Tax law changes in 2023/2024: Federal Ministry of Finance publishes several proposals

In June and July, the German Federal Ministry of Finance (BMF) presented a bundle of proposals of far-reaching tax law changes, namely:

- GrEStNG: Discussion draft of a law amending the Real Estate Transfer Tax Act (Grunderwerbsteuer-Novellierungsgesetz - GrEStNG) dated 15 June 2023,

- WCG: Draft bill on strengthening growth opportunities, investment and innovation as well as tax simplification and tax fairness (Wachstumschancengesetz - WCG) dated 6 July 2023, and

- MinBestRL-UmsG: Draft of a law for the implementation of the directive to ensure a global minimum taxation for multinational groups and large domestic groups in the Union and the implementation of further accompanying measures (Mindestbesteuerungsrichtlinie-Umsetzungsgesetz - MinBestRL-UmsG) of 7 July 2023.

However, it remains to be seen whether and to what extent the proposals will actually be implemented in the further legislative process. According to reports, this applies in particular to the GrEStNG.

I. Overview

The draft of the GrEStNG is to be seen in particular against the background that the Act on the Modernization of the Law on Partnerships (Gesetz zur Modernisierung des Personengesellschaftsrechts – MoPeG) will adjust the so-called joint ownership principle (Gesamthandsprinzip) in the case of partnerships with effect from 1 January 2024. This will call into question certain provisions of the German Real Estate Transfer Tax Act (Grunderwerbsteuergesetz – GrEStG). In addition, the rules on the taxation of share transfers are to be completely revised, the so-called group clause is to be amended and an opening clause for the Federal States is to be introduced to foment the acquisition of real estate for private residential purposes.

The WCG is intended to take tax measures to improve the liquidity situation of companies and encourage companies to invest and innovate on a lasting basis. However, tax tightening is also envisaged under the slogan of tax fairness.

The MinBestRL-UmsG shall transpose the EU Directive (EU) 2022/2523 on the introduction of a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups into German law (so-called Pillar 2). As a flanking measure, the draft provides, among other things, for simplifications to the Controlled Foreign Companies (CFC) rules and the abolition of the so-called license barrier.

Below we outline the key proposals and their anticipated impact on the following areas:

- Corporate taxation (see under section II),

- Tax amendments related to MoPeG (see section III),

- Real estate tax law (see under section IV),

- Foreign tax law (see under section V),

- Fund taxation (see under section VI),

- Disclosure rules for domestic tax arrangements (see under Section VII); and

- Other aspects (see under section VIII).

II. Corporate taxation

In the area of corporate taxation, the above-mentioned drafts contain the following proposed amendments:

1. Interest barrier rule

The so-called interest barrier rule under §§ 4h of the German Income Tax Act (Einkommensteuergesetz - EStG), 8a of the German Corporation Tax Act (Körperschaftsteuergesetz - KStG) must be adapted to the requirements of the ATAD by 31 December 2023 at the latest. This is to be done by the WCG and would lead to a significant tightening of these rules from 2024 onwards.

1.1 Expansion of the concept of interest

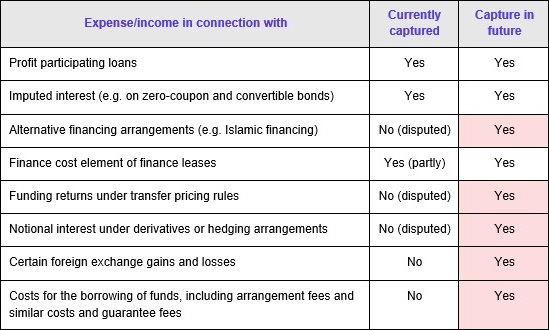

Currently, the interest barrier rule only applies to expenses and income that are remuneration for the use of debt capital (fundamentally Federal Tax Court, judgement dated 22 March 2023, XI R 45/19, BeckRS 2023, 17483, on arrangement fees). However, according to the ATAD, the concept of interest/borrowing costs is to be expanded to include expanses and income economically equivalent to interest and expenses incurred in connection with the raising of finance defined in art. 2 (1) of the ATAD.

