Tax Refunds for Dividend Income

With a judgement of 14,05.2014 (10 K 1007/13 G), the Münster Fiscal Court has ruled that, contrary to the practice of the tax authorities, dividends from affiliated enterprises benefit from a full exemption from trade tax and not just a 95% exemption This judgement means that affiliated enterprises can expect high trade tax refunds.

Principle: Dividends only exempted to 95%

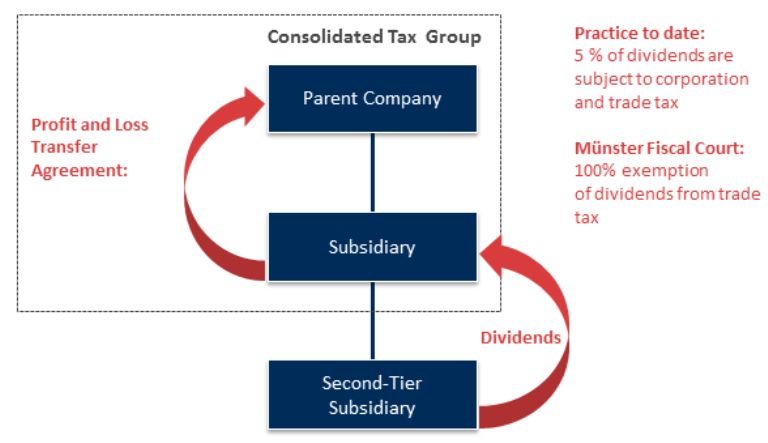

If a corporation receives dividends from another corporation, these are ultimately 95% tax-free if a holding of 10% or 15% exists. Therefore 5% of the dividends remain subject to corporation tax and trade tax.

Münster Fiscal Court demands full exemption from trade tax

In the case ruled upon, a German limited liability company received dividends from its Italian subsidiary. The German limited liability company on its part had entered into a profit and loss transfer agreement with its parent company. Its profit was therefore to be attributed to the parent company and to be taxed there. According to the practice of the tax authorities to date, the dividend received was only to be exempted to 95% from trade tax. The Münster Fiscal Court has opposed this by demanding a full exemption from trade tax and therefore explicitly tolerating a possible loophole in the law.

Practical impact

Although the case ruled on concerned a foreign dividend, the same would also apply to a domestic dividend received by a corporation which has entered into a profit an profit and loss transfer agreement with its parent company. The tax office which lost this case has lodged an appeal with the Federal Fiscal Court (I R 39/14). Whether the tax authority will as a result be able to secure its long-standing practice of taxing such dividends, however, appears questionable. Corporate groups with relevant dividend income in the past should keep such cases open and should apply for a trade tax reduction or a full exemption for trade tax purposes for assessment periods which are not yet statute-barred.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now