Public M&A Report 01/2020

Number and volume of offers

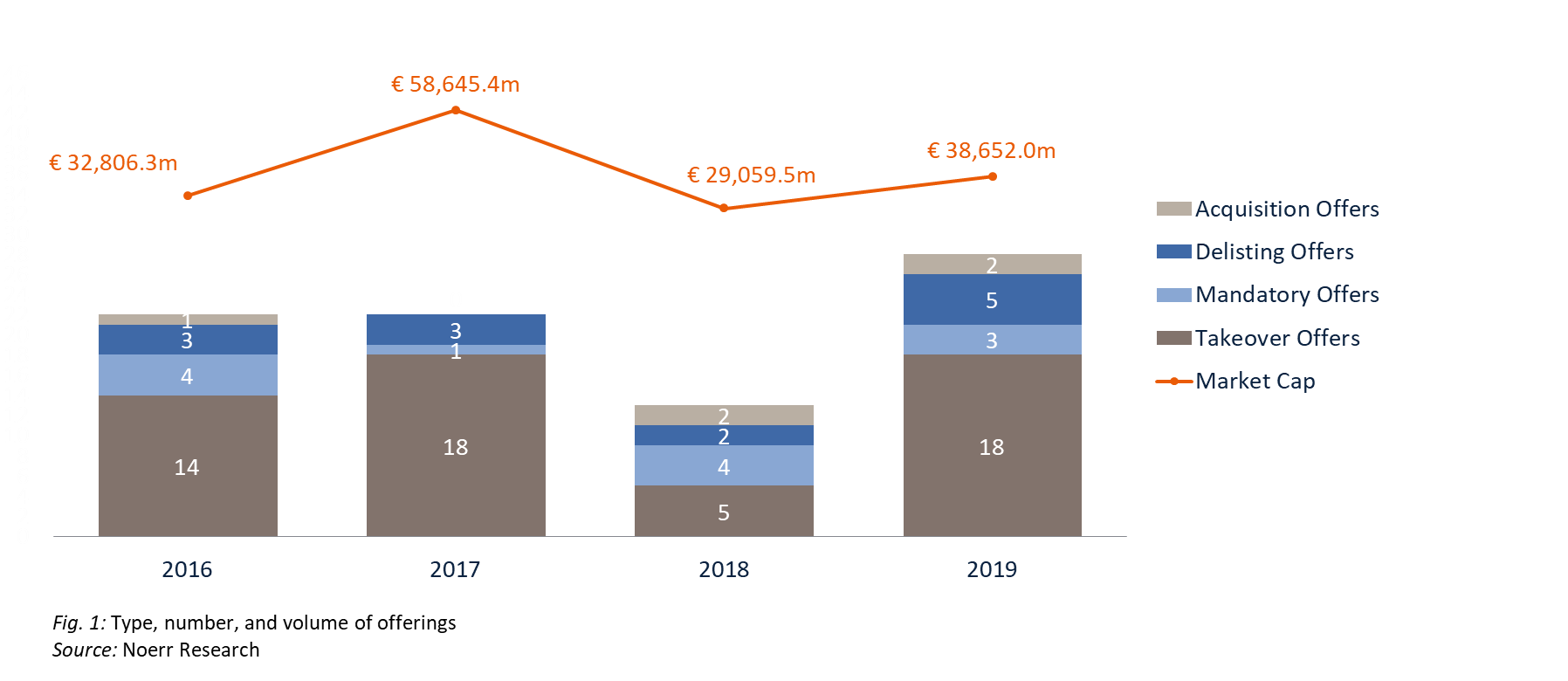

In 2019, the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht; „BaFin“) approved and published 28 public offers pursuant to the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz; “WpÜG”). These offers targeted companies with an aggregate market capitalization at the offer price (“MCO”) of EUR 38.7 billion and comprised eighteen takeover offers, five delisting offers, two acquisition offers and three mandatory offers. In addition, one offer was prohibited by BaFin due to a failure to publish an offer document within the prescribed time frame.

Compared to the previous year, the number of transactions in the German public takeover market grew significantly in 2019 to 28 offers that were published plus one that was prohibited by BaFin: In 2018, there were only thirteen offers (plus two that BaFin did not approve). The offer volume (as expressed by the MCO) rose from EUR 29.1 billion in 2018 to EUR 38.7 billion in 2019, representing a 32.65% increase.

