Turnover calculation of joint ventures in EU merger control

With judgment of 5 October 2020 (T-380/17, HeidelbergCement AG/Schwenk Zement KG v. European Commission), the General Court of the European Union commented on important questions relating to the calculation of turnover where joint ventures are involved.

Background

Transactions have to be notified to antitrust authorities if a transaction constitutes a relevant concentration, and the undertakings concerned meet certain threshold relating to turnover, market shares or asset value. In the European Union, concentrations have to be notified that involve the acquisition of control and where, in the business year preceding the transaction, (i) the undertakings concerned generated certain combined worldwide turnover and (ii) at least two undertakings concerned each generated certain EU-wide turnover or, if applicable, certain turnover in individual Member States.

The applicable consolidated group turnover reflects the economic significance and resources of the companies involved and serves to distinguish transactions of EU-wide dimension from transactions of merely national importance. The correct calculation of turnover is therefore decisive to determine which antitrust authority has jurisdiction, and to ensure that a transaction which is subject to a notification requirement is notified to, and authorised by the competent authority prior to its implementation.

Joint ventures as acquiring parties

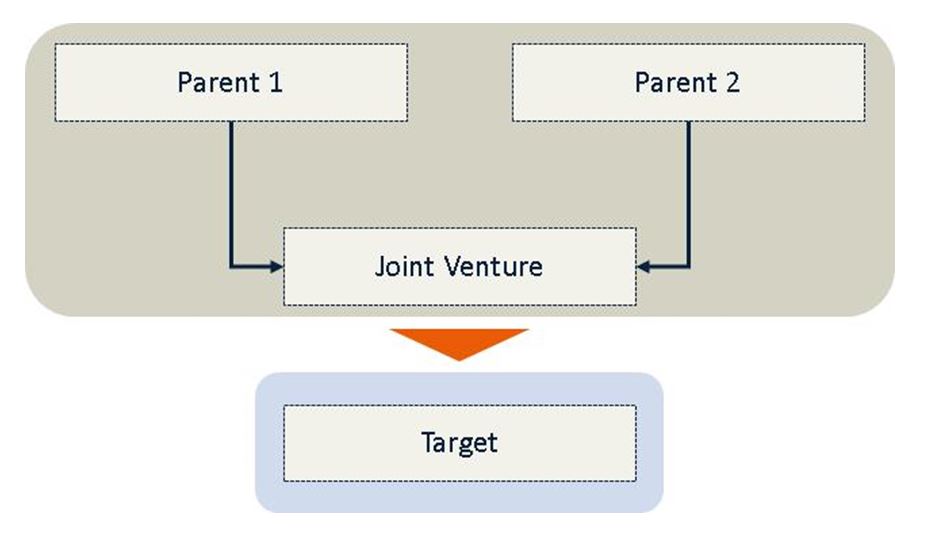

In cases where the acquiring party acquires an undertaking, the undertakings concerned for the turnover calculation purposes are, firstly, the acquiring party and, secondly, the undertaking to be acquired (target). If a jointly held joint venture acquires an undertaking, the question arises as to which of the companies are the undertakings concerned. The following chart is intended to illustrate this:

The undertakings concerned in this example are, firstly, (i) the joint venture whose consolidated turnover comprises the turnover of both of its parent companies and, secondly, (ii) the target. A notification to the European Commission in Brussels is required if the joint venture and the target together meet the worldwide turnover threshold, and the joint venture and the target each meet the turnover threshold for the EU. If the turnover generated by the target is too low, a notification in Brussels is not required while national notifications may still be required.