The changes expected to result from this are presented below in tabular form based on ATAD's non-exhaustive list of borrowing costs.

As a result, the material scope of application of the interest barrier rule is to be expanded considerably, in particular to include gains and losses from derivative transactions (cf. Tax Court of Berlin-Brandenburg, judgement dated 8 January 2019, 6 K 6242/17, BeckRS 2019, 2587), costs for the borrowing in the broader sense and foreign exchange gains and losses related to financing.

1.2 Abolition of exceptions

Furthermore, the exceptions currently existing from the interest barrier rule of the so-called "equity escape" (cf. § 4h (2) (c) EStG) and the so-called "stand-alone clause" (cf. § 4h (2) (b) EStG) are to be abolished due to an incompatibility with the ATAD (in our view, there is no fundamental contradiction to the ATAD here). This has different impacts in practice:

- Equity escape: In practice, this exception is of little significance. The reason for this is that its prerequisites – in particular proof of the absence of harmful financing within the meaning of § 8a (3) KStG throughout the entire group – are only hardly met or cannot be met at all.

- Stand-alone clause: More practical significance has the stand-alone clause. This exemption currently excludes businesses that are not part of a group from the interest barrier (e.g., a GmbH without subsidiaries, in which no shareholder is holding more than 50%). In the future, such structures would be included; this would presumably also be the case for standard securitization vehicles that are regularly held by several foundations (to the extent that debt capital is securitized, however, the actual impact should be minor; in contrast, structures that securitize other assets such as e.g. German real estate, private equity or infrastructure could be called into question.

Different lobby groups have rejected such an abolition without replacement.

1.3. Allowance, but only once for similar businesses

A positive aspect is that the previous EUR 3 million exemption limit is to be converted into an allowance - i.e. net borrowing costs would only be subject to the restrictions of the interest barrier above this amount.

However, this relief is to be combined with a massive tightening. In contrast to the current situation, similar businesses that are under the same management are to be considered together, with the consequence that the EUR 3 million allowance can then only be claimed once. According to the explanatory memorandum to the draft, this is intended in particular to affect structures in which activities (e.g. construction projects) are "atomized" in subsidiaries; however, the current wording of the proposal goes significantly and possibly unintentionally beyond this:

- Similar businesses: For the concept of similar businesses, the explanatory memorandum refers to § 4 (6) sentence 1 no. 1 KStG. The concept of similarity covers not only activities in the same branch of trade, but also activities that partially overlap and/or complement each other; however, the geographical proximity of the businesses concerned is not relevant (cf. Federal Fiscal Court, judgement dated 13 April 2021, I R 2/19, Federal Tax Gazette II 2021, 777; Tax Court of Münster, judgement dated 21 April 2021, 13 K 3663/18 G, BeckRS 2021, 10713).

- Uniform management: With regard to the concept of uniform management, the explanatory memorandum to the draft contains no comments. This is an indeterminate legal concept which may be defined more precisely by recourse to the group and affiliate concept under company law (cf. § 18 of the German Stock Corporation Act).

Against this background, there is the possibility that customary group structures in which subsidiaries cooperate on the basis of a division of labor, and also investment structures in which there is no undesired “atomization”, could claim the EUR 3 million allowance only once. This should be reviewed in the legislative procedure and the regulation, to the extent necessary, be limited to genuine cases of abuse.

1.4. Exception for public infrastructure

Art. 4 (4) subpara. 1 (b), (2) and (3) ATAD provides for the possibility that net borrowing costs relating to the financing of public infrastructure projects may be exempted from the interest barrier. This exemption is to be implemented by § 4h (6) EStG for the financing of (i) long-term public infrastructure projects (ii) under general funding conditions (iii) with a specific source of funds:

- Long-term public infrastructure projects: This term is not defined in the draft of the WCG. However, according to the ATAD, it refers to projects for the provision, expansion, operation and/or maintenance of substantial assets that are considered to be in the general public interest by a Member State of the EU (cf. art. 4 (4) subpara. 2 ATAD).

