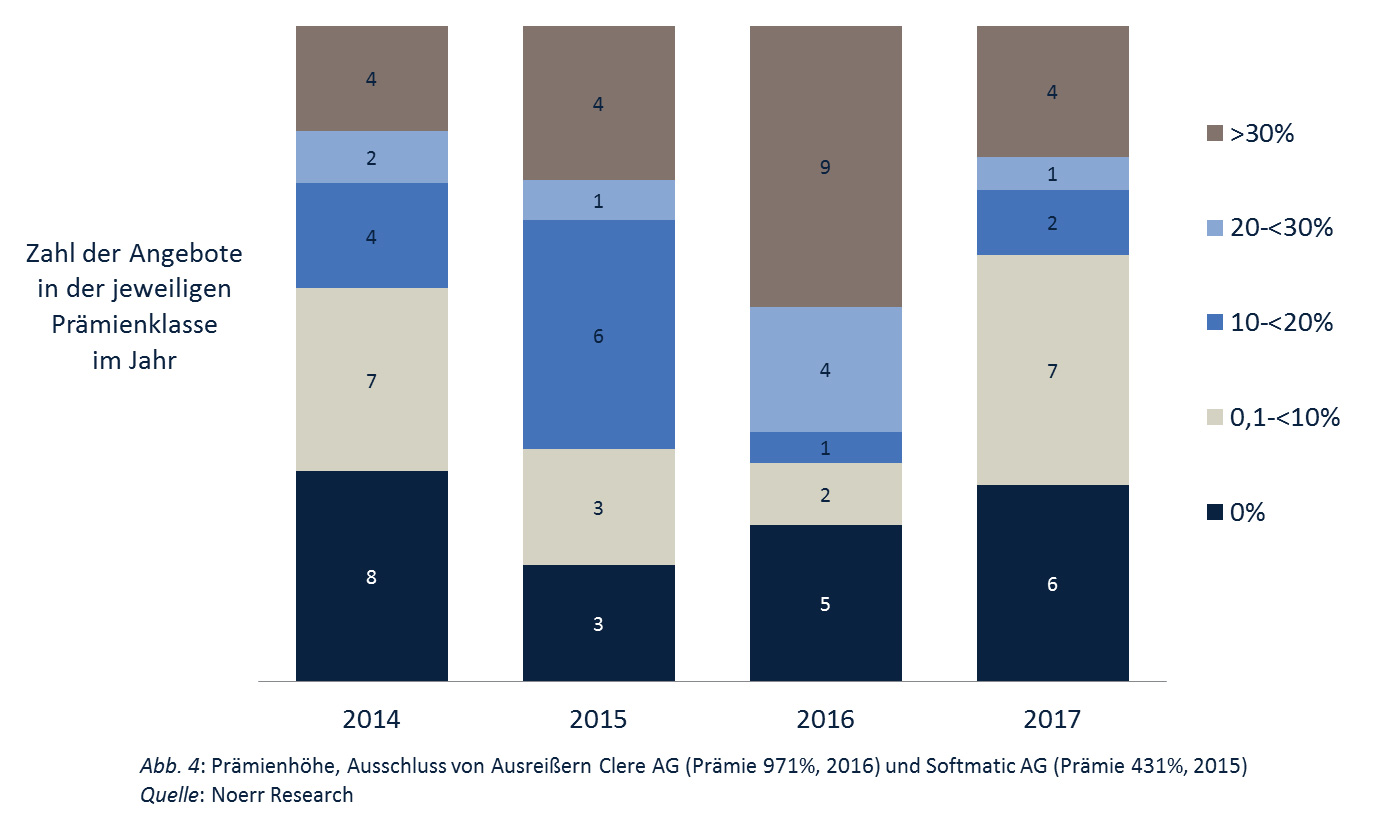

In 2017, the average premium offered on the three-month VWAP of the target company shares at announcement of the offer amounted to 12.09%.

In 2016, however, the (unadjusted) average amounted to 73.21%. Adjusted for the mandatory offer by Elector GmbH to the shareholders of Clere AG, where due to the effects of a capital reduction a calculated premium of 971.43% was paid, the average amounted to only 33.81%. The corresponding mean values amounted to 19.87% in 2015 (adjusted), and 7.58% in 2014. The development of the average premiums on the three-month VWAP of the target company shares at announcement of the offer has been inconsistent over the years. In this light, generalizing statements seem hardly possible.

