Benchmark interest rates 2021

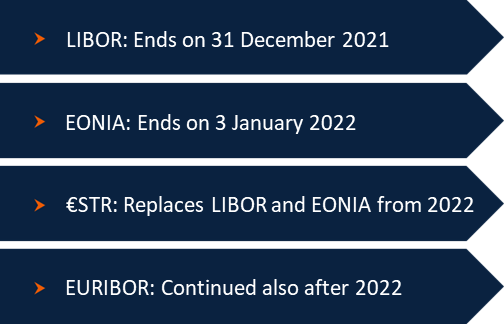

2021 will bring major changes for users of certain benchmark interest rates. With the cessation of the London Interbank Reference Rate (LIBOR) and the Euro OverNight Index Average (EONIA) by the end of 2021 and the beginning of 2022, respectively, the transition to the European benchmark interest rate Euro Short-Term Rate (€STR) is in full progress. However, the Euro InterBank Offered Rate (EURIBOR) is also subject to constant review and adjustment. A successful transition from EONIA or LIBOR to €STR requires that market participants already provide for benchmark rates and fallback or substitute rates in their agreements that comply with the European Benchmark Regulation (EU) 2016/1011 (Benchmark Regulation). For the time being, this is not necessary for products making reference to EURIBOR, as the new hybrid calculation method of the EURIBOR has already been adapted to the requirements of the Benchmark Regulation. However, it is currently not foreseeable whether the EURIBOR will exist permanently and beyond 2025 after the expiry of LIBOR and EONIA if market participants increasingly switch to the €STR as a reference rate. In the current consultation procedure of the working group on euro risk-free rates (Working Group), a two-fold solution is currently being discussed for the EURIBOR, which broadly differentiates between globally and locally active market participants. The consultation procedure will end on 15 January 2021. Recommendations resulting from the consultation are expected towards the end of Q1/2021.

Status quo of the European reform process for benchmark interest rates

The EURIBOR, which is administered by the European Money Markets Institute (EMMI) is a benchmark rate used in many derivatives, loan agreements, promissory notes and bond products to determine a variable interest rate. The reference rate for term deposits in European interbank market, which has been determined since 1999, has already been adjusted several times, in particular to make the benchmark interest rate less vulnerable to manipulation. These adjustments have become crucial after the manipulation allegations in connection with the LIBOR scandal. EMMI currently administers five EURIBOR interest rates ranging from a term of one week to one year. In parallel to the EURIBOR, EMMI administers and publishes the short-term rate EONIA, i.e. the interest rate at which unsecured amounts of money in euros are lent on the European interbank market from one banking day to the next.

EONIA and LIBOR to be replaced by €STR – What action is required?

European benchmarks are subject to a change by the European legislator that has been consistently driven forward for many years. This change is to reach its first conclusion in 2022, when EONIA will be completely replaced by €STR, which is administered and published by the European Central Bank, and with the ultimate cessation of the London Interbank Index LIBOR by 31 December 2021. Not least due to the possible consequences of a hard Brexit, LIBOR had come under further pressure because until last, it was not clear for users whether they would be able to continue to refer to LIBOR in their products. For the purposes of gradually replacing EONIA and LIBOR, the European Central Bank has therefore been publishing the €STR, which is designed as an overnight rate for unsecured lending with overnight maturity, in parallel with EONIA and LIBOR since 2 October 2019. In addition, the calculation of EONIA has been based on €STR since 2 October 2019 to simplify the transition.

For financial products that refer to LIBOR or EONIA for interest rate calculation, these changes mean that alternative regulations and, if necessary, contract adjustment clauses must be found and, in some cases, subsequently agreed. Against this background, a mechanism has already been established in the market that allows for fallback solutions and contract adjustments, which now have to come into effect. The adjustment of existing contracts that refer to EONIA or LIBOR and that mature after the cessation of EONIA and LIBOR must be completed by the end of 2021. Many credit institutions have set up task forces for this purpose in order to accompany this transition. The first products such as interest rate swaps that fully reference to €STR can already be found on the market, although their market share is still small. However, standard contractual clauses in variable-rate products, providing that €STR shall be used as a fixed alternative benchmark rate if the main benchmark cannot (or can no longer) be determined, are not (yet) broadly visible in the documents used on the market.

The future of the EURIBOR – Statutory alternative interest rates?

Unlike LIBOR and EONIA, the EURIBOR can continue to be used as a benchmark rate in financial products beyond 2021. The comprehensively reformed benchmark rate already meets the requirements of the European Benchmark Regulation. However, users of the EURIBOR must still determine fallback solutions in their contractual documents that would take effect if the EURIBOR were to be permanently discontinued as a benchmark. This raises the question of whether, instead of the abstract and flexible fallback descriptions for alternative benchmarks that have been customary up to now, contractual documents should in future increasingly refer to specific and officially determined alternative rates such as €STR. Arguing in this direction, the Working Group already recommends using €STR as an alternative benchmark for the EURIBOR in variable-rate financial products and to firmly agree on €STR for these purposes when contracts are concluded.