- General conditions of eligibility: This term is also not defined in the draft of the WCG; according to the explanatory memorandum to the draft, reference is made to note 94 of the current circular letter to the interest barrier of the Federal Ministry of Finance for specification.

- Source of funds: The funds for financing must come directly or indirectly from the public budgets of the EU, the Federal Republic of Germany, the Federal States, the municipalities or from other public-law corporations or an entity exempt from tax under § 5 (1) no. 2, 17 or 18 KStG.

Moreover, this exemption applies only if all the assets created are located in an EU Member State, the project operator is resident in an EU Member State, and the income from the infrastructure project is subject to taxation in an EU Member State. In the end it is rather questionable whether the exception for public infrastructure will have a wider scope of application in practice.

1.5 No grandfathering

With regard to the changes to the interest barrier, the draft of the WCG does not provide any protection for existing financing (so-called grandfathering). In other words, the deduction of net borrowing costs may be limited under the new rules from the tax year 20024 onwards, even though the borrowing was taken out beforehand.

2. Interest rate cap

In addition to the interest barrier, the deduction of net borrowing costs in relation to financing between related parties within the meaning of §. 1 (2) of the German Foreign Tax Act (Außen-steuergesetz - AStG) is to be limited to an interest rate cap by §. 4l EStG (so-called interest rate cap (Zinshöhenschranke)).

The maximum interest rate shall be 2% p.a. above the base interest rate pursuant to § 247 of the German Civil Code (currently 5.12% p.a.). It is questionable at what point in time the base interest rate is to be applied (at the time of taking out the borrowing vs. adjustments over the term). Moreover, in our view, the link to the statutory base interest rate makes little sense, among other things because this is only adjusted and published every six months.

The following exceptions to the interest rate cap shall exist:

- Counter-evidence: On the one hand, the taxpayer can prove that both the creditor and, in the case of a group of companies, the ultimate parent company could only have obtained the financing at an interest rate above the maximum rate, all other things being equal. This brings back (bad) memories of §. 8a (1) sentence 1 no. 2 KStG in the version of the (original) old thin capitalization rules, which the tax authorities already interpreted very restrictively at the time, leading to considerable dispute (cf. Federal Ministry of Finance, circular letter dated 15 December 1994, Federal Tax Gazette I 1995, 25, note 61; Federal Fiscal Court, judgement dated 25 January 2005, I R 12/04, BeckRS 2005, 24002031).

- Proof of substance: On the other hand, the interest rate barrier shall not apply if the creditor carries out a substantial economic activity in the state in which it has its registered office or management; §. 8 (2) sentence 2, 3 and 5 AStG (inter alia, prohibition of outsourcing) are to apply mutatis mutandis. The substantive exception is excluded if the above-mentioned state does not provide administrative assistance by way of exchange of information, which is required to carry out taxation in the individual case.

The draft of the WCG also does not provide for a grandfathering in relation to the proposed interest rate cap.

3. License barrier rule

The license barrier rule pursuant to § 4j EStG, which was introduced in 2018, provides for a prohibition of business expense deductions for the corresponding license expenses in Germany in certain cases of low taxation of license income abroad (e.g., due to a "patent box"). However, the practical significance of the license barrier is limited. Against the background of Pillar 2, the reform(s) of the CFC rules as well as the Tax Oasis Defense Act (Steueroasenabwehrgesetz), this barrier is to be abolished again by the MinBestRL-UmsG as of 1 January 2024.

4. Use of tax losses

The draft of the WCG provides for the following changes to the use of tax losses:

- Loss carryback: As of the tax year 2024, the period for a loss carryback for income tax and corporate income tax purposes is to be increased to 3 years; the current maximum amount of EUR 10 million (or EUR 20 million in the case of joint tax assessment) is to apply permanently. For trade tax purposes, however, there will continue to be no loss carryback.