Categorizing the offers in the years 2014 to 2017 by premium rate and comparing the results over time shows a similarly inconsistent development:

The distribution of offers over the premium categories varies greatly. It is evident that each year a significant percentage of offers is being made without (i.e. on the basis of the statutory minimum offer price) or with minimal premium.

Focus: Practice of submission of reasoned statements by the management board and supervisory board pursuant to sec. 27 WpÜG

Background

The central step for the management board and the supervisory board of the target company in the bidding process is the reasoned statement pursuant to section 27 WpÜG. The reasoned statement usually contains a recommendation to the shareholders to accept or reject the offer. Therefore, its content has a deep impact on the shareholders, other market participants and the general public.

The corporate bodies of the target company must publish the reasoned statement without undue delay, usually within two weeks after the bidder has forwarded the offer document. This obligation falls upon each of the management board and the supervisory board individually (as joint bodies). Normally, the reasoned statement is published as a single document (joint statement). This was the case for all offers in 2017. The corporate bodies must take position as to the kind and amount of the consideration, the foreseeable effects of a successful offer, the stated objectives of the bidder and the intentions of the management board members and supervisory board members to accept the offer. Furthermore, other typical contents of the statement have become established in practice; in large parts these contents are derived from the offer document.

Two aspects of the reasoned statement shall be analysed based on the practice in the year 2017: The practice regarding the submitting of the statement on the basis of the so-called fairness opinions and the phenomenon of the "neutral statement".

Obtaining fairness opinions to support the reasoned Statement

The focus of the reasoned statement is the assessment of the appropriateness of the offer consideration. The corporate bodies cannot restrict themselves to assess whether the bidder fulfilled the requirements as to the minimum offer price. Rather, the assessment of the appropriateness of the consideration requires a comparison of the offer consideration with the true value of the company as assessed by the corporate bodies of the company. The WpÜG does not define a special valuation method to determine the objective value of the company by the corporate bodies of the target company. In contrast to structural measures in accordance with the provisions of the German Stock Corporation Act or the German Transformation Act, company valuations pursuant to the German Principles for the Performance of Business Valuations (IDW S 1) are seldom being conducted in practice (merely one case in the year 2017). The reasoned statements rather compare the consideration offered to the shareholders with valuation ranges, obtained by a cumulative application from various valuation methods and financial indicators. The reasoned statements in the year 2017 used in the great majority of cases (18 of 22) a selection of the following valuation methods and other value indicators:

-

comparison with current and historical stock exchange prices and/or stock exchange price analyses;

-

comparison with financial analysts’ target prices;

-

comparison with the preacquisition price or considering the so-called Irrevocable Undertakings;

-

simplified company valuation pursuant to the so-called Discounted Cashflow method;

-

multiples method;

-

comparison with premiums paid in other public bids or the average paid premiums.

To strengthen this assessment, there is an international practice, to obtain so-called fairness opinions by external consultants (e.g. investments banks, auditing companies or other financial consultants). While preparing the fairness opinions, parts of the aforementioned valuation methods (in particular the company valuation pursuant to the so-called Discounted Cashflow method and the multiples method) are being applied by the external consultants. However, the corporate bodies have no statutory obligation to obtain a fairness opinion; the reasoned statement can also be issued without external support.

Fairness opinions exclusively assess the financial adequacy of the consideration. They mainly consist of a type of valuation report (so-called Valuation Memorandum) and an executive summary letter of the result of the valuation (so-called Opinion Letter), addressed to the management board or the supervisory board. Usually, merely the Opinion Letter is attached to the reasoned statement. On the other hand, the Valuation Memorandum is not disclosed due to the confidential information it contains.

When compared over several years since the beginning of the year 2014, the proportion of the reasoned statements which include at least one fairness opinion remained almost on a constant level. In the year 2017 it amounted to 77.27% (in the year 2016: 76.19%, in the year

2015: 75.00%, in the year 2014: 71.43%) of the analysed reasoned statements. Therefore, only five of 22 target companies went without a fairness opinion. These cases were either cases of lower MCO or individual cases in which the usual valuation methods cannot achieve meaningful results (e.g. joint statement of the corporate bodies of the CLERE AG on 8 June 2017).