Development of the market segments (Large-Cap, Mid-Cap and Small-Cap)

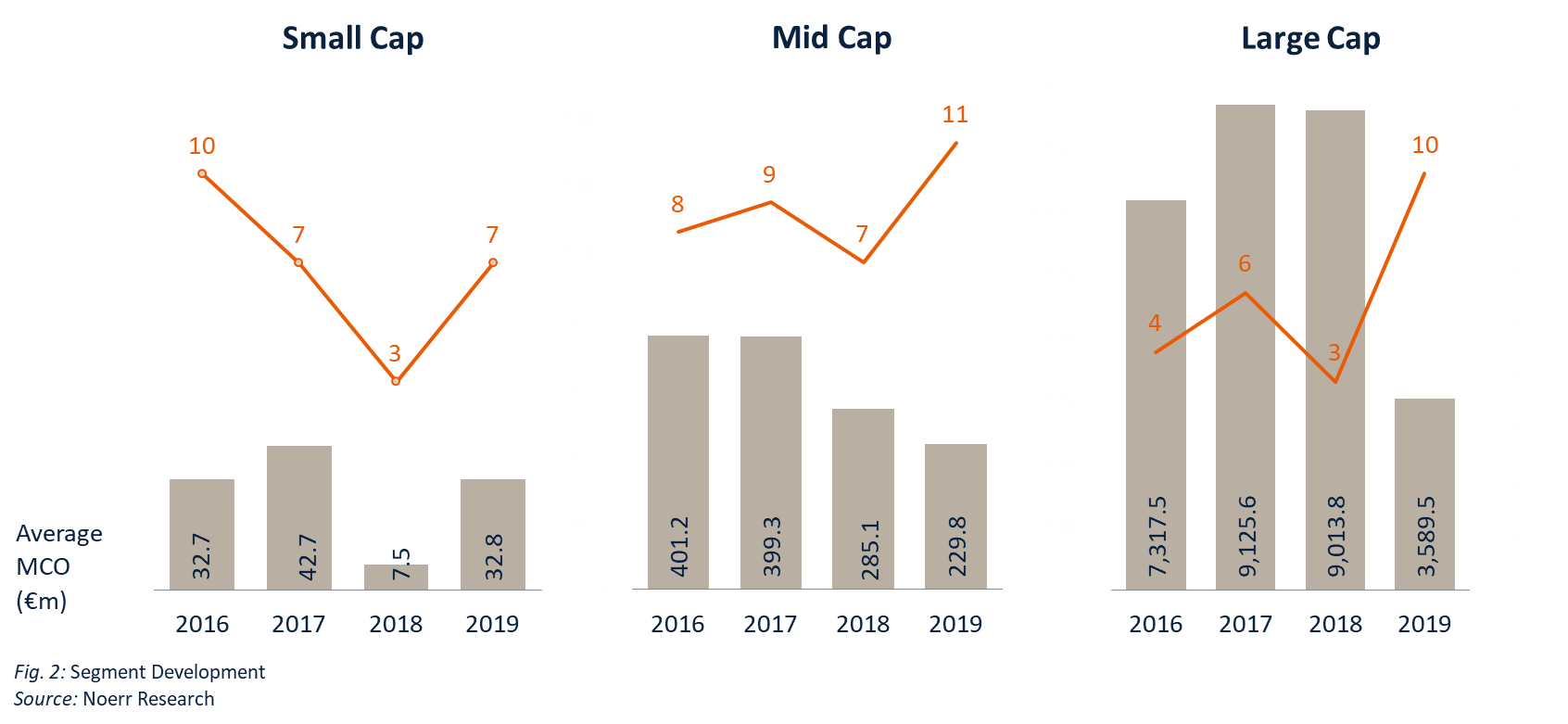

The market can be subdivided into three segments in terms of MCO: small-cap (MCO of target company less than EUR 100 million), mid-cap (MCO of target company equal to or greater than EUR 100 million but less than EUR 1 billion) and large-cap (MCO of target company equal to or greater than EUR 1 billion).

The development of the average MCO in the individual segments can be shown as follows:

Compared to 2018, the average offer volume in the large-cap segment dropped dramatically to EUR 3,589.5 million (2018: EUR 9,013.8 million). It must be considered, though, that there was one particular offer in 2018 which comprised a volume of EUR 20 billion. No bid of this magnitude was made in 2019.

