Three matters of practical relevance concerning the SEPA direct debit

Obligatory notification, internet mandate and SEPA direct debit for businesses – Notes on the article published in the journal “Zeitschrift für Vertriebsrecht” 2015, p. 14 ff.

The direct debit enables cashless payments to be made at low cost and is therefore an attractive payment method, not least for online trading and e-commerce. It allows the payee to independently ensure that a payment – whether one-off or recurring as part of an on-going business relationship – is received on time. This is what makes the direct debit interesting for distribution systems.

By 1 August 2014, the EU-wide changeover from national direct debit systems to the SEPA direct debit scheme had to be completed. SEPA stands for “Single Euro Payment Area”. Its legal basis is Regulation (EU) No. 260/2012 of the European Parliament and of the Council of 14 March 2012 establishing technical and business requirements for credit transfers and direct debits in euro and amending Regulation (EC) No 924/2009 (“SEPA Regulation”; OJ L 94 dated 30 March 2012, p. 22).

In practice, businesses – including distribution systems – switched over to the SEPA direct debit system quite smoothly and on time. Nevertheless, a project of this type always raises questions for (legal advisory) business. In this case, this is essentially the following three questions:

- Are the model mandate texts, particularly the reference to the entitlement to claim a refund for a debited amount, binding?

- Is the use of online rather than written SEPA mandates admissible?

- Is it possible for companies – e.g. franchisor and franchisee – to stipulate the use of the SEPA direct debit for businesses in their general terms and conditions?

Parties involved in a direct debit

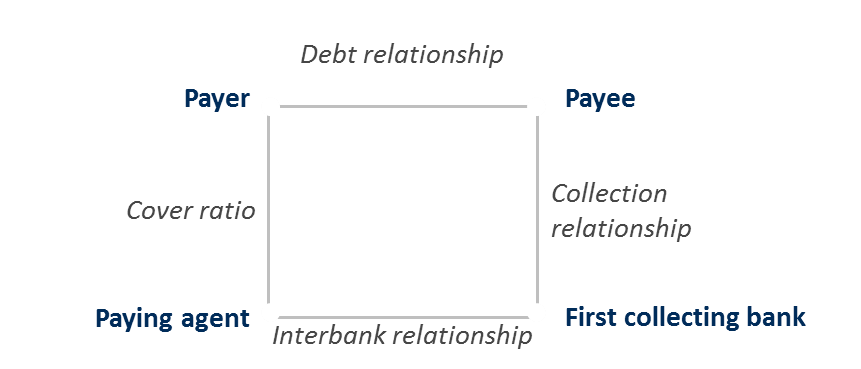

A direct debit is a payment transaction initiated by the payee who specifies the relevant payment amount to be debited to the account of the payer who agrees to the transaction. The fact that a direct debit is initiated by the payee distinguishes it from a bank transfer.

A payment by direct debit is usually based on the 4-party configuration shown. The payee specifies the amount for collection in the direct debit and submits it to his bank (the first collecting bank) which credits the amount to the payee’s account and forwards the direct debit to the payer’s bank (paying agent) which debits his account accordingly.

Use of SEPA model mandate texts

In practice, payees in Germany usually rely on the model mandate texts provided by the association “Die Deutsche Kreditwirtschaft”. This raises the question of what the effect of deviating from these standard formulations might be and, more specifically, whether this might invalidate the mandate. Without a valid mandate, the payment transaction is deemed to be unauthorized and the payee faces a “circle of recourse” (Regresszirkel): the payer can demand that the paying agent credit the amount back to him (return direct debit). The direct debit is then returned to the first collecting bank and the relevant amount debited to the payee’s account.

The SEPA Regulation does not contain any binding requirements on the form that a SEPA mandate has to take but merely stipulates the minimum amount of information it should contain, such as technical specifications (e.g. IBAN, BIC). Regardless of this freedom of form, it is nevertheless advisable to use fixed model mandate texts to avoid any risk of counteracting the harmonizing effects introduced by the EU-wide changeover to the SEPA system.

Admissibility of the online use of SEPA mandates

When SEPA mandates are issued online, this poses the problem of their not being signed by hand and thus raises the question of whether they have actually been issued in a valid form within the meaning of Section 125 of the German Civil Code (Bürgerliches Gesetzbuch – BGB). In any event, the SEPA Regulation itself does not contain any express form requirement. Even when considered as a whole, the provisions of the SEPA Regulation suggest that the form in which a mandate is issued is to be left to the parties concerned to determine within their freedom to contract.

It is thus fundamentally (still) possible to use the SEPA direct debit scheme in e-commerce. It should be noted, however, that stricter requirements of form can be stipulated within individual contractual relationships. Payees wishing to submit to a collecting bank SEPA mandates that they have obtained online, should first clarify form requirements with the collecting bank. The evidential value of the mandate issued is primarily determined by the way in which a mandate is technically implemented in e-commerce.

SEPA direct debit for businesses in general terms and conditions

The SEPA direct debit for businesses may also be of interest to distribution systems with regard to B2B transactions, i.e. between businesses. In franchising, for instance, one recurring payment between franchisor and franchisee would be the on-going franchise fee. It is irrelevant for use of the direct debit system whether this fee is a constant (fixed fee) or variable amount (e.g. based on turnover). The franchisee’s purchase of contractual products from the franchisor may also give rise to payment obligations for settlement by direct debit. A franchisee can also use the direct debit system to process its (end) customers’ contractual payment obligations. The same applies to the franchisor if it maintains its own shop premises or owner-operated enterprises (Regiebetrieb), or even its own online shop. The payment procedure is then usually stipulated in the general terms and conditions.

In spite of the judgement by the Federal Court of Justice (Bundesgerichtshof – BGH) on direct debiting services (judgement of 14 October 2009, file no. VIII ZR 96/07), today the SEPA direct debit scheme is very likely to be admissible in companies’ general terms and conditions.

Please get in touch with us if you like more information on this subject. We will be happy to provide you with the complete text of the article published (in German) in the journal “Zeitschrift für Vertriebsrecht” 2015, p. 14 ff.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now