Since the end of November 2020, the Working Group, which was initiated by the European Securities and Markets Authority (ESMA), the European Central Bank, the European Commission and the Belgian Financial Services and Markets Authority (FSMA), has also been conducting a consultation procedure on possible fallback interest rates based on €STR and standard triggering events for their use in contractual documents. The consultation is scheduled until 15 January 2021. The Working Group’s recommendations based on the consultation are expected towards the end of the first quarter of 2021.

The central element of the consultation is the Working Group’s proposal to generally differentiate between users types of the EURIBOR and thereby to approximate the system to the EURIBOR fallback mechanism in the documentation of the International Swaps and Derivatives Association (ISDA). Experienced and globally operating capital market participants and companies with own treasury departments could calculate a possible EURIBOR substitute retrospectively on the basis of the daily €STR fixings. For less experienced or more local market participants and certain products where payment certainty is more important, there might be a need to determine the substitute rate in advance, so forward-looking rates are required. To the extent that forward-looking interest rates, such as a derivative based on €STR development, are not yet available, the Working Group proposes a waterfall structure that can alternatively refer to subsequently identified developments.

In July 2020, the European Commission also published a proposal for a regulation amending the Benchmark Regulation, which aims to pave the way for the identification of legally established alternatives for certain benchmarks, the termination of which would have a significant negative impact on financial markets. The background to the draft is the idea of reducing the possible contractual and adjustment costs for users of benchmark interest rates if a benchmark rate is amended or discontinued by means of legally established successor and alternative interest rates. At the same time, a safe harbour of usable benchmarks is to be given in particular to supervised entities given their obligations under the Benchmark Regulation.

Special requirements for supervised entities

The legal basis for determining, administering and using benchmarks or reference rates is the Benchmark Regulation, which entered into full force in January 2018, with its associated Delegated and Implementing Regulations. Through regular adjustments and extensions of the regulatory framework, such as the climate benchmarks introduced by Amending Regulation (EU) 2019/2089 or the requirements for sustainability-related disclosures for benchmarks introduced on 30 April 2020, the requirements for benchmarks are subject to regular review. At level 3, the European Securities and Markets Authority (ESMA) has also published explanatory Questions & Answers, which are supplemented and regularly updated at German level by the guidance of the German Federal Financial Supervisory Authority (BaFin).

Restricted admissibility in the use of benchmark interest rates

The Benchmark Regulation provides for special requirements on ‘supervised entities’, i.e. especially credit institutions and insurance or reinsurance companies. According to Article 29(1), supervised entities may only use benchmarks in financial instruments issued by them that are registered with ESMA’s benchmark register or that have been provided and administered by an administrator located in the EU and registered with ESMA’s register. This shows the European legislator’s intention that in the contractual documents used by supervised entities, both the chosen benchmark interest rate and its alternatives or substitute benchmarks must be registered benchmarks or must come from registered administrators. Bearing this in mind, a statutory fallback rule would immediately lead to a redesign of all agreements used by supervised entities, as market standard financial products usually provide for abstract fallback rules with a multi-level fallback mechanism, but without naming specific alternative rates.

Implications for the production and maintenance of mandatory fallback plans

Supervised entities that use benchmark rates in their agreements are also obliged pursuant to Article 28(2) of the Benchmark Regulation to produce and maintain ‘robust written plans’ (fallback plans) setting out the actions that they would take in the event that a benchmark materially changes or ceases to be provided. To the extent possible and appropriate, the European legislator intends that the fallback plans will identify one or more alternative benchmarks that could be used as a reference in lieu of the benchmark that is no longer provided. In addition, the fallback plans must explain why such benchmarks would be suitable alternatives. Upon request of the respective supervisory authority, supervised entities are obliged to submit their fallback plans and any updates.

The contractual documentation used by market participants should be based on the mechanisms set out in the fallback plans. Therefore, market standard terms and conditions used for bonds or promissory notes determine a variable interest rate making use of a default cascade of measures with a wide variety of options for fallback actions that apply if the original benchmark rate is not (or no longer) available. The predominant cascade mechanism that emerged as a standard regulation and which basically originates from the documents of the Loan Market Association (LMA) and the ISDA, can be found in a similar form in almost all financial products with variable interest rates. If an official replacement interest rate for EURIBOR were to be introduced at a European level, both the fallback plans of the supervised entities and their contractual documents would have to reflect this adjustment in their documentation. Also, the pre-contractual information documents used by credit institutions would also have to be changed, in particular the “Standard European Consumer Credit Information” form and its annexes.

However, so far, a new market standard has not yet developed in the financial products of supervised entities. Consequently, neither the model bond terms and conditions of the German banking association Bundesverband deutscher Banken e.V. (BdB) for AT1 capital, nor the recently circulated model bond terms and conditions of the German insurance companies association Gesamtverband deutscher Versicherungswirtschaft e.V. (GdV) for RT1 bonds provide default fallback provisions. Market participants will therefore have to observe the current developments and the Working Group’s consultation process. A need for action could be expected in the coming year.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now