The number of ten large-cap transactions in 2019 must be regarded as very high compared to previous years (only three in 2018 and six in 2017), even keeping in mind the fact that as much as three takeover offers were presented to the shareholders of OSRAM Licht AG („OSRAM“).

At eleven transactions with an average offer volume of EUR 229.8 million, no substantial developments can be noted in the mid-cap segment compared to the previous year. While 2018 saw only seven transactions, the average offer volume exceeded that of 2019.

The number of transactions in the small-cap segment rose from three to seven transactions, compared with the previous year. At EUR 32.8 million, the 2019 average offer volume in the segment substantially exceeded that of 2018 (EUR 7.5 million).

Distribution of offer volume over number of transactions

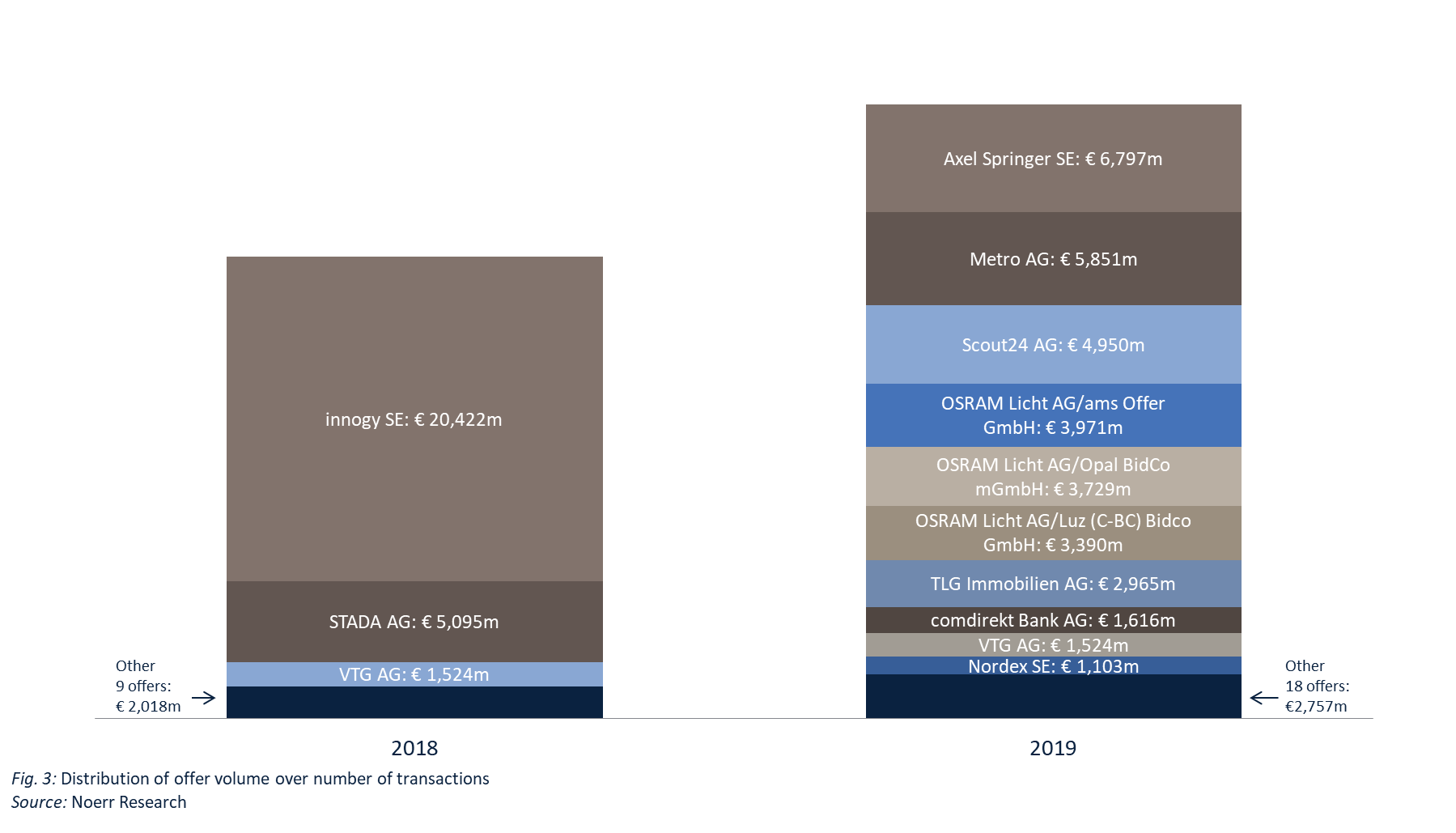

Ten offers were recorded in the large-cap segment in 2019. With an aggregate offer volume of EUR 35.9 billion, these ten offers represented 93% of the overall 2019 offer volume.