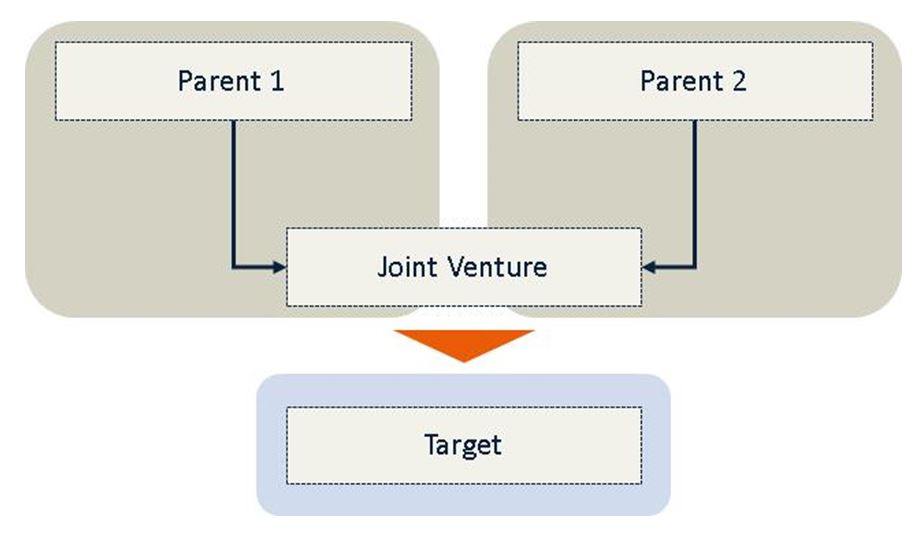

The situation is different if the joint venture is not an undertaking concerned while the two parent companies are, as illustrated by the chart below:

The undertakings concerned in this example are (i) parent 1, (ii) parent 2 – each including one half of the turnover generated by the joint venture – and (iii) the target. This means that parent 1 and parent 2 can already satisfy the EU turnover test, without the turnover of the target being of any relevance. Even if the target generates zero or very little turnover in the EU, a notification in Brussels may nevertheless be necessary.

Judgment

According to the General Court, the economic reality is decisive for the question as to whether each of the parent companies must be taken into account for the calculation of the turnover “by the joint venture”. This means that at least in situations where the joint venture is a mere vehicle for the acquisition of the target, the parent companies are undertakings concerned, and not the joint venture itself. Beyond this scenario, the decisive criterion in the assessment should generally be who the actual economic players are, i.e. those essentially initiating, organising, and financing the transaction.

For this assessment, the General Court attaches great importance to the active involvement of the parent companies (or only one of them) in the transaction process. The General Court refers to the following elements which suggest that the parent companies play a significant role:

- Representatives of a parent company determined the composition of the steering committee and attended negotiations already at an early stage, negotiated non-disclosure agreements, organised and conducted the due diligence, planned the integration, prepared the documentation, engaged with banks and negotiated the purchase price.

- Even though the other parent had a rather passive role, it had indicated its consent at the beginning of the transaction process, was regularly informed and involved in considerations regarding the transaction structure.

- The joint venture also had no human and other resources to manage a transaction of this size alone.

- Even though the joint venture had financed 80% of the purchase price and was able to pay 20% from own funds, the decisive aspect for the General Court was that it was ultimately the parent companies that provided the capital for those own funds and authorised the financing in general.

The General Court deems it to be irrelevant whether or not the joint venture had an independent market presence (i.e. could be considered “full-function”) and any strategic interest of its own in the transaction procedure.

Comment

The judgment shows once again how important it is to thoroughly analyse the data relevant for establishing jurisdiction of antitrust authorities. This includes the correct calculation of turnover which ensures that a reportable transaction is actually notified to the competent authority prior to its implementation. Getting it wrong will cause problems where a necessary notification has not been made, and the required clearance decision has not been obtained, so that the issue of “gun jumping” arises which may lead to both legal (pending voidness of the transaction agreements) and financial (fines) sanctions. In addition, it may not be possible to stick to the transaction schedule if authorities have to be involved which were previously not considered.

What is important in this context is to have a clear understanding of the roles of the parent companies. In cases of doubt, the General Court recommends clarifying the issue with the European Commission in advance. However, we note that an informal consultation procedure with the Directorate-General for Competition cannot be completed within a few days. Sometimes a lot of information has to be submitted before the case team can make a robust statement on which companies can rely, sometimes only after several weeks have passed and after involvement of, for instance, the Legal Service.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now