- Suspension of minimum taxation: In addition, the minimum taxation, which currently limits the offsetting of loss carryforwards against current profits in excess of EUR 1 million to 60 %, is to be suspended from the tax years 2024 to 2027. This will make asset deals and Reorganizations at fair market values significantly more attractive.

- Re-introduction of minimum taxation: As of the tax year 2028, minimum taxation will be re-introduced, but only for the total amount of income exceeding EUR 10 million (or EUR 20 million).

- Synchronization of trade tax: The minimum taxation is also to be suspended for trade tax purposes from trade tax period 2024 until and including trade tax period 2027 and subsequently only apply above an amount of EUR 10 million.

The changes summarized above are very welcome.

5. Preferential regime for retained earnings (§ 34a EStG)

Members of a commercial partnership are generally taxed on their share of the partnership's profits, irrespective of whether they withdraw or retain them at company level. An exception to this is provided for by the preferential regime for retained earnings under § 34a EStG. This allows the respective members, upon application and under certain conditions, to retain all or part of their share of profits at company level at a tax rate of 28.25% (plus solidarity surcharge and church tax). Additional (“distribution”) taxation only occurs in the event of withdrawal. In practice, however, the preferential regime for retained earnings is often not used, in particular because the effective tax rate is significantly higher than 28.25% (see below) and certain events can lead to unwanted subsequent taxation of the reinvested amounts.

With the WCG, practically significant improvements - but also tightening - are to be made. In particular, the following should be pointed out

- Increase in the volume of preferentially taxed retained earnings: Under the current legal situation, the amount that can be retained at a preferential tax rate of 28.25% is reduced by the trade tax incurred at company level and the profits withdrawn for the payment of income tax on these retained earnings. The effective retention tax rate is therefore often at or above 35%. Both of these aspects are to be changed by the WCG, so that in future full retention at 28.25% would be possible in individual cases (§ 34a (2) EStG-E).

- Relief from subsequent taxation: According to the draft of the WCG, the order of application in the case of excess withdrawals will be changed in favor of taxpayers. Under the current legal situation, excess withdrawals (i.e. withdrawals in excess of contributions and taxable retained earnings) result in tax-privileged retained earnings being deemed to have been withdrawn first. In this respect, there is currently a subsequent taxation at the rate of 25% (plus solidarity surcharge and, if applicable, church tax), even if tax-exempt or regular-taxed profits were retained in the company. According to the WCG, the withdrawal of regular-taxed or tax-exempt profits that have been retained in the company so far (post-tax withdrawal amount) is to be given priority; only to the extent that this so-called post-tax withdrawal amount has been used up will there be a taxable subsequent taxation of the profits retained at a preferential rate (§ 34a (4) et seq. EStG-E).

- Tightening of subsequent taxation: At the same time, the events that can lead to subsequent taxation of preferentially retained earnings are to be expanded. In particular, the transfer of Business units (Teilbetriebe) or partial co-entrepreneurial interests (Mitunternehmeranteile) for a consideration or free of charge (e.g. also contributions to corporations pursuant to § 20 of the German Reorganization Tax Act (Umwandlungssteuergesetz - UmwStG) shall in the future lead to a proportionate subsequent taxation (§ 34a (8) EStG-E).

6. Corporate tax option (§ 1a KStG)

As an alternative to the preferential regime for retained earnings, a check the box election for partnerships has been introduced for assessment periods beginning on or after January 1, 2022. This allows commercial partnerships (Personenhandelsgesellschaften) and partnership companies (Partnerschaftsgesellschaften) to apply to be treated as corporations for income tax purposes. This option for corporate taxation leads to a far-reaching - albeit not congruent - equal treatment of a partnership with a corporation for income tax purposes.

The WCG is intended to adapt the existing regulations in favor of taxpayers:

- Scope of application: In the future, the option is to be open to all partnerships and thus, for example, also to civil partnerships and purely internal companies. For tax-wise asset-managing partnerships, however, this will often not be of interest for tax purposes, because the option would not be carried out in accordance with §§ 25, 20 UmwStG at book values and would therefore lead to the realization of hidden reserves at company level (§ 1a (1) sent. 1-4 KStG-E).