In spite of this extreme concentration in the large-cap segment – and even considering the special case of OSRAM - last year’s total offer volume was still much more evenly spread over the total number of transactions than that of the previous years. Instead of only one or two large-cap offers of extremely high volume, there was a multitude of offers with more or less similar transaction volume. Thus the long-term observation that very large individual transactions decisively influence the total market volume was not confirmed in 2019.

Premium amount

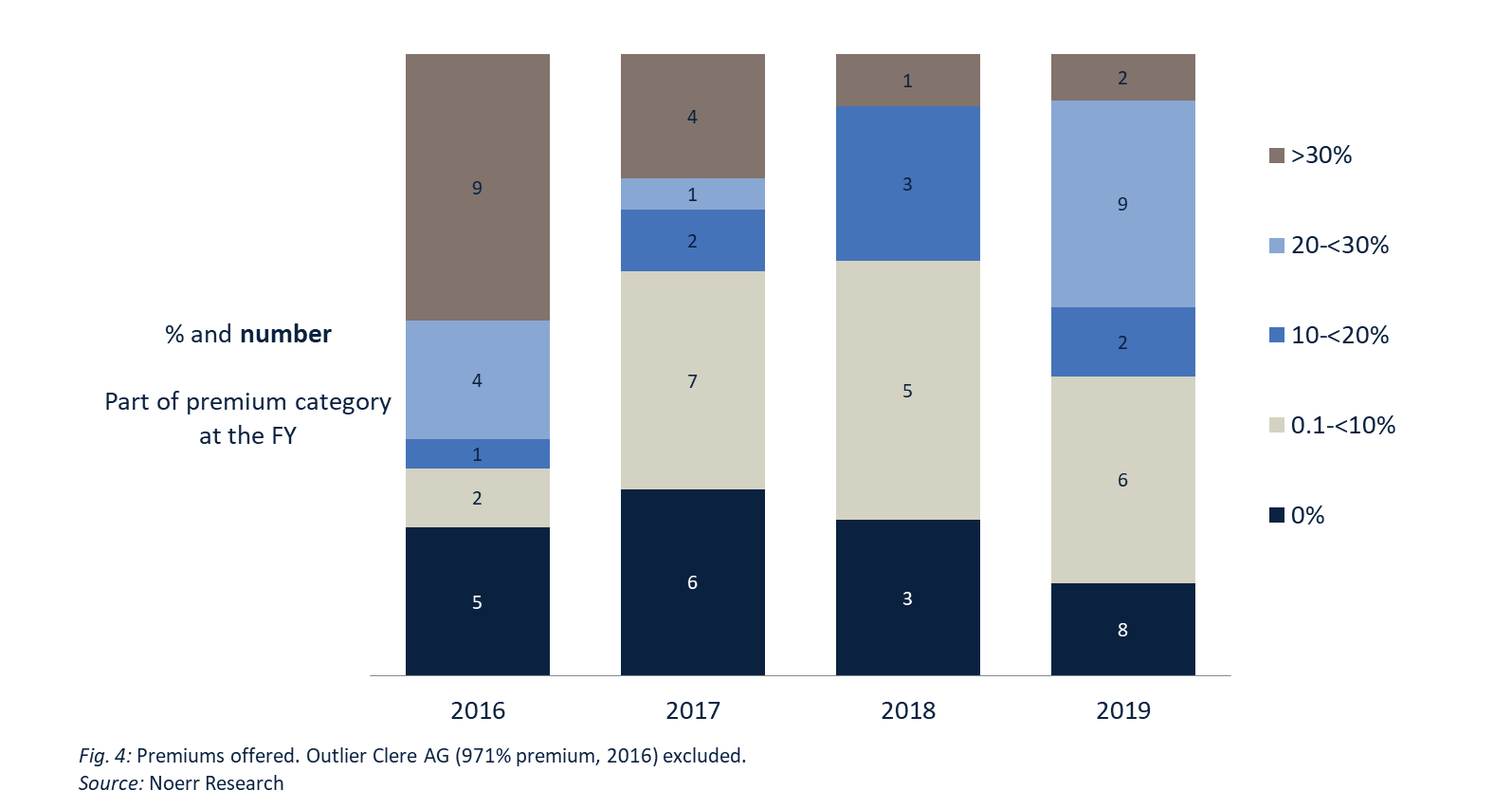

In 2019, bidders paid an average premium of 17.5% above the volume-weighted average price of the target companies’ shares as calculated over the three-month period preceding the publication of each respective bid („3-month VWAP“). The highest premium – 158.33% - was paid to the shareholders of Fyber N.V. in the context of the takeover offer by Advert Finance B.V. In six cases the target’s shareholders did not receive any premium at all. In one case (offer to the shareholders of Kremlin AG) the offer document stated that the 3-month VWAP could not be determined. The offer was therefore not included in the calculation of the average premium amount.

While eleven of the 2019 transactions involved premium payments above 20%, only two offers in the highest premium range of more the 30 % were recorded. The average premium, however, increased significantly (by 116.58%) compared to only 8.08% in 2018. The average premium of 12.09% in 2017 was also considerably below that in 2019.

Although, compared to the first half year of 2019, the average premium dropped in the second half year, this effect must be attributed to one single offer involving the considerable premium rate of 158.3% in the first half year of 2019. Premium amounts were much more evenly distributed in the second half year.

The following chart illustrates the premiums offered in the transactions of the year 2019, subdivided into different categories, and compares them to the premiums paid in the preceding years:

Reasoned statements pursuant to section 27 WpÜG

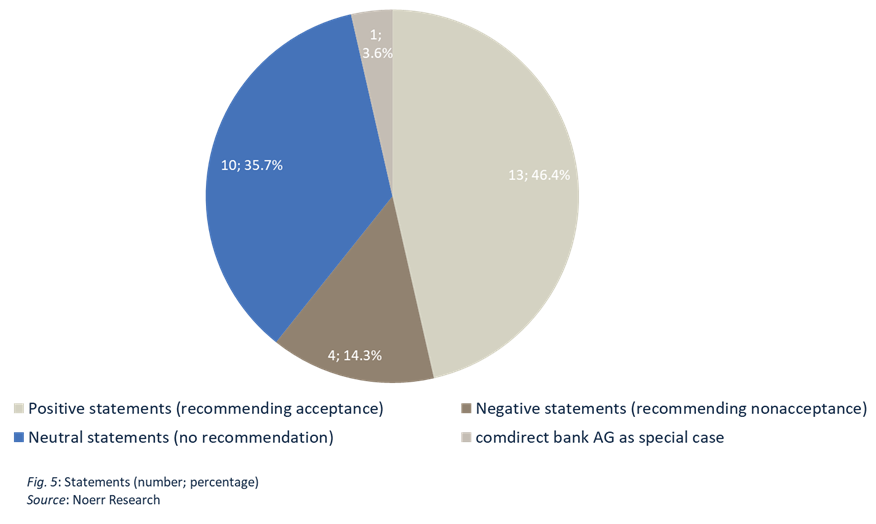

In 2019, the corporate bodies of target companies published a total of 28 reasoned statements pursuant to section 27 WpÜG, reflecting the number of bids published.

The definitive assessments of the offers by the targets‘ corporate bodies can be summarized as follows:

22 of the 28 reasoned statements published in 2019 (approx. 79%) were supported by so-called fairness opinions, assessments by external consultants regarding the adequacy of the consideration offered.

In seven cases (approx. 25%) the corporate bodies of the target company received several fairness opinions. In six of these seven cases (targets: Scout24 AG; three times OSRAM; Axel Springer SE; METRO AG) the takeover offers ranged at the upper end of the large-cap category, as all these target companies had an MCO of more than EUR 3 billion. In connection with the joint reasoned statements, the supervisory boards of these target companies obtained separate fairness opinions, addressed to the supervisory board only. Such an approach has become common practice for transactions in the upper large-cap segment. For smaller transactions however, management board and supervisory board usually jointly engage one or (less frequently) several advisors to prepare one or several fairness opinions. In the latter case it might be advisable for the corporate bodies to engage a bank and an auditing firm. While an auditing firm is bound by the „Principles for the Preparation of Fairness Opinions“ (IDW S 8) published by the Institute of Public Auditors in Germany (Institut der Wirtschaftsprüfer in Deutschland e.V.; „IDW“), there is no obligation for banks to adhere to these methods. Due to methods and analyses partly applied in different ways, the respective opinions of the consultants play an even more decisive role in assessing the adequateness of the consideration offered.