In the year 2017, there was an increase in the number of fairness opinions per published reasoned statement. In seven out of 17 cases (representing 41.18%) in which fairness opinions have been obtained, the reasoned statements were accompanied by more than one fairness opinion.

-

Two joint statements of Pfeiffer Vacuum Technology AG of 24 February 2017 respectively 23 April 2017 as well as the joint statement of Drillisch AG of 07 June 2017: in each case, two fairness opinions have been obtained (jointly)

-

Joint statement of Uniper SE of 21 November 2017: two fairness opinions have been obtained (one by the management board and one by the supervisory board)

-

Two joint statements of STADA Arzneimittel AG of 10 May 2017 respectively 24 July 2017: in each case, three fairness opinions have been obtained (two by the management board and one by the supervisory board)

-

Joint statement of the Linde AG of 21 August 2017: four fairness opinions (in each case two by the management board and by the supervisory board)

In the year of 2016, in four out of 15 cases (representing 26.67%) in which fairness opinions have been obtained, more than one fairness opinion was prepared. The maximum of four obtained fairness opinions was reached in the takeover procedure concerning KUKA AG. In the year 2015, with nine cases with more than one fairness opinion only in two cases more than one fairness opinion was prepared (representing 22.22%); in the case the exchange offer to the shareholders of Deutsche Wohnen AG, even five fairness opinions were obtained. In the year 2014, such cases could not be identified among the statements reviewed.

The majority of the offers, where more than one fairness opinion had been obtained, were offers in the large-cap segment (that means with an MCO greater than EUR 1 billion). This frequently included cases that were particularly complex (e.g. exchange offers) or particularly controversial. Therefore, in the large-cap segment the obtaining of various fairness opinions can be described as usual in such constellations.

Neutral statements

Furthermore, in 2017 an increased number of so-called neutral statements were published. These are statements that do not contain a final recommendation for action to the shareholders. Recommendations for action can have either positive or negative character. In particular cases, statements may seem prudent which refrain from issuing certain recommendations for action to the shareholders. BaFin itself stressed the option of an abstention in its BaFin Journal July 2014 (p. 19).

In 2017, five of the 22 statements reviewed (representing 22.73%) did not contain recommendations for action (opposed to 12 positive and five negative statements). In 2016, of 21 evaluated statements only one was neutral (representing 4.76%, opposed to 17 positive and four negative statements). In 2015, two of the 12 statements reviewed were neutral (representing 16.67%), and in 2014 six of the 14 statements reviewed (representing 42.86%).

In four of the five neutral statements of the year 2017, the consideration was deemed adequate. Nevertheless, the corporate bodies could not bring themselves to issue an affirmative statement. They pointed to the various arguments that spoke for or against acceptance of the offer and concluded, the pros and cons could only be weighed by the offerees according to their individual circumstances. The statement issued by the corporate bodies of Drillisch AG may serve as an example. In this document, the management board and the supervisory board pointed to the multiform potential for synergy of a merger with United Internet AG, but left the final evaluation to the shareholders. The fifth statement concerned the opposite case. Management board and supervisory board of NORDWEST Handel AG refrained from issuing a negative recommendation for action, although they regarded the offer as financially inappropriate, because they took a positive view of the goals and intentions of the bidder.

Overall, neutral statements are no exception in the corporate practice. Among legal scholars, however, the opinions as to their permissibility or scope differ. On the one hand, there are those who only regard neutral statements as permissible in the exceptional cases of an argumentative stalemate or a conflict of interest. On the other hand, however, more and more jurists regard neutral statements as generally permissible as there is no duty of corporate bodies to issue unambiguously positive or negative statements. In practice, when releasing a neutral statement care should be taken to provide thorough justification. On this requirement, both BaFin and legal scholarship agree.

The Noerr Public M&A Report for the first half of 2017 analyses the evolution of public takeovers over a four-year period by number and volume, as well as the evolution of premium amounts and market trends.

Download Public M&A Report

The Noerr Public M&A Report analyses the evolution of public takeovers over a four-year period by number and volume, as well as the evolution of premium amounts and market Trends.

The authors Volker Land and Stephan Schulz closely examine some of the currently relevant issues for public takeovers from a legal perspective.

> Noerr Public M&A Report as PDF