- Application on newly established partnerships and changes of legal form: Under the current legal situation, the option can only be exercised up to one month before the beginning of the fiscal year for which the option is to be exercised for the first time. This excludes the tax option model for newly formed partnerships as well as partnerships that have changed their form in the "first year". According to the WCG, these companies shall be able to exercise the option up to one month after conclusion of the partnership agreement or registration of the change of form in the commercial register; corporations can therefore (e.g. due to greater flexibility under civil law) change their legal form to a partnership without changing their tax status (§ 1a (1) sent. 7 KStG-E).

- Non-contribution of the general partner shares not harmful: The tax neutrality of the option for corporate taxation requires that the partners "contribute" all functionally essential business assets. This can also include the shares in the general partner in the legal form of a corporation. As a result, the partners would have to transfer the civil law ownership in the general partner shares to the partnership in the course of exercising the option. Fortunately, the WCG provides that the retention of these shares shall not result in the failure of the book value carry-over (i.e., the tax neutrality of the check the box election (§ 1a (2) sent. 2 KStG-E).

- Taxation of distributions: Under the current legal situation, profits of an opting partnership are deemed to have been distributed to its partners and are subject to distribution taxation there,if these can "demand payment of the profits". In practice, this can lead - depending on the provisions of the partnership agreement - to unintentional distribution taxation despite the fact that the profit shares are not withdrawn but retained. The WCG provides that, in future, taxation on distributions will only occur in the event of an actual withdrawal (§ 1a (3) sent. 5 KStG-E).

III. Consequential amendments to MoPeG

The MoPeG, which comes into force on 01 January 2024, requires consequential tax changes.

1. Income tax

Pursuant to the changes proposed by the draft of the WCG to § 39 (2) no. 2 of the German General Tax Code (Abgabenordnung - AO) partnerships with legal capacity shall be treated as joint owners for the purposes of income taxation and their assets as joint ownership assets as from 1 January 2024. This ensures that, despite the MoPeG, there will be no change in the income taxation of so-called asset administrating partnerships.

In our view, the MoPeG does not require any changes in relation to commercial partnerships, because the relevant provisions do not refer to the civil law concept of joint ownership (Gesamthand) but to the tax-wise qualification of a co-entrepreneurship (Mitunternehmerschaft)

2. Inheritance and gift tax

In § 2a of the German Inheritance Tax Act, the WCG is to stipulate that partnerships with legal capacity are also deemed to be joint owners for the purposes of inheritance and gift tax and that their assets are deemed to be joint owners' assets as from 1 January 2024. As a result, partnerships will continue to be treated transparently also for these purposes.

3. Real estate transfer tax

The MoPeG is also one reason for the discussion draft of the GrEStNG. In the view of the legislator, the adjustments to the joint ownership principle mean that the rationale for the tax exemp-tions in §§ 5, 6 and 7 (2) GrEStG does no longer apply. These provisions are therefore to be designed independently of the legal form for partnerships and corporations.

Irrespective of the changes required in relation to the MoPeG, the discussion draft of the GrEStNG also provides for the following changes:

- Share unification of 100 %: The supplementary provisions in § 1 (2a) to (4) GrEStG are to be abolished and, at the same time, the current holding periods and the holding quota of 90 % shall no longer be applicable. Instead, share acquisitions in a real estate company are to be taxed in the future when the entirety - i.e. 100% - of the shares are unified pursuant to § 1a GrEStG; in the event of a concerted action, several share acquirers are to be treated as an acquisition group (Erwerbergruppe).

- Taxation of unit deals: Currently, no real estate transfer tax is triggered in relation to real estate unit funds in the event of a change of investor. This shall be changed in the future by § 1b GrEStG. In this regard, it is problematic that the real estate will then be doubly entangled (steuerverstrickt) for real estate transfer tax purposes, i.e. once in relation to a transfer of the share in the capital management companies of the fund (Kapitalverwaltungsgesellschaften) and once for transfers of the units of the investors in the fund.