The 2019 maximum of three fairness opinions ordered in connection with the preparation of one reasoned statement was reached in connection with the joint reasoned statements by the corporate bodies of METRO AG as well as Axel Springer SE, respectively. In both cases the management board of the target company ordered two fairness opinions, while the supervisory board ordered one.

Focus: Amendment of sec. 26 WpÜG – Extension of blocking period following a failed or prohibited public offer to include persons acting in concert with the bidder

by Sebastian Diehl, LL.M. and Dr. Andreas Wöller, LL.M., Noerr LLP, London

Where an offer has failed due to a minimum acceptance threshold not being reached or where an offer is prohibited by BaFin for certain reasons, bidders have been subject to a blocking period of one year during which the bidder is not allowed to present a new takeover offer.

With effect from 20 December 2019, the blocking period has been extended to include persons acting in concert with the bidder (as defined in sec. 2 para. 5 WpÜG). The goal of this amendment is to prevent bidders from circumventing a blocking period, however, there might be implications for investors who, due to the size of the group they control, have a large number of persons with whom they are deemed to act in concert.

Previous rule

The blocking period was designed to protect the target company from undue interference with its business for a prolonged period of time. Before the amendment of sec. 26 WpÜG, the prevailing if not quite unanimous opinion held that the blocking period applied only to the bidder itself. Offers by companies belonging to the same group as the original bidder were still possible. In the past, BaFin approved new offers by subsidiaries of the original bidder, most recently in the case of a second takeover bid for OSRAM. An application for interim relief by OSRAM’s group works council, aimed at compelling BaFin to prohibit the takeover offer, did not succeed before the Higher Regional Court of Frankfurt. (However, the Court did not decide on the merits of the complaint, as it did not consider the complaint to be admissible in the first place.)

New rule

Probably triggered by the (ultimately successful) new takeover offer for OSRAM, sec. 26 WpÜG was amended in December 2019. In the future, in addition to the bidder itself, persons acting in concert with the bidder are also excluded from publishing a new offer for one year after the initial offer failed or was prohibited. This also includes offers from persons who only during the second offer (i) act in concert with the first bidder or (ii) act in concert with a person who acted in concert with the first bidder during the initial offer.

In addition to persons who coordinate with each other regarding the acquisition of securities of the target company or their exercise of voting rights, the term „persons acting in concert“ encompasses in particular all subsidiaries of a group, both in relation to the group parent entity and in relation to each other.

Practical implications

The legislative change leads to a significant extension of the blocking period’s scope of application. It could in particular affect acquisition vehicles in private equity structures, where often not only the fund entities and their general partners but also (controlled) portfolio companies can be considered persons acting in concert. The same applies to companies under common state control.

It is therefore important for bidders to consider the consequences of the blocking period for its other group companies already when preparing the offer. This also applies to bidder consortia and agreements with existing shareholders (for instance in the form of irrevocable undertakings). Persons involved in such constructs are also affected by a blocking period even if they no longer act in concert with the bidder at the time of the second offer. If the blocking period does apply, BaFin can grant an exemption only with the target company’s consent. The only other alternative for a potential bidder who is subject to the blocking period would then be to trigger a mandatory takeover offer via separate block trades.

Exchange offers pursuant to the WpÜG in light of the new prospectus regulation. The German transitional rules and a glimpse into the future

by Dr. Philip M. Schmoll, Noerr LLP, Frankfurt am Main

An exchange offer pursuant to the WpÜG is a public offer in which shares or other securities are offered in return for shares in the target companies. Normally, the shares on offer are newly issued shares of the bidder. Due to the interplay between takeover and prospectus legislation, the offer documents for exchange offers are highly complex. The entering into full force on 21 July 2019 of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (“Prospectus Regulation”) presents an occasion to focus again on exchange offers.

Amendment of sec. 2 no. 2 half sentence 1 of the WpüG Offer Ordinance

The scope of application of the Prospectus Regulation to public exchange offers is determined by two circumstances: First, the shares offered as consideration must be offered publicly. Second, they must, as a rule, be admitted to trading on a regulated market. Sec. 2 no. 2 half-sentence 1 of the WpÜG Offer Ordinance (WpÜG-Angebotsverordnung; “WpÜG-AngebV”) therefore links German takeover legislation to prospectus law in order to avoid triggering a requirement to prepare a separate securities prospectus. According to the above WpÜG-AngebV provision, minimum information content in accordance with prospectus law must be added to the exchange offer document. Following the entry into force of the Prospectus Regulation, sec. 2 no. 2 half-sentence 1 WpÜG-AngebV was adapted accordingly. The bidder is now obligated to include in the offer document the minimum information content required for a securities prospectus if securities are offered as consideration. In this respect, the new legal situation is no different from the old one.

However: Exchange offers are regularly made by bidders whose existing shares have been admitted to trading on a regulated market without interruption for at least 18 months and whose shares on offer are fungible with its existing shares. According to the new rules applicable in such a case, it is sufficient for a bidder to include only the information required for a so-called simplified prospectus. This means, above all, that only historical financial information and, if applicable, interim financial information for the last financial year which ended before the publication of the offer document must be included. Bidders may now also refrain from preparing a discussion of their business position and financial situation (in the prospectus usually called “Management Discussion and Analysis”, or “MD&A”). A “description of the principal markets, in which the issuer competes” (in the prospectus usually called “Markets and Competition”) is not required either. Thus the amendment to sec. 2 no. 2 half-sentence 1 WpÜG-AngebV is a first step to make things easier for bidders in comparison to the old legal situation, which did not provide for such a simplification.

The „Exempted Document“

Further simplifications compared to the former legal situation seem to be on the horizon. The change in sec. 2 no. 2 half sentence 1 WpÜG-AngebV is intended to be no more than an interim solution.

Article 1 para. 4 point (f) and para. 5 point (e) of the Prospectus Regulation provides for exemptions from the obligation to publish a securities prospectus „in connection with a takeover by means of an exchange offer“. According to the provision, no prospectus is required in connection with exchange offers, provided that „a document is made available to the public [...] containing information describing the transaction and its impact on the issuer“. Such a document is called „Exempted Document“. Under the old legal framework, both the Prospectus Directive and WpPG provided for exemptions in connection with exchange offers. These, however, still required the publication of a document containing information equivalent to the information required in a prospectus, so there was no room for any simplification in comparison to the usual prospectus regime. By means of the Prospectus Regulation, the European legislator has now distanced itself from the requirement for equivalent information.

The Prospectus Regulation authorises the European Commission („Commission“) to adopt a Delegated Regulation with respect to the minimum information content required for an Exempted Document. The adoption of the delegated act is still pending. After it has been adopted, sec. 2 no 2 half-sentence 1 WpÜG-AngebV will probably be adapted again, requiring bidders to supplement their exchange offer document with an Exempted Document. The future scope of information to be included in exchange offer documents pursuant to prospectus law will thus depend on the design of the Delegated Regulation.

In preparation of the Delegated Regulation, the Commission consulted the European Securities and Markets Authority („ESMA“). After a public consultation, ESMA presented its final report on 29 March 2019. ESMA‘s report contains suggestions with respect to the Delegated Regulation, including tables with the minimum content for an Exempted Document. According to this suggestion, bidders whose existing shares have been admitted to trading on a regulated market for a period of 18 months without interruption and whose shares offered as compensation are fungible with its existing shares would be required to prepare a simplified Exempted Document only. Compared to a simplified prospectus, such simplified Exempted Document would mainly allow the bidder to abstain from describing its significant contracts, and also from providing a summary of all its insider information published during the preceding 12 months or information regarding the taxation of its securities. Furthermore, an Exempted Document is not required to contain a summary. For bidders who cannot prepare an Exempted Document, ESMA’s proposal provides no alleviation in comparison to the usual prospectus regime, as it aims to prevent circumvention of the prospectus regime by means of backdoor listing.

Let us hope that in implementing minimum requirements for information content in an Exempted Document, the Commission will show a little more courage and provide for more extensive simplifications than ESMA has done. Nevertheless, the fact that the preparation of exchange offers will be less demanding in the future than it used to be, is to be welcomed. In any case, by making a provisional amendment to sec. 2 no. 2 WpÜG-AngebV, the German legislator has created a practical interim solution for the time until the Delegated Regulation is adopted, a solution which ensures legal certainty for bidders and for BaFin during exchange offer procedures and which fulfils the offer targets‘ demand for information.

Full report: Noerr Public M&A Report