- Adjustment of the group clause: The current exception under the group clause pursuant to § 6a GrEStG only covers certain restructuring measures under the German Reorganization Act (Umwandlungsgesetz – UmwG) and other corporate measures within a group (Konzern). In the future, an exemption pursuant to § 5 (1) GrEStG shall be available if the significant influence (bestimmender Einfluss) of a person over the real estate does not change as a result of a transaction. This would mean that in future all transfers within a 100 % owned group would be tax exempt.

- Favorable treatment for the acquisition of owner-occupied residential property: To foment the acquisition of owner-occupied residential property by individuals, the discussion draft contains an opening clause for the Federal States. This allows the individual Federal States to tax the acquisition of owner-occupied residential property at a reduced tax rate. The structure of such tax relief is left to the legislation of the individual Federal State.

However, it remains to be seen whether and to what extent these proposals will be adopted in the further legislative process.

IV. Real estate tax law

In addition to the GrEStNG, the WCG also results in changes in the area of real estate tax law. In particular, the limit for harmless additional income from electricity production and sales from photovoltaic systems and charging stations in the context of the so-called extended exemption for real estate income pursuant to § 9 no. 1 sentence 2 et seq. of the German Trade Tax Act (Gewerbesteuergesetz - GewStG) is increased from 10 to 20 % already as of trade tax period 2023 (the relief was introduced by the Fondsstandortgesetz). The tax authorities have already issued a detailed interpretation guideline on this provision (cf. Tax Authorities of the Federal States, joint decree dated 17 June 2022, Federal Tax Gazette I 2022, 958).

V. Foreign tax law

The MinBestRL-UmsG is intended to transpose the global minimum level of taxation for multinational enterprise groups and large-scale domestic groups into German law (Pillar 2; see section 1 below). As a flanking measure, the draft also provides for simplification of the taxation of the addition of profits (see section 2 below).

1. Pillar 2

Pillar 2 is a minimum taxation which shall ensure a taxation of at least 15% for groups with a total turnover of EUR 750 million or more. For the implementation of this minimum taxation, the national legislators shall make use of three instruments:

- Income Inclusion Rule (IIR): The IIR is the primary mechanism by which minimum taxation shall be ensured. The IIR represents a form of lump-sum CFC taxation. The country of residence of the parent company of a group must levy a "top-up tax" at the level of the parent company on the income of foreign subsidiaries or of the parent company itself, to the extent that these are subject to income taxation of less than 15%.

- Undertaxed Payments Rule (UTPR): Secondarily, the UTPR is intended to ensure minimum taxation. It is only applied if a minimum taxation of 15% is not already achieved by applying the IIR, e.g. if no IIR or a comparable rule applies in the country of residence of the parent company (e.g., because the parent company is domiciled in a third country or the country of residence of the parent company has not (yet) implemented Pillar 2). Under the UTPR, “top-up tax” is levied in the subsidiaries' countries of residence according to a certain key, provided that income taxation is less than 15%.

- Subject to Tax Rule (STTR): The STTR takes a special place. The STTR is an article of a double taxation treaty that gives the source state extended taxation rights with respect to certain payments.

Pillar 2 is to be implemented by the Minimum Taxation Act, which in general is to apply for business years starting after 30 December 2023. The individual provisions to implement the above-mentioned instruments and complementary as well as accompanying provisions will be presented in a separate news article.

2. CFC rules

In addition, the MinBestRL-UmsG also provides for amendments to the AStG and the GewStG to relax the CFC rules:

- Reduction of the low tax rate: The frequently criticized low tax rate of 25 % shall be reduced to 15%. This reduction affects both the standard CFC taxation (§ 7 AStG) and CFC taxation for passive capital investment income (§ 13 AStG) as well as the so-called tightened CFC rules (§ 9 of the German act to counter tax avoidance and unfair tax competition).

- Trade tax exemption in relation to CFC inclusion: According to the explanatory memorandum to the draft, the real of § 7 sentences 7 to 9 GewStG and the amendment of § 9 no. 3 GewStG are intended to abolish trade tax on the amount of CFC inclusion. The intention of the legislator is clear. However, since the draft wording would retain the words "of this company" in relation to the foreign permanent establishment, it is questionable whether this intention would also have been unambiguously incorporated into the law (cf. Federal Finance Court, judgment dated 11 March 2015, I R 10/14, BeckRS 2015, 94759). This potential issue should be mitigated.

- Trade tax exemption of profit shares: In addition, § 9 no. 2 GewStG is to be amended to the effect that profit shares from foreign commercial partnerships are also exempt from trade tax to the extent that they contain low-taxed passive income and an amount of CFC inclusion. It should be noted, however, that the trade tax exemption already applies today in these cases for partnerships with substance and partnerships that are to be classified as investment funds.

The above-mentioned changes are to apply as of the tax year / trade tax period 2024.

VI. Fund taxation

The draft of the WCG also includes changes to the fund taxation:

- Capital gains from companies with German real estate: By amending § 6 (5) of the German Investment Tax Act (Investmentsteuergesetz - InvStG), gains from the sale of shares in corporations that predominantly hold German real estate are to become taxable for investment funds. This would lead to unequal treatment with respect to corporate structures outside the InvStG, where such gains are fully or largely tax-exempt under § 8b KStG, whereas this is not the case for investment funds pursuant to § 5 (6) InvStG. Whether the German Federal Ministry of Finance is aware of this unsystematic fault is unclear. This follows not least from the fact that the Federal Finance Ministry has not yet seen any need for action on this point during the recent evaluation process of the investment tax reform in 2018.

- Additional income from electricity in the case of special investment funds: The threshold in § 26 no. 7a InvStG for additional income from electricity, above which the status as a special investment fund may be forfeited, is to be raised from 10% to 20% in line with the rules on the extended trade tax exemption for real estate income. To the contrary, there shall be no change in the material scope of application of § 26 no. 7a InvStG, so that there will still be no adjustment to the planned, significantly more generous investment law regulations of the proposed Future Financing Act (Zukunftsfinanzierungsgesetz; as before, e.g., no ground-mounted systems are covered).

- Subject to tax rule in relation to real estate funds: Against the background of certain tax-exempt real estate fund structures in Finland - which became known through the DAC 6 Disclosure Regime - the partial real estate income exemption in § 2 (9) InvStG for Chapter 2 Funds and the tax exemption in § 43 InvStG for Chapter 3 Funds shall be adjusted in such a way that the exemptions require that the relevant income is subject to tax abroad (so-called subject to tax rule).

The above changes shall apply as of the tax year 2024.

VII. Notification obligation for domestic tax arrangements

From 2025, the obligation to notify cross-border tax arrangements under DAC 6 is to be extended to purely domestic tax arrangements by means of §§ 138l to 138n of the German General Fiscal Code (AO). However, this notification obligation shall only apply if further requirements (e.g., exceeding a turnover, income or revenue threshold, belonging to a group within the meaning of § 18 AktG, investment funds or special investment funds and certain investors) are met. In addition, as with DAC 6, certain hallmarks must be met; however, unlike DAC 6, these are all subject to a "main benefit test" (i.e., the or one of the main benefit(s) of the arrangement must be obtaining a tax benefit). Notifications are to be made within two months of the event triggering the notification requirement.

VIII. Other aspects

Finally, the draft WCG contains other proposals to change corporate and group taxation, inter alia:

- Post-spin off lock-up: The ruling of the Federal Fiscal Court dated 11 August 2021, I R 39/18, BeckRS 2021, 41936, is taken as an opportunity to tighten the post-spin off lock-up of § 15 (2) for the German Reorganization Tax Act (Umwandlungsteuergesetz – UmwStG).

- Value added tax: In particular, introduction of mandatory electronic invoicing in B2B transactions.

- Climate Protection Investment Premium Act: Subsidy for certain movable fixed assets that contribute to reducing energy consumption in the company by means of a climate protection investment premium of 15% of the acquisition and production costs.

- Research Subsidies Act: Increasing tax incentives for research

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now